Ready for this? If there is sandbagging in sales at your company, it’s your fault.

Reps sandbag deals for a reason and oftentimes that reason makes sense based on what you’ve told them to do. Read on to learn when sandbagging deals occur, instances it might actually be appropriate, and how to discourage this behavior from the beginning.

What is sandbagging in sales?

Sandbagging in sales occurs when a salesperson intentionally delays closing a deal to ensure better results in the future.

Reps might sandbag by delaying sending an agreement for signature, holding off on post-meeting follow-ups, adding unnecessary steps in the closing process (think: NDAs, legal review, or proofs of concepts), or slowly responding to emails from customers and prospects.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialWhy does sandbagging occur?

Salespeople sandbag deals for a couple of reasons, but the two primary reasons are to work the sales commission structure and to showcase consistency.

- Commission

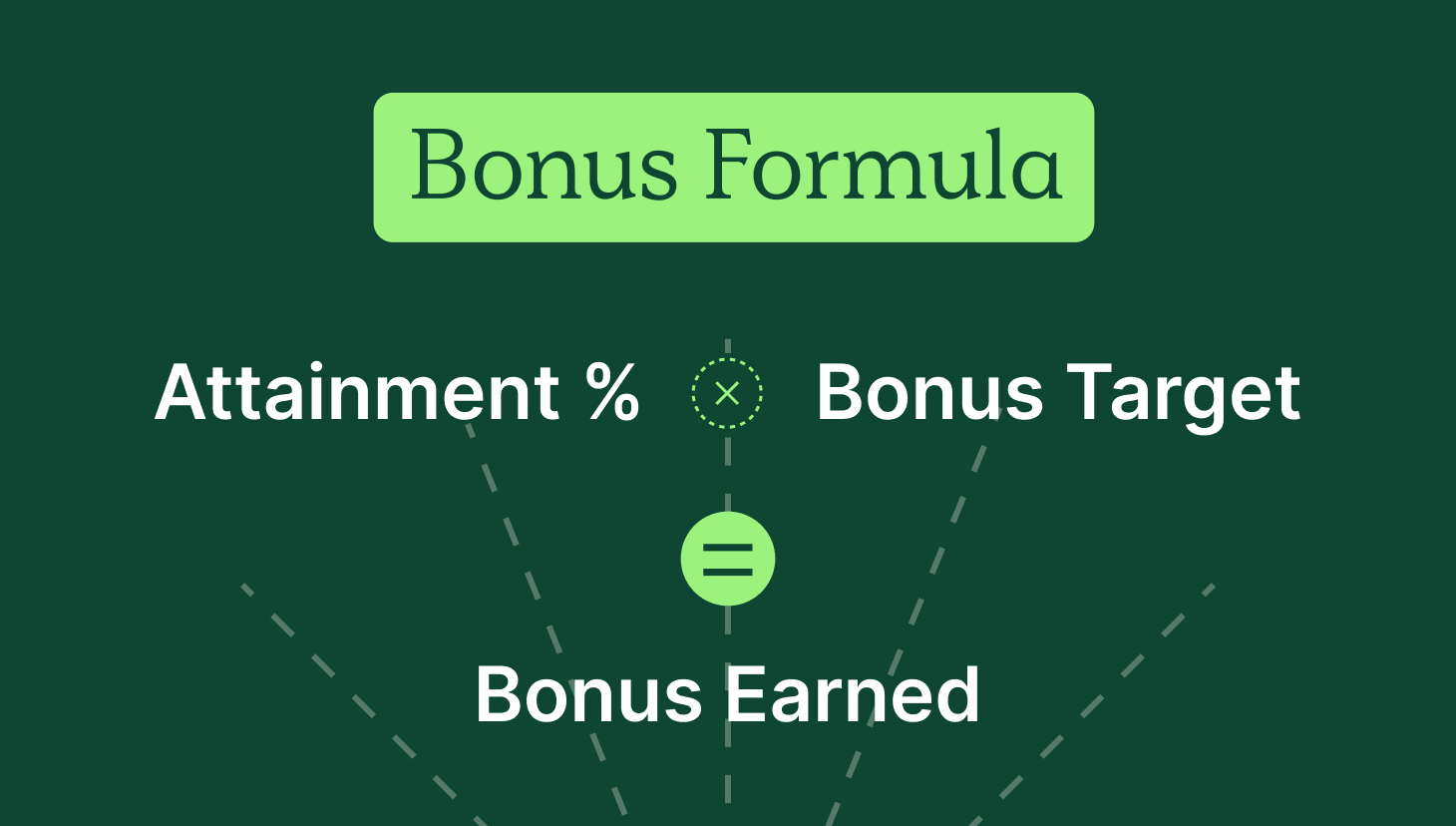

Most commonly, reps sandbag deals because they believe they will earn more in the long run by closing it at a later time. That might be because of a commission cap, an upcoming change to a comp plan, or to hit an accelerator. Whatever the reason, they see more dollar signs when they think about postponing a signature.

- Consistency

Secondly, to appear consistent across quarters, a rep may intentionally schedule a deal into the next one. For instance, say you’re a rep who has already hit their quota for the quarter. You have a vacation coming up next month and don’t want to go away for two weeks without closing a deal. This is a perfect example of when a seller might sandbag a deal after already achieving target.

Downsides of sandbagging

While reps sandbag to game the system a bit, they put a lot at risk by delaying a deal. The longer the delay — the greater the risk.

A good rule of thumb? Remember that you can’t guarantee a deal until it closes. Even if you feel really good about it, have a verbal confirmation that the customer intends to sign or you’re in the room with the buyer who has a pen in hand, you can’t count it until finalizing the paperwork.

Maybe a competitor comes in at the last minute and undercuts you. Maybe your champion gets laid off.

If you delay the signing of the deal for any reason, you add risk.

Other downsides include unexpected comp plan changes that reduce your sales commission rates or shifts to your territory design.

How to prevent sandbagging in sales

So, how can you prevent sandbagging in sales from happening? There is no tried and true way to avoid it, but there are three ways to reduce the likelihood.

- Compensation plan

Start by looking at your sales compensation. If you have very generous accelerators or very punitive decelerators, your reps are more likely to sandbag deals in order to maximize their earnings. To head off sandbagging, remove decelerators (and cliffs) or make the accelerators less enticing. You can also create a rule around year-to-date performance. This ensures a rep won’t miss quota two quarters in a row followed by a quarter 300% over goal. Also, remove your commission cap.

- Sales training and coaching

Create a culture where it is unacceptable to even hint at sandbagging deals. If your team focuses on winning deals as quickly as possible, then the results will follow. Weekly deal reviews with solid next steps – and accountability – go a long way.

- Process

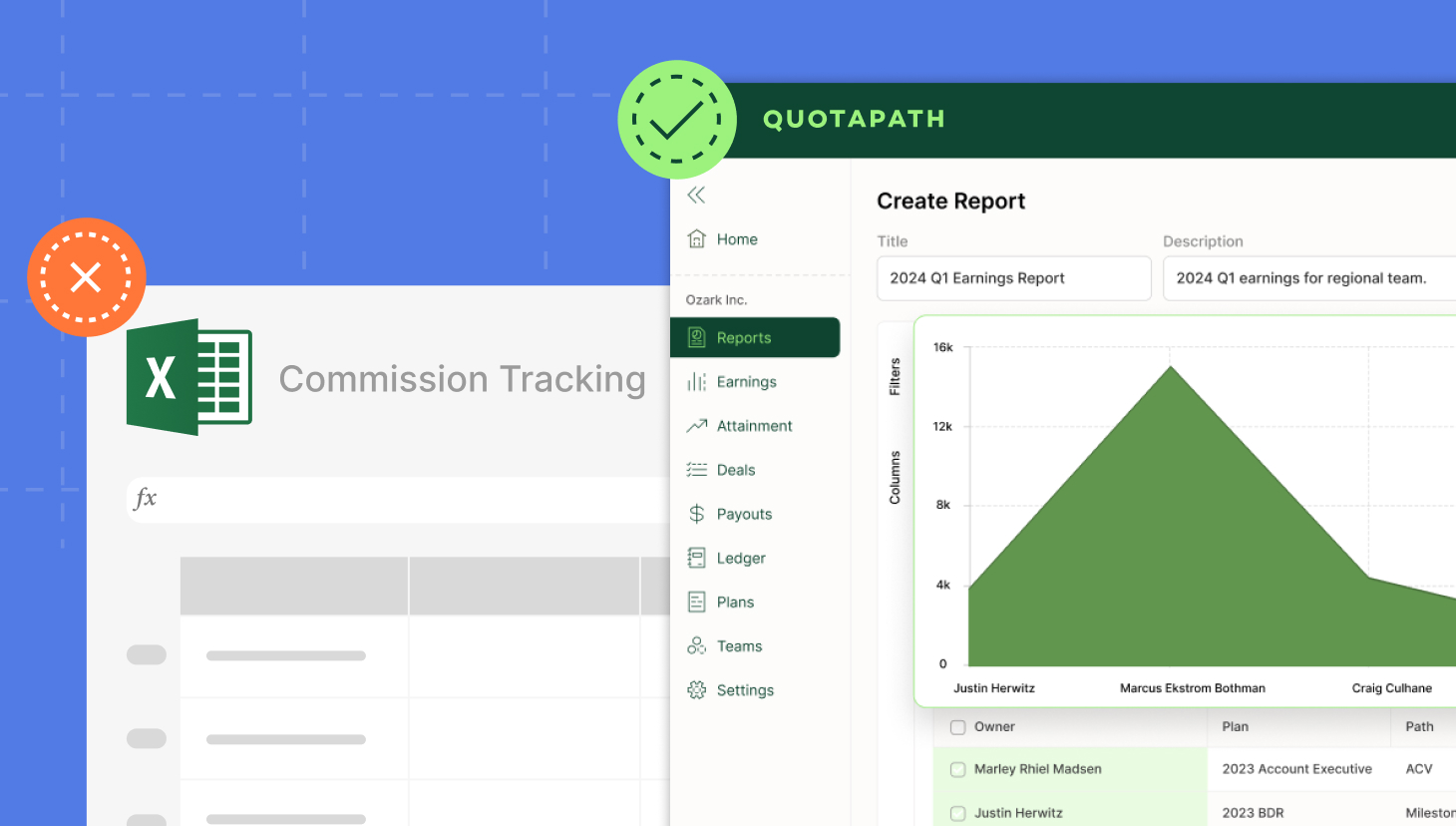

Lastly, lean on technology. Technology can help prevent sandbagging. You should have notes for each deal if you record your sales calls. If that’s the case, it makes it harder for a rep to fudge the details of what a customer said because you’ll have full visibility into these calls.

Remember, the goal isn’t to entirely eliminate sandbagging by these methods. Rather, it’s to reduce the incentive so reps don’t think it’s worth it.

Upsides of sandbagging

Okay, this is the part where I might ruffle some feathers. I had a boss once tell me, “If I ever catch you sandbagging a deal, I’ll fire you on the spot.” But, as you’ll see in the examples below, sometimes there are advantages for reps to sandbag deals.

But what about the company?

The biggest argument I’ve seen from a leadership lens in favor of sandbagging goes back to establishing consistency over time. Some sales teams have “lumpy” results, meaning they have quarters where they hit 200% of quota and some quarters where they hit 40% of quota.

A sales leader might think to themselves, “I wish they would just hit 100% every quarter instead!”

However, sandbagging is not the way to accomplish that.

Instead, build your sales comp to discourage lumpiness. Are the accelerators too aggressive? If so, you might be encouraging overperformance at the expense of the following quarters. Do you have a commission floor? If so, maybe sandbagging is actually your issue, not the solution.

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanExamples of sandbagging

Below, I’ve outlined a few examples of sandbagging. If you’re a leader in sales, these should sound familiar.

Account Executive sandbagging in sales example:

Jennifer is an Account Executive at a high-growth SaaS startup called Naturize. Naturize sells software to help its customers encourage employees to go on more hikes for their mental health. Naturize’s compensation plan pays Jennifer 10% of every deal she sells. She also earns a Milestone Bonus, a flat $2,000 bonus, if she hits 100% of her monthly quota. She had a great January, already at 120% of quota, and has collected her Milestone Bonus.

February, however, isn’t looking so hot. Her pipeline dried up a bit, but she continues to work a deal through legal that she could close in January if she pushes her legal department.

It’s worth about 75% of her quota. If she closes it in January, she pretty much guarantees to miss her February quota (and therefore her February Milestone Bonus). On January 25, she decides she’ll sandbag this deal, and… what do you know! It closes on February 3 and she’s able to easily come up with the rest of her quota to earn her Milestone Bonus.

SDR sandbagging example:

Davis is an SDR at a B2B SaaS company called Alttitude. Alttitude is a tool that automates checklists for companies. It’s Davis’s job to schedule demos for Account Executives, and they get paid $100 for each demo that occurs. However, there is a quota of 20 demos per month. For every demo after the 20 target, Davis earns a reduced rate of $10 per demo. It’s late in April and Davis has enough demos scheduled to hit quota.

Davis secures a hot lead on the phone who says this tool sounds perfect. Now they have to decide on whether or not to sandbag this demo to next month. If they book it for this month, they’ll only earn $10. If they schedule it for next month, $100 in their pocket. They sandbag the demo to next month by claiming the AE’s schedule is “just too busy this week”.

Account Manager sandbagging example:

Justin is an Account Manager at a company called Mixxter that sells high-tech bakery equipment. Mixxter sells hardware but makes most of its income off the software that runs the hardware. It’s his job to maintain customer relationships and also upsell bakeries when they need more hardware or additional software. He gets paid 10% of any upsells he closes each quarter. However, Mixxter doesn’t want Justin spending all his time on upsells, thereby forgetting about contract renewals. So Mixxter’s CFO puts in a commission cap for upsells. Once Justin hits $100k in upsells each quarter, he is no longer eligible for commission on further upsells.

Well, one day a small bakery comes to him and says they acquired a competitor and are expanding to 10 more locations. He is excited about this upsell opportunity until he remembers he’s already approaching that commission cap and he’s only halfway through the quarter.

So, he tells the customer that it would be better to slowly expand their account over the next 6 months rather than all at once. The customer initially agrees, but when he calls them on the first day of the next quarter, they have actually signed a deal with Divimixon, Mixxter’s biggest competitor. The upsell vanished and in its place, churn appeared.

To sandbag or not to sandbag

See the dilemma? Sometimes it absolutely makes sense to sandbag from the rep’s perspective if a company writes a comp plan that indirectly encourages it.

Unsure if your comp plan promotes sandbagging? Let’s chat.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesAbout QuotaPath

QuotaPath’s sales commission software pairs an easy-to-use experience with a highly technical backend. That’s why so many teams use us to get Sales, RevOps, and Finance all on the same page when it comes to sales compensation.

To see how we fit into your tech stack, check out our integrations page. And, to learn more, book a time with a member of our team today.