Your account managers are your 2023 company MVPs.

The responsibility of customer retention, renewals, upsells, and expansions fall mostly on their shoulders. And, during a market downturn, retention, renewals, and expansions are your key to predictable revenue.

As such, your AM team, who is working diligently to build and maintain relationships with those in power to commit or quell your renewals, should be compensated fairly and equitably to keep them motivated.

Try QuotaPath for free

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialAccount manager commission plan best practices

Account manager compensation plans are tricky to design because they need to balance the needs of the company with the needs of the individual account managers. To design effective account manager compensation plans, consider the following:

Make sure the plan is aligned with your company’s overall sales strategy. What are your top priorities? Are you focused on growing your business, retaining your existing customers, or both? Your compensation plan should be designed to support your sales strategy.

Consider the size and complexity of your accounts. You should compensate account managers who manage large, complex accounts differently than those who manage smaller, less complex accounts.

Take into account the level of experience of your account managers. If you have more experienced account managers with “senior” or “level II” titles, compensate them more than those who are new to the role.

Be competitive. Make sure your account manager commission plan is competitive with other companies in your industry.

Communicate the plan clearly to your account managers. Ensure your team understands how the plan works and how they can earn more money.

Consider seasonality. If the amount of renewals is heavier during certain months or quarters and lackluster during others, create a plan that accommodates for seasonal dips.

Review and update the plan regularly. Your sales strategy and your account managers’ needs may change over time, so it’s important to review and update your compensation plan regularly.

What metric to tie your AM comp plans to — GRR vs. NRR

Net revenue retention, gross revenue retention, or a mixture of both?

What business metric you attach to your account management commission plan will depend entirely on your company goals.

For instance, if you want your account managers to focus solely on renewing existing customers, we recommend a compensation plan that rewards the highest for doing so. One example of such a plan is the Gross Revenue Retention (GRR) model which includes a cliff. In this plan, the rep is unable to renew past 100%.

AM Compensation plan example — GRR

Quarterly quota: $250,000 in GRR

70% – 80% = $83.33 bonuses

Example: > 80% – 100% = $100 bonuses

The AM earns a fixed bonus amount for every percentage gained toward reaching 100% of their book of renewals.

Now, for net revenue retention (NRR), consider a compensation plan that promotes upsells and retention together. This model enables upsells and expansions to make up for the loss of churned customers. Additionally, NRR provides a more holistic pulse on your business by factoring in the revenue generated from existing customers vs. just GRR. Plus, the AM has the ability to earn above 100% target and gets a higher bonus once doing so.

AM Compensation plan example — NRR

Quarterly quota: $250,000 in NRR

70% – 100% = $100 bonuses per percentage toward 100% target

Example: 100%+ = $40 bonuses

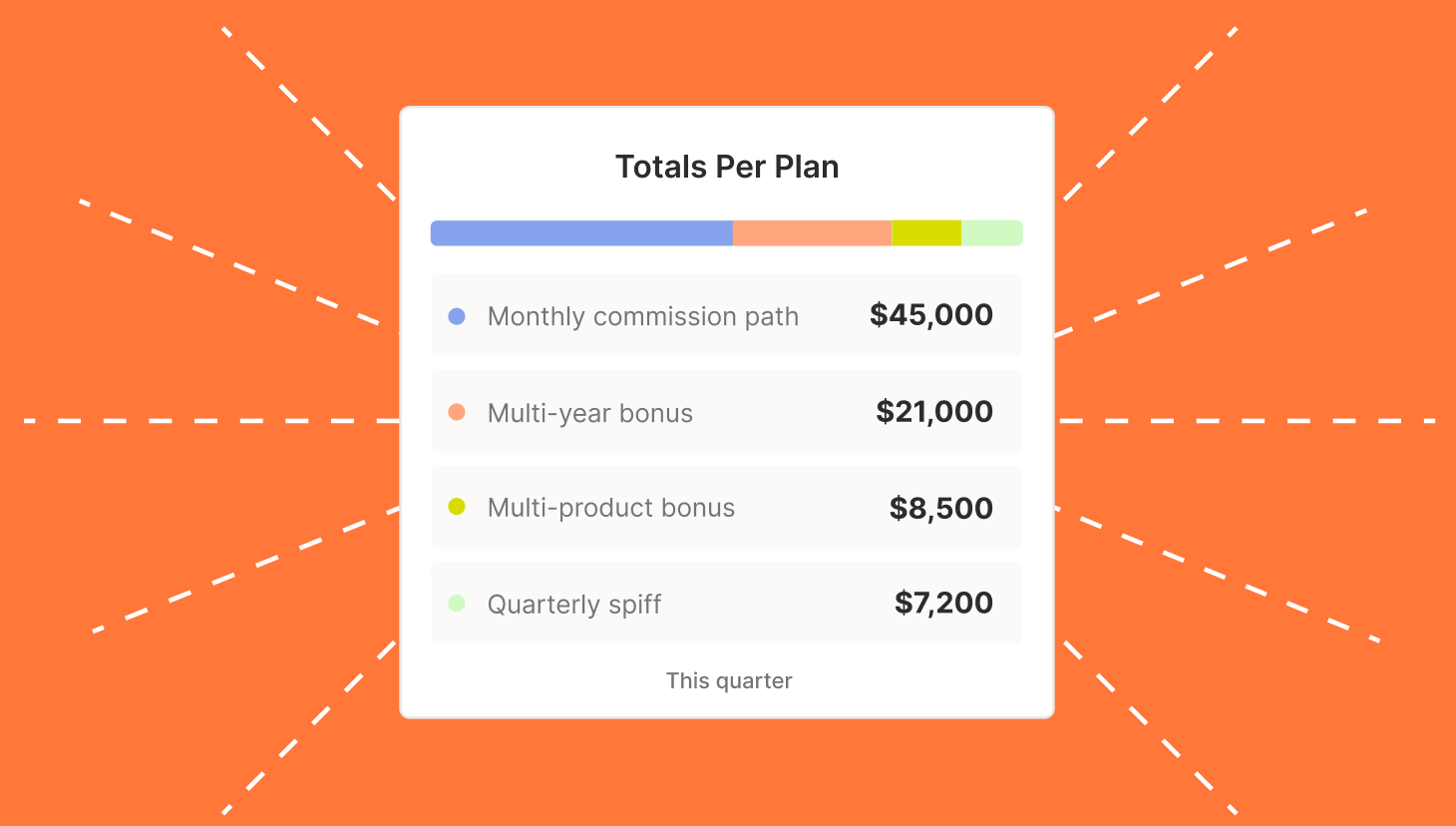

You could also combine the two by paying on Gross & Net Revenue Retention. If you go this route, you’ll split the total business between GRR and NRR so that the number doesn’t alter quarter-over-quarter.

Create Compensation Plans with confidence

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanHow to adjust for downsells and churn

If you pay AMs according to NRR targets tied to annual recurring revenue (ARR) and wonder how to account for commissions for downsells and churns, consider the following.

Members from RevOps Co-op, a professional Slack community for RevOps folks, shared this:

“The way I handle this is through several fields:

- Commissionable ARR: This is always positive except in clawbacks. We leverage this to calculate any hurdles/Conversion opps.

- Amount up for renewal: Total amount that should be renewed

- ARR change: the difference in upsell or downsell from the original renewal

- ARR: The total ARR from the opportunity

You can then run a report using these fields to determine net new ARR from what is upsold, downsold, or churned leveraging these fields and their close dates.”

If net new ARR is negative due to a large churn within the quota period, the AM would not earn any commissions if the comp plan is solely tied to net new ARR.

However, if you split an AM comp plan between net retention and upsell opportunities 50/50, with a sliding scale for over-attainment or underperformance, then your AM could still earn a commission from upsell dollars.

Comp plans for account managers

Your account manager’s commission plan could be the most critical part of your compensation strategy this year.

For help with your compensation strategy, we’ve got a team of experts ready to help. Or, sign up for a free 30-day trial in QuotaPath. Over your trial, you can map and test potential revisions to your AM comp plans based on your CRM data.

Need a hand with your sales compensation plans for AEs and SDRs? We’ve got 20 adjustable templates in Compensation Hub, ready for you to play with and customize. Check it out, build a plan, and pump into QuotaPath to launch a free trial our commission tracking software.