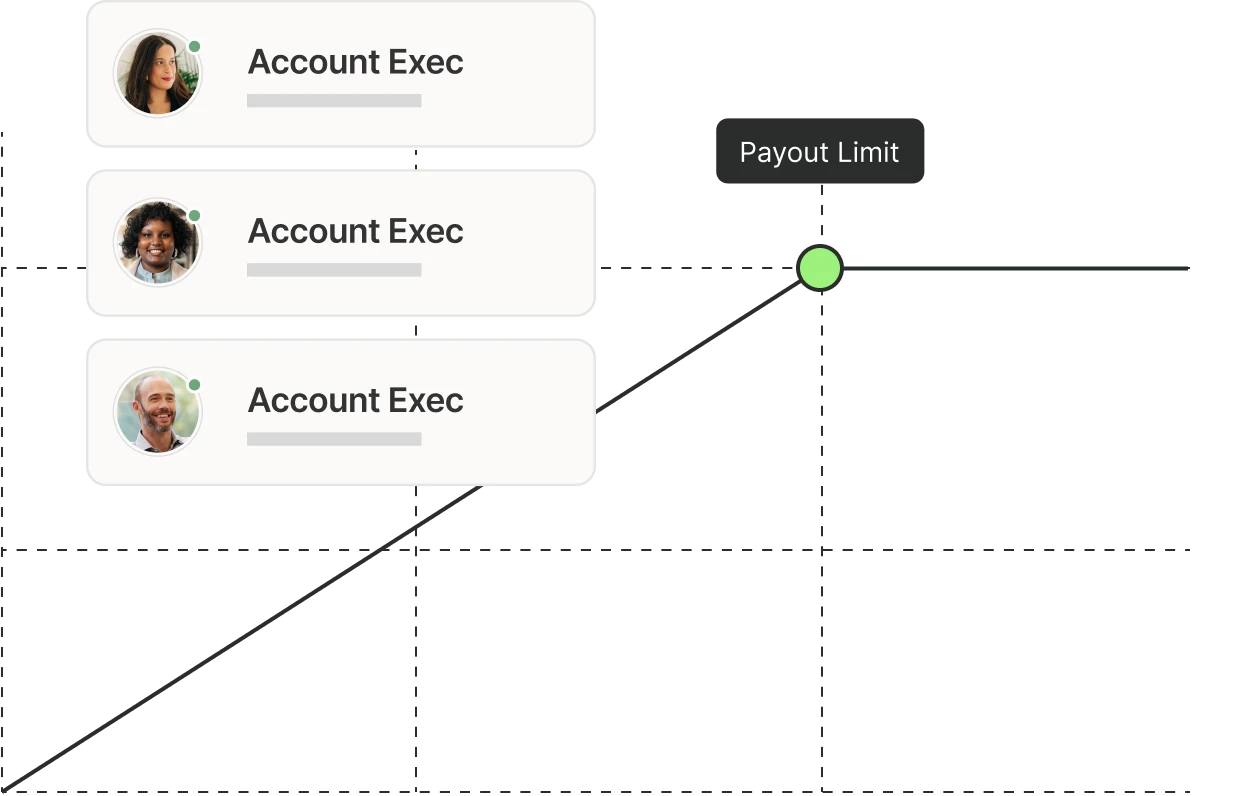

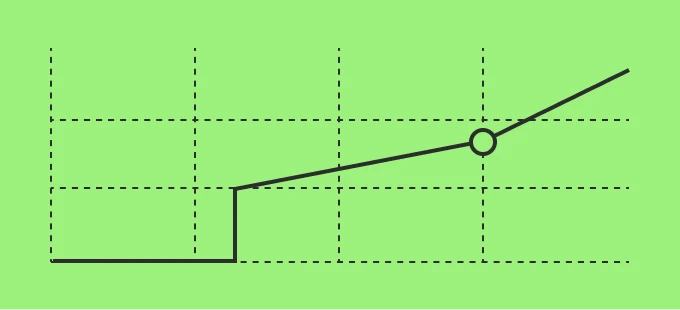

Sets a limit on how much your company pays out

Capped Commission

Compensation templates with capped commission models often stifle growth. We don’t recommend it. However, if you need derisk the amount of commissions your business pays out, this is one way to do it.

When to use this plan?

Why use a Capped Commission plan?

Derisks paying commissions

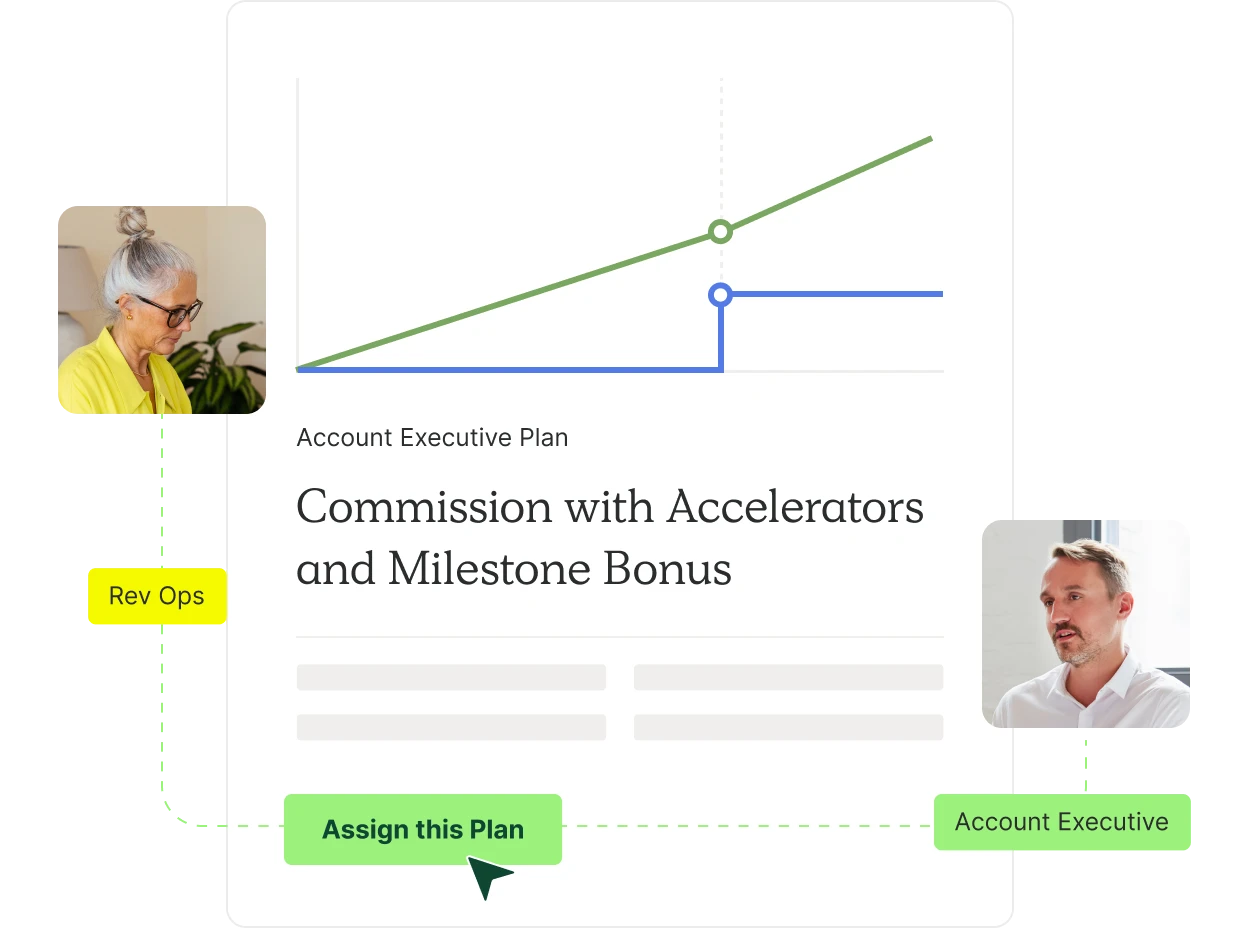

Customize the Commission with Milestone Bonus Plan Template

Like this plan? Sign up for QuotaPath for free to add your business inputs and adjust the variables.

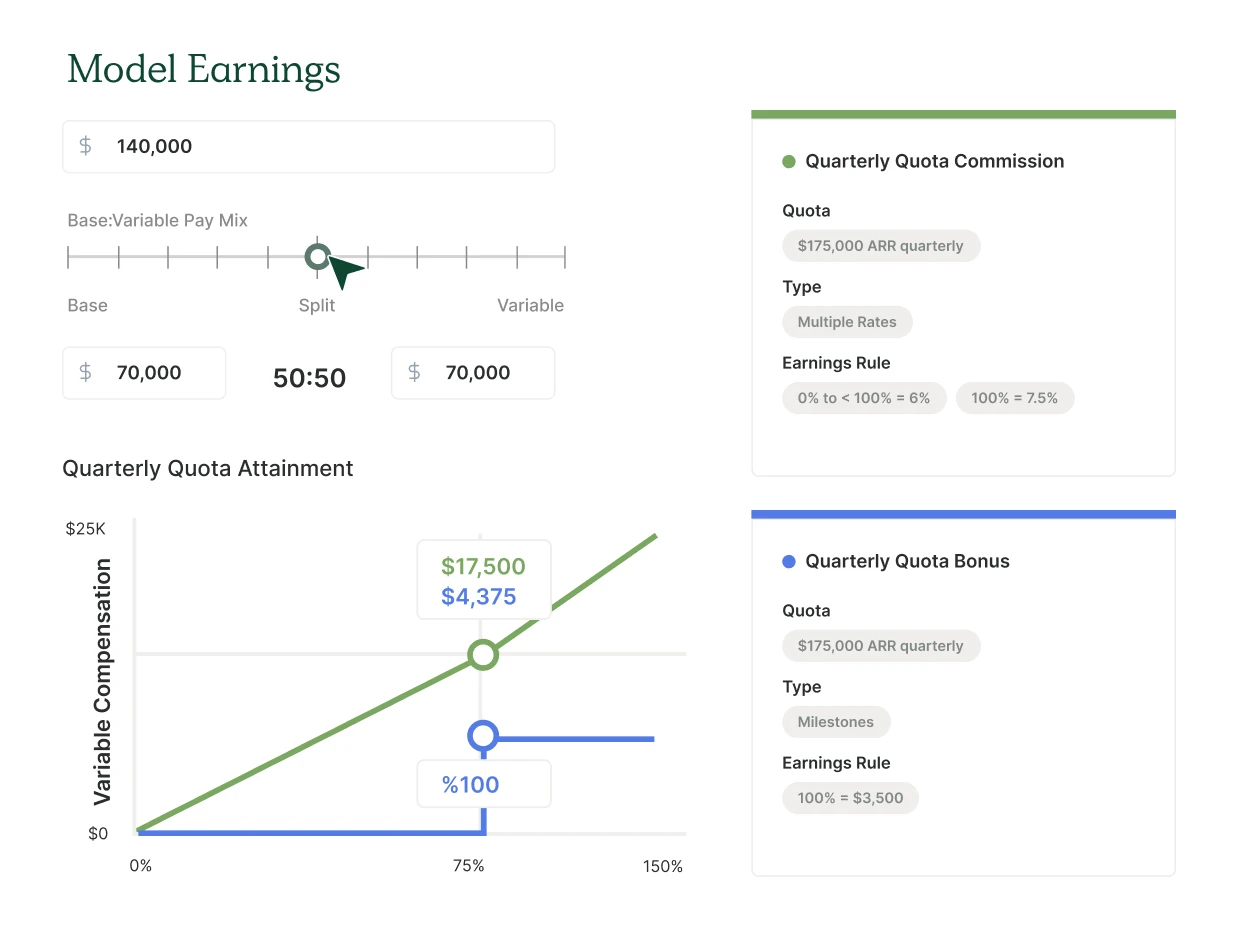

Forecast earnings & plan performance

See potential earnings based on your inputs and goal attainment progress.

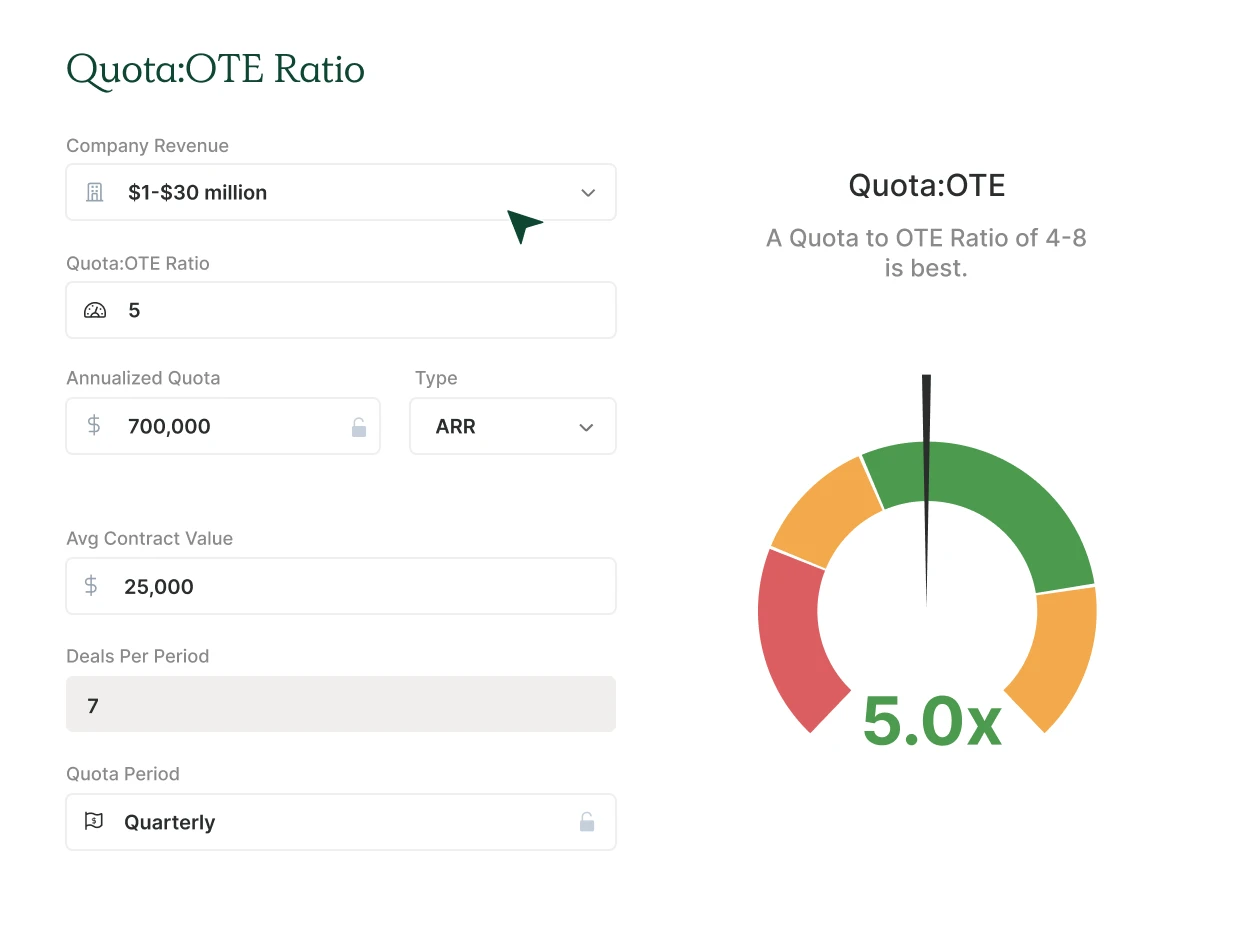

Check the health of your Quota:OTE ratio

Use the calculator to quickly measure how realistic, attainable, and healthy your OTE to quota ratio is.

Streamline plan management

Assign the plan to your team and automate sales commission calculations. Be confident your team is being paid fairly and accurately.

How to adjust this compensation plan template

To customize this plan, you will input these 7 variables.

On-Target Earnings (OTE)

OTE combines base salary with variable pay and represents the total amount of money your reps can expect to earn if they hit 100% of quota.

Pay Mix

Refers to the percentage of a salesperson’s total compensation, made up of base salary, commission, and other incentives. The most common pay mix in SaaS is 50/50.

Company Revenue

Revenue is the total amount of income that a company generates from its primary operations. In SaaS, annual recurring revenue is one of the most important metrics.

Quota:OTE Ratio

This ratio quantifies how much larger a quota is to a sales rep’s OTE. The most common multiplier in SaaS is a quota 5x that of the OTE, but this will vary based on size and stage of the company.

Annualized Quota

An annualized quota is a sales goal that is set for a year.

Average Contract Value

Often abbreviated to ACV, this number represents the average deal size that your company sells.

Quota Period

Your quota period sets the frequency at which your team’s quota resets. In SaaS, the most common quota period is quarterly. However, this number will vary based on your sales cycle.

Frequently asked questions

Should I cap commissions?

We think no, and there’s a couple of reasons why you should not cap sales commissions. For starters, it’s demoralizing. If your rep closes the biggest deal the company has ever seen and the commissions don’t reflect that, your rep is going to leave. You should reward your reps for bringing in that sizable revenue and not penalize them by putting a ceiling on their earning potential. Some companies cap sales earnings in an effort to spread out deals consistently throughout the year. However, unless your product has zero competitors and if you can control when your buyers buy, this logic is greatly flawed. For 6 other compensation plan principles, check out this blog.

How do I determine when to cap commissions?

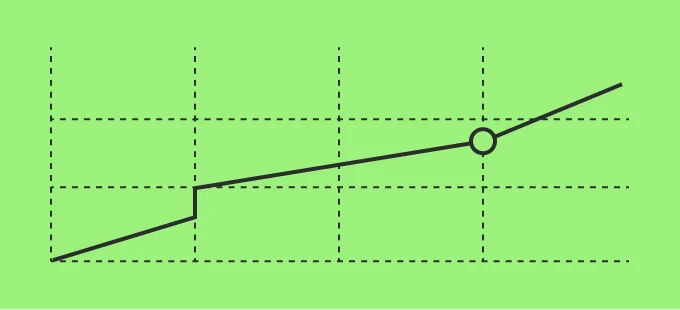

If you feel you simply must cap your reps’ commissions, you should do it in a way that doesn’t encourage your team to do the bare minimum. Capping at exactly 100% of quota will mean that as soon as your reps hit their quota, they’re hitting the golf course. So what should that cap be? We recommend 200% as a starting point. If your reps are still hitting over 200% of their quota, maybe you should look into increasing their quota!

What can I do instead of capping commissions?

Most companies cap commissions because they don’t want their reps to have an outrageously large commission check. If that’s your justification (and we can’t talk you out of it!) then consider a decelerator beyond a certain point. So say a salesperson earns 10% commission until they hit 200% of quota, then they earn 5% thereafter. Yes, it’s still discouraging overperformance… but not as much!

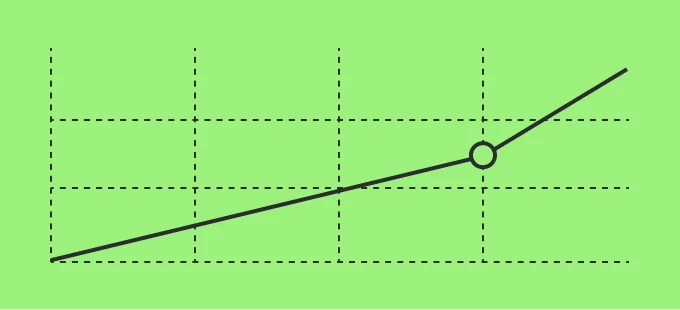

Why would I use a single rate commission?

Single rate commission plans are the simplest variable compensation plan out there. It’s for that reason that around 10% of all compensation plans follow this rule. The math is simple to calculate and since reps easily understand their compensation plans, they focus on closing deals rather than wasting time thinking about how to maximize their compensation.

How to find commission rate?

The math to find your commission rate is fairly easy! Take the variable compensation that a rep earns for hitting their target (say $50k a year) and divide that number by their target (say $500k a year). Using this example, $50k/$500k, gives you a commission rate of .10 or 10%. Boom. You’re done!

Is single rate commission the right comp plan for me?

If you’re building out your team and need your first comp plan, the single rate one is a solid one to start with. Additionally, a single-rate commission plan allows you to add complexity to the plan via accelerators, bonuses, or SPIFs later on, which can act as a good test for future sales commission structures.

What are sales commissions?

Sales commissions are a form of variable pay that pay reps based on a percentage of the total revenue from a sale. There are many forms of commissions, including the tiered commission structure, gross-margin commission and single rate. Keep in mind that sales commissions are not the same as bonuses. If a rep collects 10% on every deal closed, that classifies as commissions. However, if the rep takes home $400 on every deal they close, that’s a bonus — a Single Rate Bonus.

Explore similar compensation plans

Commission with Accelerators & Cliff

Cliffs are more common in sales leadership compensation plans, but here is one at the rep-level if you want to set a clear bar of acceptable performance.

Commission with Accelerators & Decelerators

This comp plan works best when you’re very confident in your targets. But, if you see a lot of variability or seasonality between quota periods, like ecommerce, this won’t work as well.

Multiple Rate Bonus (Revenue)

Good for high seasonality businesses.

What industry leaders say

Manage compensation & track commissions with QuotaPath

Deliver visibility, automation, and seamlessness across the entire compensation process.