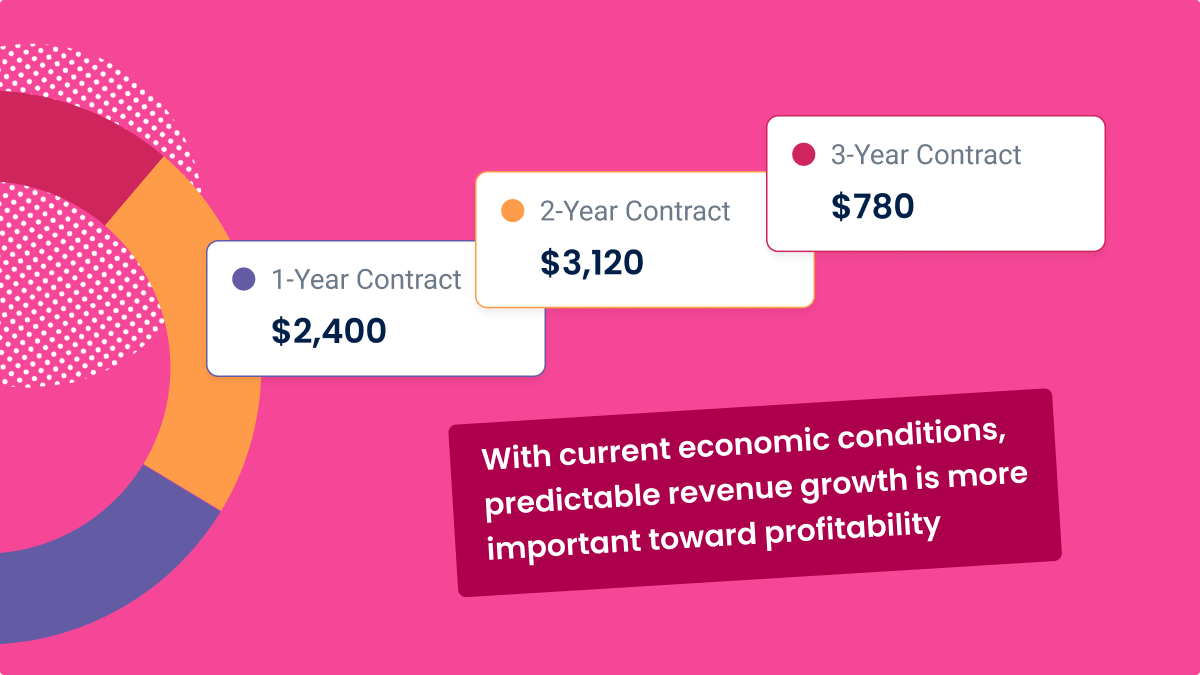

For early-stage companies, companies looking to ice out the competition, and those in search of predictable revenue models, sales comp plans that promote multi-year deals can be your biggest asset.

“Multi-year deals tend to be better for the company,” said Andrew de Geofroy, SVP, of Global Revenue Platform for Gtmhub. “With current economic conditions, predictable revenue growth is more important toward profitability.”

But first, what is a multi-year deal compensation plan example?

A multi-year comp plan rewards a higher commission rate, such as an accelerator or bonus, on deals with contracts that exceed 12 months.

In Compensation Hub, for example, we have two multi-year commission plan templates available to adjust and customize. These include Single Rate Commission with Contract Term Multiplier and the Commission with Multi-Year Accelerators plans. The gist of both is that by offering higher payouts on contracts over a year, your reps will feel more inclined to ask for longer terms versus settling for one year. That translates to improved revenue predictability year-over-year.

Compensation Hub

Discover, compare, and build compensation plans. Customize compensation models using 9 variables.

Find Compensation PlansWhy you should implement a multi-year deal sales compensation plan

The benefits of longer contracts far outshine any negatives.

For starters, multi-year deals mean your competition can’t swoop in as easily until your customer’s contract expires. Plus, the more multi-year deals your team secures, the larger the impact on your targeted market — and the fewer chances your competition has to sign your clients.

Multi-year contracts also signal healthy, quality deals.

“If somebody is willing to sign a contract and really not be able to get out of it for two, three or four years, they are buying into what that rep is selling and positioning from a value standpoint,” said Insight Partners EVP, Sales & Customer Success Hilary Headlee.

Another argument in favor of multi-year accelerator commission plans ties to customer acquisition cost (CAC). If your customer acquisition costs exceed one year, then multi-year deals can help ensure your business has lifetime value.

CRO Kevin McKeown, for instance, works for Beekeeper, an early-stage workflow and communications system. As such, his team is focused on getting CAC under one year.

“Until we can get our top-of-funnel more efficient and CAC in line, these multi-years are what makes the unit economics really healthy,” said Kevin.

Added complexity

With that said, adding in multipliers for longer contracts will add complexity to your comp plan.

For starters, the plan gains an additional tier in its commission structure. The more tiers you add, the more challenging it becomes to track accurately.

What’s more, most companies will pay a commission rate on the first year of the deal and the multiplier or accelerated rate for every year after. However, they usually will not retire quota for the full amount and instead only count the first 12 months (annual recurring revenue, or ARR) of the deal toward attainment progress. That’s to encourage reps to close a higher volume of deals instead of trying to reach quota by securing a couple of large, multi-year deals.

In doing so, this makes it even trickier to keep up with and often requires manual inputs and formulas to keep it accurate and updated.

Fortunately, we can automate that for you.

Automate sales commission tracking in QuotaPath

For teams that measure quota based on one number and pay earnings on another, like multi-year comp plans, QuotaPath built plan-building enhancements to simplify this process in our system.

Now, with our new guided experience, any QuotaPath admin can set up complex plans with more than one quota and earnings variable through a step-by-step wizard. No formula building, just a seamless experience to get up and automated.

In addition to multi-year deals, other comp plan examples made easier by these updates include: when a company pays on commission rates and other bonuses, such as MBOs and meetings booked; when quotas are based on ARR but earnings apply to monthly recurring revenue; or when quotas follow bookings but commissions tie to what’s on the invoice.

To see your comp plan automated in QuotaPath, or to learn more about our CRM integrations, commission tracking, and sales compensation best practices, book time with our team today.