We’re in a challenging market with two bank failures and a US recession forecasted by 58% of surveyed economists.

As a result, businesses are changing their key business metrics over previous years to accommodate for the approaching market downturn. That means less attention to grow-at-all-costs and more on predictable revenue, such as churn rate and customer acquisition cost.

So, now that we’re deep into 2023, how’s it going? Are you meeting this year’s most important metrics?

Your comp plan’s success can act as a way to gauge this. Below, learn how to assess your comp plan’s effectiveness.

Create Compensation Plans with confidence

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanWhat to look at

A successful comp plan motivates your sales team to behave in a way that helps your business meet its goals and objectives. But there are times when it’s necessary to change sales compensation plans mid-year.

An economic downturn marks one of those times when numbers across the board might be less than desirable

So, take a look at your comp plan to see if it supports your most important Q2 initiatives.

Here’s what you need to look at.

Are your compensation plans aligned with your most important business metrics?

One of the biggest mistakes companies make around comp plan design is a failure to align the plans to the business goals. This is especially true as it pertains to key metrics, such as gross revenue retention, gross margin, and customer acquisition cost.

If your comp plans do not incentivize your teams to move the needle on these, consider shifting them to do so.

For example, if the company’s main metric focuses on growing gross revenue retention, the comp plans should align teams to drive GRR. To do that, you might offer accelerated commission rates on multi-year deals or when a customer signs from a segment that data shows have the highest retention rates (think: ideal customer profile).

Will your company hit your Q1 targets?

If yes, great!

Not so much? How far off are you? If it’s way off, something likely needs to change, but not necessarily at the comp plan level. You probably need to step back and reassess your business goals. Then support your adjusted objectives with Compensation Hub to motivate behaviors that achieve those goals.

What percentage of your team has or is on pace to finish the quarter at goal?

We recommend that 80% of your team should hit their quotas. This level of attainment enables businesses to stay current with profitability and retention of sales reps.

If you’re well below 80%, take a look at the following.

First, identify the root cause of the problem. It’s likely not your comp plan, so what is it? A lack of leads? Closing skills? Motivation? Once you know the root cause, you can start to address it.

Then, check the math. Are the quotas and OTEs realistic? How did your team initially set these and what data was that based on? How does that data match today’s environment? If you set unrealistic goals without considering the economic landscape, your team is likely to fail and become discouraged. If this is the case, we recommend decreasing quotas.

Next, how are training and support? Your sales team needs to be trained and supported in order to succeed. Provide them with the resources they need to close deals, such as training on your products or services, or access to sales leads.

You can also add logo commissions and other SPIFs to encourage and motivate your team for quick wins.

What’s the difference between the earnings and attainment of your lowest-performing rep and your highest?

Identify how big of a gap exists between your lowest and highest-performing reps and find out why. If the cause relates to a plan or territory, you need to adjust your plans or territories to make them more equitable to everyone on your team.

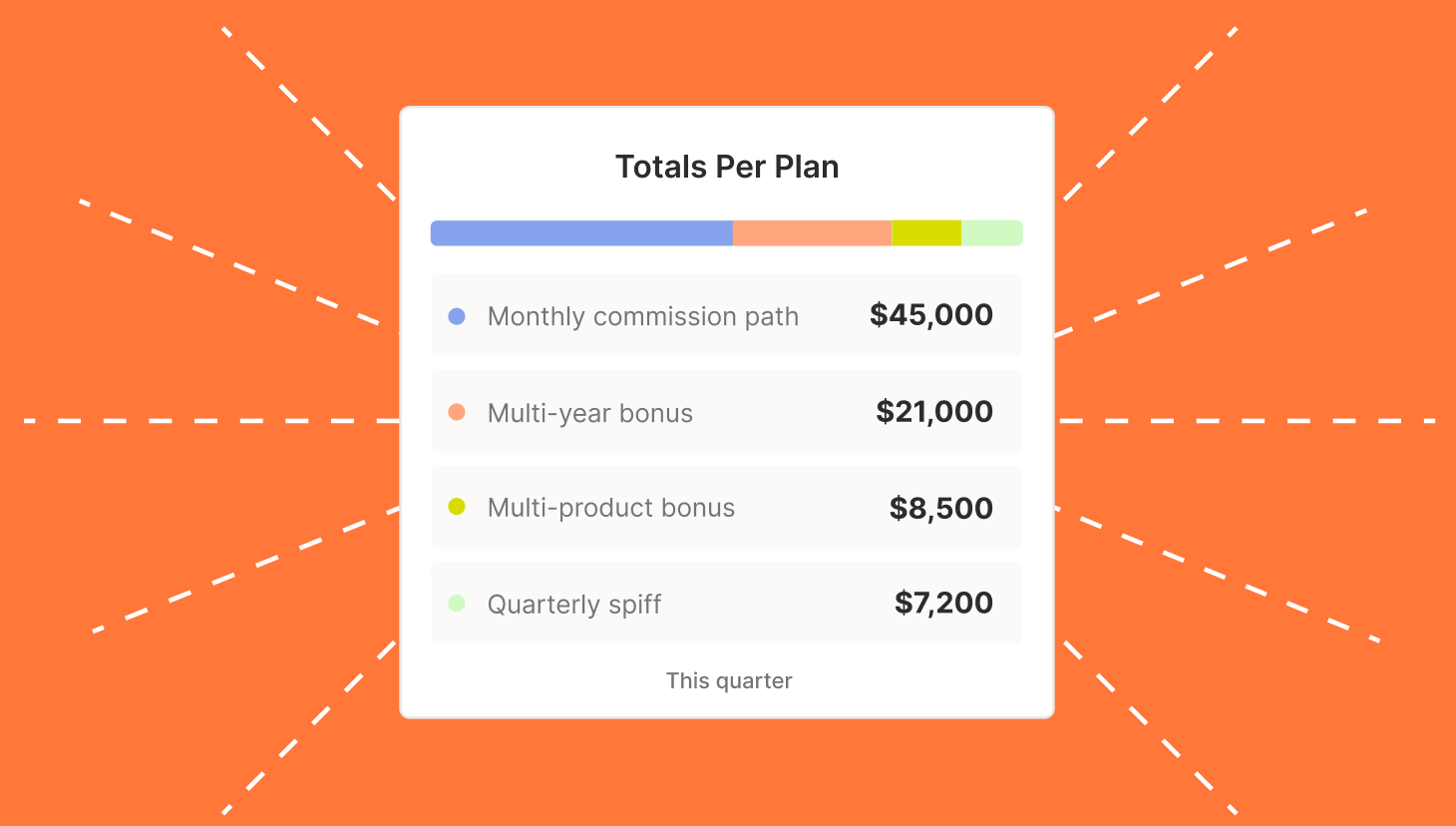

How much in commissions are your reps actually making?

Do these commissions align with their on-target earnings (OTE)? If not, it’s time to make an adjustment so that it is more attainable.

You’ve heard of tech jobs advertising $275K OTEs, but how many of the reps actually achieve that? Those who adopt this trickery will soon be saying goodbye to the top talent they misled.

To check how realistic your OTEs are, use our free Quota:OTE Ratio Calculator.

Are you paying high commissions even though your team isn’t hitting targets?

This may indicate that you need to add a commission floor to secure a minimum performance before reps begin earning commissions. In doing so, you motivate quota-carrying team members to hit targets while protecting the company from rewarding shortfalls in performance.

However, be careful with commission floors. If they are set too low, then what’s the point of having one? Reversely, setting them too high can discourage reps and cause sandbagging.

What are your reps saying about it?

Getting feedback from your reps is essential when assessing the success of your comp plan. Otherwise, you end up making broad and often incorrect assumptions about what your reps care about. This results in bad comp plans that don’t incentivize your sales team.

Questions to ask your reps include:

- How motivated are you by the current structure

- How do you like it?

- Can you explain to me how you’re paid?

Evaluating the success of your comp plan is only the start.

Try QuotaPath for free

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start Trial3 compensation levers to pull if something needs to change

Now that you’ve assessed your comp plans, it’s time to mull over making adjustments. Here are three compensation levers to pull if something needs to change.

Standardize plans

When you standardize comp plans, everyone with the same quota has the same earning potential. You can do this by standardizing the commission rates, bonuses, and OTEs so that everyone has the same income potential. This is the best way to create transparency, trust, and equality around sales compensation.

Use our 20 compensation plan templates when standardizing.

Add a commission floor for leadership and customer support/renewal teams

While we don’t encourage commission floors or cliffs for account executive plans, we definitely recommend them for leadership and customer support and renewal teams. A commission floor incentivizes team members to hit minimum key targets while protecting the company from paying commissions for underperformance.

Add SPIFs or higher commission rates to incentivize the behaviors you’re hoping to drive across the business.

A SPIF is a short-term reward to motivate quota-carrying teams, like sales reps and sales engineers. You can leverage these bonuses to help close performance gaps toward company goals.. Some ways to add these to your comp plans include:

- SPIF on ideal customer profile (ICP) deals

- Add a bonus when a deal isn’t discounted

- Offer a kicker for early renewals

- Pay higher rates or SPIFs on products that generate the highest gross margins

These levers are a good starting point, but it’s important to keep some compensation plan best practices in mind.

Comp plan best practices

These comp plan best practices will help prevent you from making any major mistakes while you finetune your plans.

- Avoid caps: For most sales reps, capped commission plans are a no-go. What if a rep crushes quota right out of the gate? With a cap, your rep isn’t incentivized to keep going.

- Tie your plan to measurable actions: Compensation plans should tie to measurable action. If you pay higher rates or bonuses on larger deals or longer contracts, track if your compensation adjustment inspired new selling behaviors.

- Standardize your plans: Everyone on the team with the same title should have the same compensation plan. This allows for everyone to be paid equitably.

- Test changes before adopting: To see how an adjustment will play out before implementing, test it. You can do this by running a SPIF, which is a short-term element within a compensation plan.

- For instance, some SPIFs to test might include:

- Different rates for different products — launch a new product, pay a higher rate on it

- Different industries — you give an extra 5% on SaaS deals

- Upfront payments — you want to see if your reps can get people to pay upfront, so you agree to pay them an extra 1% for Q4 if their customers do.

- If it changes behaviors the way you intended it to, then add it to your next comp plan.

- For instance, some SPIFs to test might include:

- Create a feedback loop with sales: Meet with your quota-carrying team and ask for their opinion.

- All changes should have a formal communication rollout: This is essential to get buy-in. If your sales team doesn’t understand the plan and why it’s changing you risk losing your sales team. There are five main steps to a proper plan rollout:

- Educate management on the plan first.

- Senior management shares a high-level review of the new plan with the entire team.

- Sales managers present a detailed review of the new plan to their individual teams.

- Sales managers meet with each rep for a one-on-one plan review.

- Plan verification where reps sign off on the plan to show understanding.

Follow these comp plan best practices to avoid any major pitfalls as you make adjustments to your comp plans.

Resources to help

Businesses have shifted their focus from growth at all costs to churn prevention and revenue stability due to market uncertainties. While you’re evaluating your most important metrics of the quarter, don’t forget to include an assessment of your comp plan.

Start by looking at your plan to answer key questions that diagnose plan issues. Then make changes to drive desired behaviors by quota-carrying teams. Keep the compensation best practices in mind to avoid major pitfalls as you finalize and implement your new plans.

Are you looking for an easier way to pull up real-time and forecasted attainment or earning at the rep or team level? Try QuotaPath’s free commission tracking software by signing up for a 30-day trial.

Or, schedule time with our team to learn how to make mid-year adjustments easily by automating your compensation process.