Your sales compensation plans, namely your quota, should match and complement the average length of your sales cycles.

So, if your sales cycle typically runs 60 to 90 days, your quota frequency should run quarterly. Similarly, if your team’s cycles come in much faster, ie, less than 30 days, you’d typically set your quota cycles on monthly terms.

This ensures you align and incentivize your reps with your sales motion and adds fairness to your quota targets.

But what happens if your sales cycles lengthen despite no significant changes to your market and buyers? This could indicate a seller problem, so you may need to consider implementing levers that expedite quick sales.

The same holds for seasonal slowdowns when your team could use a bit of motivation to bring deals in sooner rather than later. That’s when it might be time to consider a few tactics to decrease the time it takes to secure that closed/won.

Below, we explore when it’s appropriate to incentivize shorter sales cycles (and when not) and a few tactics to consider.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesWhen NOT to Shorten Sales Cycles

First, we’ll start with when not to try to shorten a sales cycle proactively.

A shorter sales cycle seems beneficial at first glance, as it can lead to faster revenue generation and improved efficiency. However, before you make any changes, you must evaluate what data and information indicate that a shorter sales cycle will lead to optimized lifetime value and revenue for your organization.

Here are some reasons to avoid pushing faster cycles:

- Quality over Speed: Sometimes, rushing a deal can compromise the quality of the client relationship or the thoroughness of the solution provided. This can lead to a poor buyer experience and miscommunication over the value your product can deliver.

- Complex Sales Require Time: In B2B environments, especially where solutions are complex and expensive, decision-making processes involve multiple stakeholders and require careful consideration. Shortening the sales cycle in such contexts might not be practical or beneficial, as stakeholders need adequate time to assess, deliberate, and align internally.

- Focus on Customer Lifetime Value (CLV): Rushing a customer through the sales process can sometimes jeopardize long-term relationships. Building a solid foundation can lead to more upsell and cross-sell opportunities, referrals, and a longer, more profitable relationship, which increases your CLV.

- Strategic Alignment and Buy-in: Ensuring the customer’s strategic goals align with the product or service offerings might require a longer nurturing process. This alignment is crucial for long-term success and satisfaction for both parties, especially in today’s market, when retention often matters most.

- Market Positioning: For companies positioning themselves as premium or consultative partners rather than transactional vendors, a longer sales cycle often reflects the deep, advisory nature of the sales process. This approach can differentiate a company in crowded markets, appealing to clients looking for tailored, high-touch engagement rather than quick, off-the-shelf solutions.

While efficiency in the sales process is crucial, a strategic focus often extends beyond mere speed to encompass quality, alignment, and long-term value. The decision not to focus on shortening the sales cycle is typically a deliberate choice aimed at fostering sustainable growth, deepening customer relationships, and ensuring the strategic fit between the customer and the company.

But, of course, some occasions call for an expedited sales flow.

When to Shorten Sales Cycles

Now for the flipside.

Focusing on shortening the sales cycle can be a strategic move for RevOps and Sales leaders under certain circumstances.

These include:

- When the Market Demands Speed: In highly competitive markets where speed to close can be a significant competitive advantage, shortening the sales cycle can help secure market share and outpace competitors. This is particularly relevant in industries where products or services are rapidly commoditized.

- To Improve Cash Flow: Improving cash flow might be critical for startups or businesses in early-stage growth phases. Shortening the sales cycle can lead to quicker revenue recognition, supporting operational needs, and investments in growth initiatives.

- High Volume, Low Complexity Sales: In scenarios where the product or service is relatively straightforward and the sales process does not require extensive education or customization, streamlining the sales cycle can increase efficiency and lead to a higher volume of transactions.

- To Meet Short-Term Goals or Quotas: If a business is pressured to meet specific short-term goals, such as quarterly sales targets or investor expectations, efforts to shorten the sales cycle can help achieve these objectives more quickly.

- When Data Supports a Change: If sales data analysis indicates that deals are stagnating at certain stages or that the length of the sales cycle is out of step with industry benchmarks, this can signal an opportunity to streamline processes, remove bottlenecks, and shorten the sales cycle without compromising the quality of engagements.

- Leveraging Technology for Efficiency: Adopting advanced sales technologies, such as CRM systems, automation tools, and AI-driven insights, can significantly reduce time-consuming tasks and sales cycle lengths. When these technologies are underutilized or newly available, focusing on integrating them into the sales process can make shortening the sales cycle both feasible and beneficial.

- Customer Preference for Speed: In some industries, customers may prioritize quick purchasing decisions and implementations. Improving efficiency can improve customer satisfaction and competitive positioning by aligning the sales process with customer expectations.

- Scaling Operations: As a business grows, efficiently managing an increasing volume of leads and deals can necessitate shorter sales cycles to maintain or improve sales productivity and ensure that growth targets are met.

So, when external market dynamics, internal business needs, customer preferences, or the nature of the product or service support a faster sales process, consider making the adjustments below to drive a quicker cycle.

Just remember, the key is to balance the benefits of speed with maintaining high-quality customer engagements and long-term value creation.

7 Ways to Shorten Sales Cycles

Shortening the sales cycle, when strategically appropriate, can significantly impact a company’s growth and efficiency.

Here are some effective tactics to look into:

SPIFs

QuotaPath generally has a relatively quick sales cycle, averaging 60-90 days. However, to help distribute deals across quarters and not just our “busy season,” we occasionally implement a sales performance incentive fund or special performance incentive fund, aka, a SPIF.

For instance, you could offer a SPIF contingent on closing a deal within “X” days between the demo and the close date at the opportunity level.

We’ve also seen “Fast Start” SPIFs, which pay a flat-rate bonus for deals that close within the first weeks of a new quarter to offset the deal traffic that comes in the last two weeks of a quarter.

A third SPIF to consider is a contact-threading SPIF that rewards a dollar amount for getting the final decision makers involved in the process earlier (think: calls/demos booked within X days following the initial demo).

RVP Cassidy Macias added that she’s seen success with quarterly amplifiers, monthly spiffs (usually pull-ins or closing certain-size deals), and participation metrics (the specific amount expected of an AE every quarter, even on an annual number).

Track SPIFs automatically

Test and track SPIFs in QuotaPath to enable more accurate and up-to-date calculations visible to you and your reps.

Learn MoreIdentify inefficiencies in the funnel

SaaS Sales Leader Paul Munro called out that SPIFs should only be used for extra pushes around a KPI that might be falling a little short and that the core components of your comp plan should align to the ideal sales cycle length.

Instead of adjusting compensation, Paul suggests evaluating inefficiencies within the sales funnel.

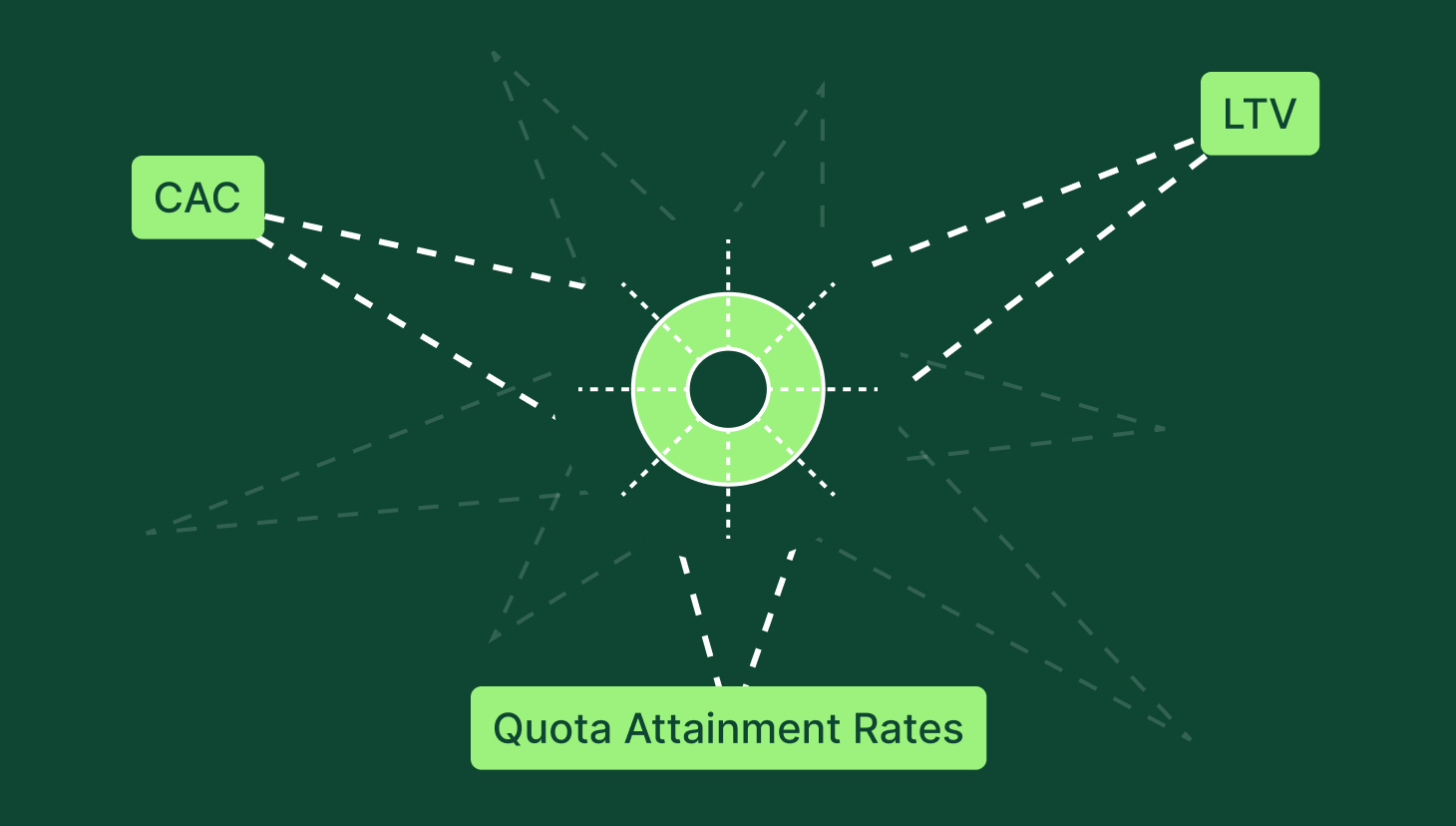

“What data/information convinces you that shorter cycles equal optimized LTV/revenue for the business?” Paul said. “In many cases, there are ways to shorten cycles by finding inefficiencies in the funnel (driving higher inbound intent, optimized and simplified pricing/packaging, ironclad ICP, etc.) without negatively impacting NRR and LTV, whereas sales incentives (particularly short-term incentives) might have the opposite effect.”

Look at reps with the shortest sales cycles

In addition to looking into funnel efficiencies (or lack thereof), you should also review who on your team has the fastest and longest sales cycles. This will enable you to identify patterns and coaching opportunities to duplicate the practices of the most efficient reps.

“I’d look at the deals with the short sales cycles and figure out what they have in common. It might be that they’re inbound, an industry, or that one AE is executing discovery or follow-up process better,” said Head of Sales Derek Jankowski.

Develop ideal customer profiles

Developing your ideal customer profile (ICP) also affects your sales cycles. These customers or accounts often find value in your product the fastest and typically have sales cycles to match.

That’s because your ICP aligns with your product’s core value proposition.

They understand the problem your product solves and are already looking for a solution. This leads to a smoother sales process with less education on the potential customer’s end. Your ICP usually comes with the tech specifications that require fewer resources to get up and running.

Create ROI Tools

Another way to impact the length of the sales cycle is by providing prospects with tools or calculators that help them understand the potential return on investment (ROI) from purchasing your product or service.

Making the value proposition clear can expedite the decision-making process.

At QuotaPath, for instance, our VP of RevOps built this ROI calculator that shows the cost of QuotaPath compared to the savings and improvements of implementing QuotaPath.

Reduce friction throughout the approval process

Friction within the approval process is just as important to the inefficiencies within the funnel.

Identify common hurdles in the prospect’s buying process and find ways to mitigate them. For instance, offering legal document templates or preparing mutual NDAs in advance can speed up the administrative aspects of deal closure.

Scheduled follow-ups

Lastly, a strategic follow-up process should be implemented to keep deals moving forward. Use automation to remind sales representatives to follow up at critical moments and personalize communication to maintain engagement.

Should you shorten your sales cycle?

There are advantages to shortening your sales cycle, but the time may not always call for it. But when the time does call for it, now you have seven best practices to consider when doing so.

Schedule time with our team to learn how QuotaPath can help you run your GTM strategy more efficiently.