450+ leaders

450+ SaaS Finance, RevOps, and Sales leaders from the U.S. and U.K.

We surveyed over 450 Finance, RevOps, and Sales executive leaders across SaaS to identify the top pain points surrounding sales compensation in today’s market. Objectives of this report:

450+ SaaS Finance, RevOps, and Sales leaders from the U.S. and U.K.

15 questions on compensation plan design, execution, management, performance, and errors.

As the market has changed, compensation plans haven’t kept pace. This has led to mismatched metrics and sales activities, resulting in dips in team-wide performances.

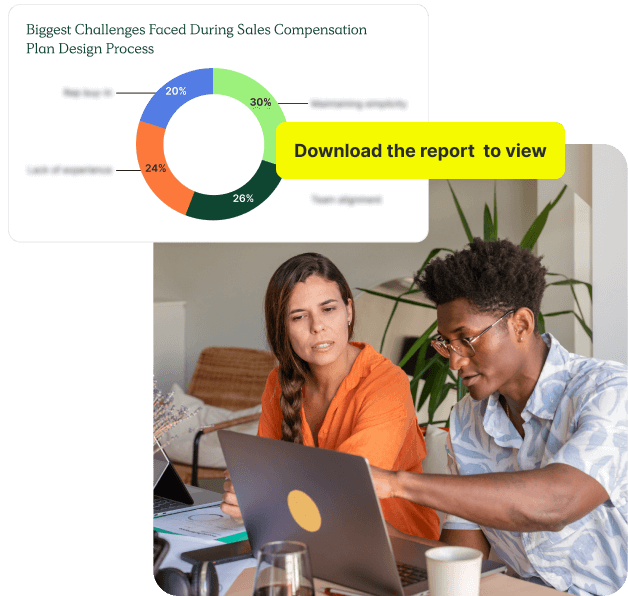

Simplicity and the effectiveness of compensation plans to drive business metrics pose the biggest concerns.

This creates an opportunity for Finance, RevOps, and Sales to collaborate earlier in the comp plan design process. Find out the toughest blockers and how to avoid those next year.

The compensation plan strategy should be a collaborative effort that leaves all parties confident in their decisions. Our report told a different story.

This often occurs at the end of the design process when it’s time for Finance’s approval. That’s when Finance implements guardrails to protect the business from inefficient effective rates or extreme edge cases by removing or adjusting compensation components or rates proposed by Sales and RevOps.

Overly complicated compensation plans delay rep understanding of how they earn commissions, leaving revenue on the table.

The challenges referenced throughout the report led to missed quotas and targets in Q1 and Q2 of 2023.

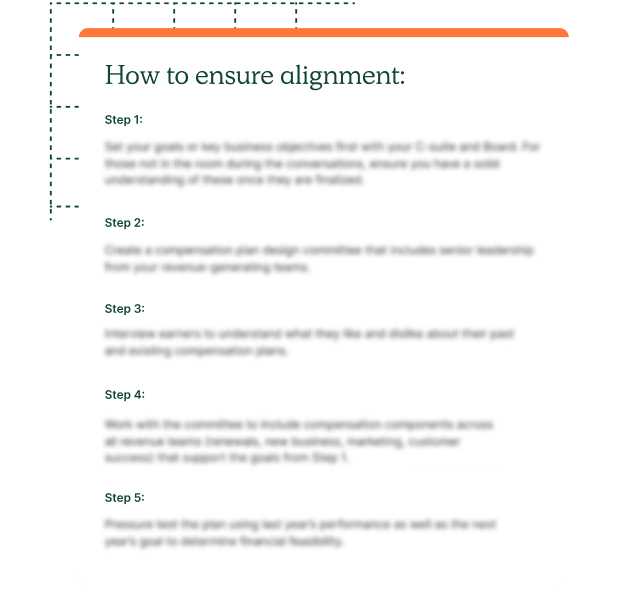

Many leaders need to overhaul their sales compensation plans and processes with alignment to business goals, motivating sales reps, and maintaining simplicity as the three pillars to overcome in 2024.

Ensure your new compensation plans address those needs. Download the report now.