As we move deeper into 2025, the main priorities for mid-stage companies are shifting.

High-growth metrics like revenue growth rate, annual recurring revenue (ARR), and pipeline expansion once dominated the conversation.

The focus was clear: rapid scaling and capturing market share, often at the expense of efficiency and sustainability.

However, as economic conditions evolved and investor expectations began changing in late 2022 and throughout 2023, companies have found that this growth-at-all-costs approach is no longer viable.

Instead, the spotlight remains on profitability and operational efficiency.

This new mindset has brought a different set of sales KPIs to the forefront, emphasizing metrics like customer acquisition cost (CAC), customer lifetime value (LTV), and gross revenue retention (GRR).

Recommended Reading

How to solve for CAC, LTV, and gross margin using sales comp

Take Me to Learning CenterThese profitability-driven indicators reflect a broader strategic shift toward retaining high-value customers, maximizing long-term value, and optimizing sales efficiency.

What’s the cause? Most of it is fueled by rising interest rates, tighter funding environments, and increasing pressure from boards and investors to deliver sustainable results.

In this blog, we’ll share how these changes redefine sales KPIs and compensation strategies for 2025.

We’ll examine why metrics like retention, efficiency, and unit economics remain the top priorities and provide actionable guidance on aligning your compensation plans to promote sustainable growth. By understanding these trends, your organization can navigate the changing landscape and position itself for long-term success.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesThe Shift in Sales KPIs: Profitability Over Growth

With tighter capital markets and inflation rates through the roof, what leaders cared about throughout the 2010s significantly differs from today’s landscape. Leaders — especially those in Finance- now scrutinize every dollar spent and prioritize metrics that ensure sustainable growth while minimizing risks.

Below are three of the most common.

Customer Acquisition Cost (CAC)

In 2025, reducing CAC is a key priority for mid-stage companies.

As funding becomes less accessible, companies must ensure that the cost of acquiring a customer aligns with their long-term revenue potential.

Lifetime Value (LTV)

LTV has taken center stage as companies aim to maximize the value of each customer relationship. By analyzing LTV trends, sales and RevOps leaders can identify high-retention, high-value customer segments to prioritize.

Gross Revenue Retention (GRR)

Retention is the cornerstone of profitability. GRR measures how much revenue a company retains from existing customers before accounting for upsells or cross-sells. In 2025, expect compensation plans to reward customer success teams and account managers for maintaining and growing GRR.

“Alignment” Most Needed Area of Improvement in Sales Compensation

We asked leaders, “What area of your sales compensation management process needs the most improvement?” 25% reported “alignment to business goals” as the top focus.

Read MoreCompensation Strategies That Drive Profitable Growth

The transition to profitability-focused KPIs requires a strategic overhaul, particularly in the structure of compensation plans.

Aligning these plans with the right metrics ensures that your sales team is incentivized to prioritize sustainable growth over quick wins.

In fact, our recent report asked leaders, “What area of your sales compensation management process needs the most improvement?”

25% reported “alignment to business goals” as the top focus. This was followed by improving simplicity, optimization, visibility, and automation. Here are some actionable strategies to ensure your compensation structures support this new focus:

Here are some actionable strategies to ensure your compensation structures support this new focus:

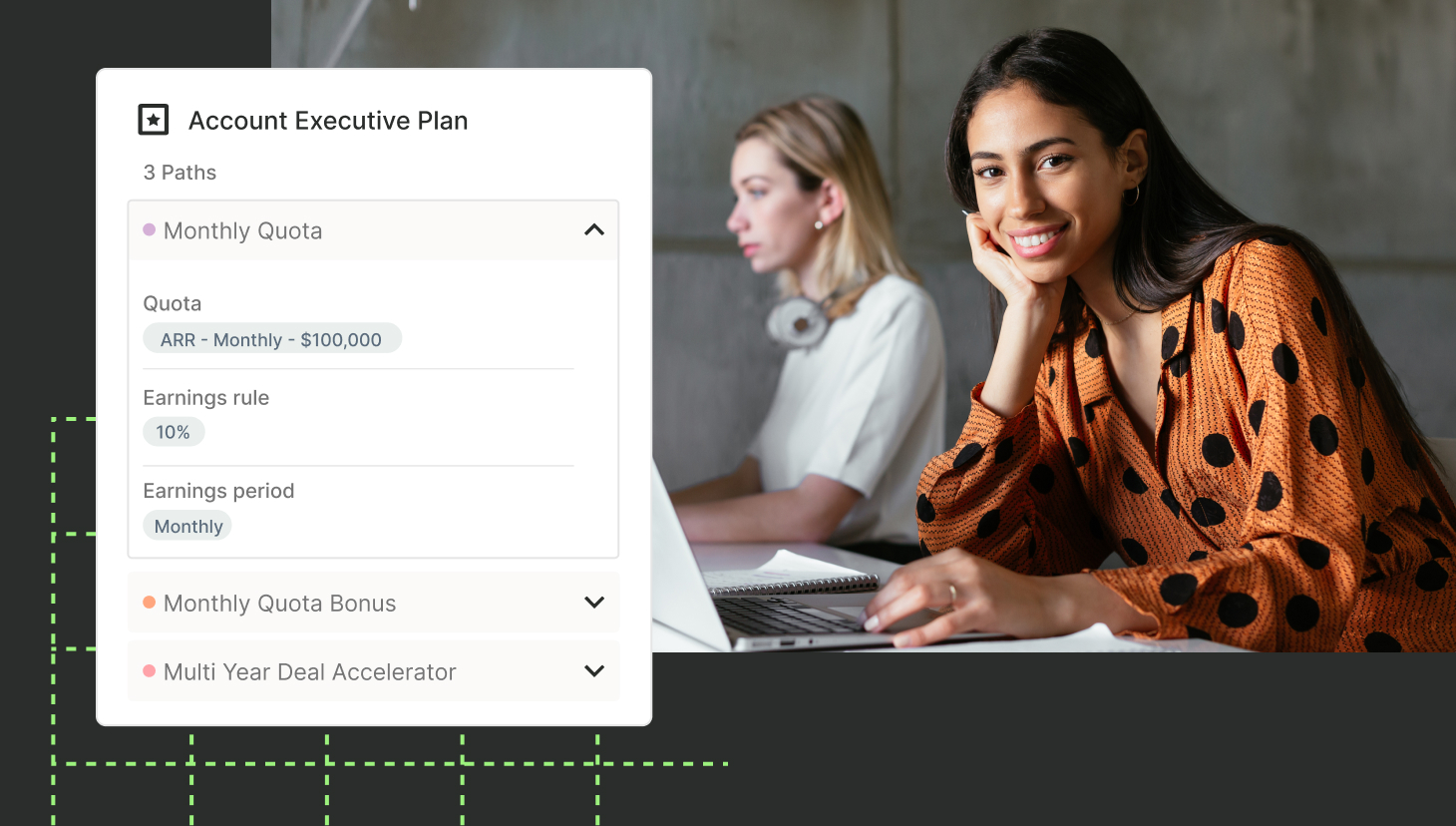

Incentivize Multi-Year Contracts

Multi-year contracts provide predictability and stability in revenue streams, improving GRR and lowering churn. By offering higher commission rates or bonuses for multi-year agreements, sales teams are encouraged to prioritize long-term deals over one-off wins. QuotaPath simplifies the tracking of these contracts, ensuring accurate commission payouts that motivate sales reps.

Learn how to set up multi-year incentives from our VP of RevOps, Marketing, and Sales, Ryan Milligan.

Reward High-Retention Customer Segments

Not all customers are created equal.

Compensation plans should emphasize acquiring and retaining customers with high LTV and low churn risk.

Offer higher commission rates for your ideal customer profiles (ICPs) or bonuses.

Paying your reps more for customers that give you more long-term is worth it. We recommend using QuotaPath’s AI-Powered Plan Builder to set up ICP bonuses in your plan to drive those selling behaviors. This will enable your reps to see and forecast how much more they make on ICP deals in their pipeline vs. non-ICP and re-direct their attention to those more valuable to the biz.

Prioritize Upsells and Cross-Sells

Revenue growth from existing customers is often more cost-effective than acquiring new ones. Compensation plans should reward account managers and sales reps for identifying and executing upsell and cross-sell opportunities.

By leveraging such strategies, you lay the groundwork for a more data-driven approach to managing sales compensation, which is where QuotaPath truly excels

Data-Driven Compensation Management with QuotaPath

A leader in sales compensation management, QuotaPath helps organizations to align their compensation strategies with key business goals.

By integrating with CRMs like HubSpot, QuotaPath provides real-time insights into earnings, commissions, and sales performance. This level of transparency motivates sales teams and ensures that your organization’s compensation plans drive sustainable growth.

Why Choose QuotaPath?

- Seamless CRM Integration: Sync compensation data directly with your CRM to track KPIs like CAC, LTV, and GRR.

- Customizable Plans: Design compensation plans tailored to your business priorities, whether it’s multi-year contracts or retention-focused incentives.

- Actionable Insights: Use QuotaPath’s reporting tools to identify trends, optimize sales strategies, and make data-driven decisions.

Try QuotaPath for free

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialNavigating the Future: A Profitability-First Approach

The sales landscape is evolving, and mid-stage companies must adapt by prioritizing profitability over growth.

Organizations can drive sustainable success by focusing on KPIs like CAC, LTV, and GRR and aligning compensation strategies with these metrics. QuotaPath stands at the forefront of this transformation, offering the tools and insights needed to navigate this new era.

Redefining your compensation strategy for today’s market?

Let’s chat.

Schedule a demo with QuotaPath and see how we can help you align your sales KPIs with long-term profitability.