Commissions floors, or “cliffs” require an individual to meet a certain performance threshold before gaining commission payout eligibility as defined by the sales compensation plan.

Usually, a certain amount of sales or revenue determines the floor or threshold.

The benefit? It can incentivize salespeople to focus on hitting key performance milestones while safeguarding the company from having to pay commissions for underperformance.

However, unintended consequences often appear with cliffs.

Rather than motivate reps to hit the threshold, commission floors can actually demotivate and frustrate reps. Instead of aiming for a high velocity, albeit smaller deals, cliffs may encourage reps to go after less, larger deals. Or, it can promote sandbagging.

Sandbagging occurs when a rep intentionally stalls a deal to game their compensation plan. If there’s a cliff, and the rep knows they can’t pass the threshold in the current month or quarter, they may hold it to have a better shot at passing the cliff in the next quota cycle.

Now, with that context, are you for or against commission floors?

This topic can be a heated one, so we reached out to a few experts in the space to hear their thoughts.

Compensation Hub

Discover, compare, and build compensation plans. Customize compensation models using 9 variables.

Find Compensation PlansGraham Collins: Against commission floors

We first asked Graham Collins, our Chief of Staff, Compensation Plan Expert, and Sales Nerd.

“Commission floors tend to encourage sandbagging,” said Graham. “If I have to hit 50% of my quota this quarter to start earning commission but I know my next deal only gets me to 40%, then I’ll kick it to next quarter.”

Plus, set the floor too high, and you’ll upset your reps. But if you set it too low, and everyone hits it, then why even have a cliff?

“Cliffs can discourage new salespeople and even applicants,” said Graham. “It’s a red flag that indicates a lot of the team missed quota so they had to add a floor.”

As an alternative, Graham suggests adding a commission rate to a different tier. For example, once a rep hits 50% of their quota target, their commissions retroactively apply to everything they’ve sold.

For compensation plan strategy support and templates, visit Compensation Hub.

Rhys Williams: Against

Rhys Wiliams, Domestique Consulting Founder & Managing Partner and former VP of RevOps at Convercent, shared four reasons against commission floors.

- If you design the comp plan correctly, you shouldn’t need a floor.

- They lead to sandbagging.

- Cliffs can be a cultural drag and make it more difficult to recruit the best AEs.

- There’s likely a larger systematic issue.

Regarding his last point, Rhys suggested the following as a potentially larger issue: “Do you have an effective demand generation forecasting meeting that is contributing to a consistent pipeline where AEs have enough coverage to hit their number?”

If yes, a floor won’t fix that.

Cassandra Anderson: Depends on the ramp period

We also asked Optimove VP of Global Revenue Operations & Enablement Cassandra Anderson for her take on cliffs.

“I see both sides,” Cassandra said, who has set floors at 50% and 70% until recently removing the floor because they have no ramp.

“A floor can ensure the company isn’t taking a bath on commissions paid before the rep is really ramped,” Cassandra said. “But does a rep lose motivation by not being paid from $1? I think the use case depends on the ramp period and the time-to-value. I’m sure there are other factors too and those are my quick thoughts.”

Final thoughts on commission floors

If you do move forward with a commission floor, one thing to remember is to set an appropriate level and align the cliff with overall business goals. For instance, having a commission floor that is too low might discourage salespeople to achieve higher goals. Reversely, having a commission floor that is too high might lead to an increase in the cost of sales and negatively impact the overall performance of the business.

To find a cliff appropriate to your business model, check out our Commission with Accelerators & Cliff comp plan example and modeler. To discover and build other comp plan designs, visit our free compensation planning resource, Compensation Hub.

Chat with our team

Learn how QuotaPath can simplify your sales compensation process and automate commissions.

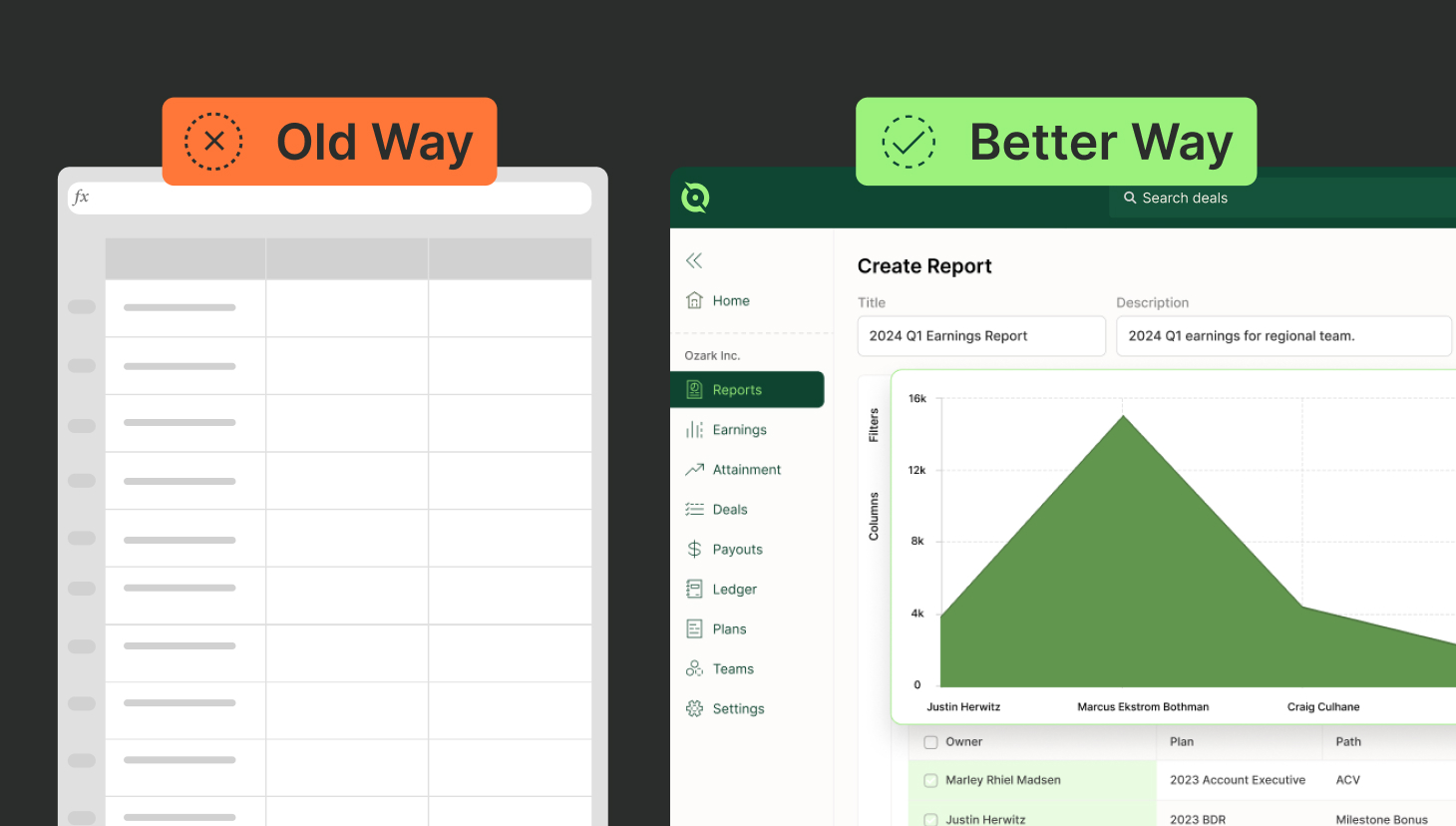

Book a DemoAbout QuotaPath

Want to see a custom demo of QuotaPath’s automated commission tracking? Book time with our team today, and see how our customers save nearly 20 hours of work every month by automating their commission tracking and payments processes.