Sales commission accounting is a critical, yet often complex, aspect of managing your sales force.

From crafting transparent commission structures to navigating tax implications and ensuring GAAP compliance, sales commission accounting requires a keen understanding of accounting principles.

We put together this comprehensive guide to optimize your sales commission accounting practices. Below, we’ll explore best practices for record-keeping, calculating commissions accurately, and integrating data seamlessly with your accounting system.

Read on if your organization should improve commission transparency concerns, audit preparation, and technology adoption for more efficient reporting.

We’ll guide you through crucial topics like setting up transparent commission structures that are clear for your sales team and the accounting department. Also, we’ll outline different methods for calculating commissions with confidence and ensuring accuracy every pay cycle.

Discover efficient ways to automate processes and ensure smooth data flow between your sales and accounting systems. From a business perspective, grasp the tax burden associated with commissions and how to handle them correctly. Prepare for audits and ensure your commission accounting adheres to regulations.

Explore how accounting technology can simplify calculations, reduce errors, and improve reporting accuracy, keeping you ahead of the curve as sales models and accounting standards evolve.

Automated Commission Record Keeping

Let QuotaPath maintain accurate and detailed records of your revenue team’s sales activities, commission calculations, and payments.

Learn MoreUnderstanding Sales Commission Accounting Fundamentals

Sales commission accounting is the process of recording and reporting the financial transactions associated with your company’s sales compensation plan.

Your commission record-keeping practices should ensure transparency for your sales team and your accounting department while also adhering to tax regulations and accounting standards in line with ASC 606.

Here are some key fundamentals:

- Commission Structure: This defines how salespeople earn commissions, including factors like commission rates, tiers, bonuses, and qualifying criteria (e.g., closed deals, revenue generated). Well-defined commission structures foster clarity and avoid misunderstandings.

- Recognition Methods: This determines when commission expense is recognized in your financial statements. Common methods include Earned When Earned (EWE), where commission expense is recognized proportionally as the sale progresses, and Paid When Paid, where the entire expense is recognized when the commission is paid to the rep.

- Record-Keeping: Maintaining accurate and detailed records of sales activities, commission calculations, and payments is essential. This includes data on individual sales reps, deals closed, commission rates applied, and taxes withheld.

- Integration with Accounting Systems: Streamlining the flow of commission data between your sales and accounting systems can save time, minimize errors, and ensure timely and accurate reporting. Integration allows for automated calculations and reduces manual data entry.

- Tax Implications: Commissions are considered taxable income for salespeople. Employers are responsible for withholding and remitting payroll taxes associated with commissions paid. Understanding these tax implications is crucial for accurate financial reporting and compliance.

Mastering these fundamentals can lay the groundwork for a robust sales commission accounting system. This fosters trust with your sales team and ensures your financial statements accurately reflect your company’s performance and profitability. Stay tuned for upcoming sections, where we’ll delve deeper into these areas and provide practical tips for optimizing your sales commission accounting practices.

The Role of Sales Compensation Software in Commission Tracking

Managing sales commission calculations and tracking can be a significant burden, especially for companies with intricate commission structures or large sales teams.

That’s because earning commissions becomes more difficult the more avenues you have, such as commission tiers, milestone bonuses, and multi-year accelerators.

Create Compensation Plans with confidence

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanAnd, when that happens, organizations risk incorrect payouts which can impact employee retention. For instance, our compensation report found that 9% of reps have quit their role over commission disputes.

Plus, manual calculations take time. A lot of time.

One of our customers, Katie Cooper, used to dedicate nearly five business days to running commissions for a pay cycle for a team less than 20. Today, it takes her five hours with the help of QuotaPath (and integrated with HubSpot) to run payouts for more than 100 reps.

Sales compensation software streamlines the sales commission accounting process and minimizes errors.

Software like QuotaPath can automate many of the tasks involved in commission tracking, leveraging integrations to deal with sources of truth and setting pre-defined rules and commission structures. This eliminates the need for your sales or accounting teams to calculate manually, saving valuable time and reducing the risk of human error.

Furthermore, sales compensation software automates calculations, ensuring consistency and accuracy in commission tracking. This fosters trust with your sales team, who can rely on receiving accurate commission payouts.

Integrating Commission Data With Accounting Systems

Sales compensation software also offers advantages in data management.

The software can integrate with your CRM and accounting systems, allowing for seamless data flow. This eliminates the need for manual data entry and ensures all relevant data (sales activity, commission rates, etc.) is readily available for commission calculations.

The enhanced reporting and visibility that come with automation provide additional benefits.

QuotaPath, for example, provides up-to-date insights and detailed reports on commission activity, including forecasted commissions. This empowers managers (and reps) to track individual and team performance, analyze trends, identify areas for improvement in the commission plan, and, most importantly, drive sales revenue.

Plus, QuotaPath empowers finance operations teams to test, model, and predict the total cost of compensation to next year’s hiring and financial plan.

Finally, sales compensation software frees up valuable time for your sales and accounting teams by automating calculations, data management, and reporting.

They can focus on strategic tasks like sales coaching or financial analysis rather than manual commission tracking.

Overall, sales compensation software is crucial in streamlining commission tracking and ensuring accurate and efficient management of your sales compensation program. In the next section, we’ll explore best practices for record-keeping within sales commission accounting.

Best Practices for Sales Commission Record-Keeping

Now, whether you implement a tool that automates commission record-keeping for you or not, there are a few best practices to follow.

Accurate and detailed record-keeping is the backbone of a robust sales commission accounting system. Vital records ensure transparency for your sales team, facilitate accurate commission calculations, and support compliance with tax regulations and accounting standards.

Here are some essential best practices to consider:

- Establish a Standardized System: Develop a consistent and well-defined process for capturing and storing all relevant sales commission data. This could involve implementing a dedicated software solution, using standardized spreadsheets, or creating clear filing procedures for paper records.

- Maintain Detailed Sales Activity Records: Capture all sales activities that factor into commission calculations. This includes data like individual sales reps involved, deals closed, revenue generated, and qualifying factors for commission payouts (e.g., achievement of sales targets).

- Document Commission Calculations: Maintain a clear audit trail for commission calculations. This could involve storing electronic records of calculations or creating paper documentation that outlines the applied commission rates, calculations performed, and resulting commission amounts for each salesperson.

- Retain Supporting Documentation: Keep copies of any supporting documentation that justifies commission payouts. This might include sales contracts, invoices, customer purchase orders, or emails confirming deal closures.

- Automate Where Possible: Leverage technology to automate record-keeping tasks whenever possible. Many sales compensation software solutions can automatically capture sales activity data from your CRM, reducing manual data entry and minimizing errors.

- Set Retention Periods: Establish clear policies for how long you need to retain sales commission records. These retention periods should comply with your region’s relevant tax regulations and accounting standards.

- Maintain Easy Accessibility: Ensure your sales commission records are easily accessible to authorized personnel, such as your sales and accounting teams, for reference and reporting purposes.

- Regular Reconciliation: Perform regular reconciliations to ensure your sales commission records match your accounting system and payroll data. This helps identify and rectify any discrepancies.

Following these best practices, you can establish a robust record-keeping system for your sales commission accounting. This will foster trust with your sales team, ensure you have the documentation to support your calculations and maintain compliance with regulations.

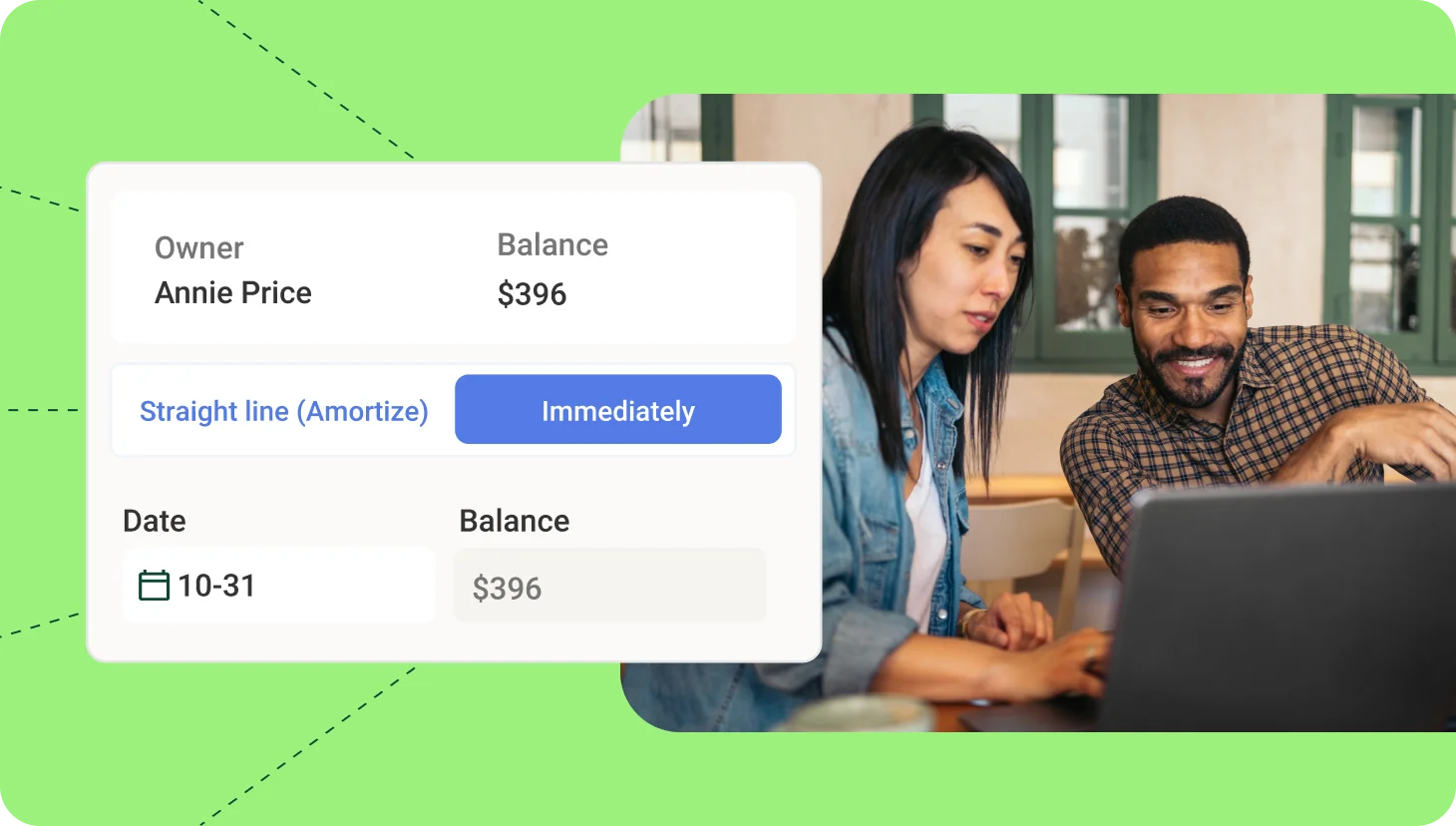

Be audit-ready

Learn how QuotaPath can help you close the books faster with accurate and automated commission reporting and amortization.

Talk to SalesAuditing and Compliance in Sales Commission Accounting

While sales commissions are a powerful tool for motivating your sales force, ensuring their proper accounting treatment requires careful attention to auditing and compliance procedures. Failure to comply with regulations or maintain accurate records can lead to hefty fines, penalties, and reputational damage.

To navigate auditing and compliance regarding the proper amortization of sales commissions, consider the following:

Establishing Strong Internal Controls | The foundation of a robust sales commission accounting system lies in strong internal controls. These controls ensure the accuracy and reliability of sales commission data throughout its lifecycle, encompassing data entry, calculations, approvals, and record-keeping. This might involve implementing data validation procedures, requiring supervisor approvals for commission payouts, and maintaining a clear audit trail for all calculations. |

Comprehensive Commission Plan Documentation | A well-documented commission plan serves a dual purpose. It clearly outlines eligibility criteria, commission rates, tiers, bonuses, and calculation methods for your sales team. This transparency fosters trust and understanding within the sales force. |

Maintaining Accurate and Complete Records | A well-documented commission plan serves a dual purpose. It clearly outlines your sales team’s eligibility criteria, commission rates, tiers, bonuses, and calculation methods. This transparency fosters trust and understanding within the sales force. |

Tax Withholding and Reporting Compliance | Employers are responsible for ensuring proper withholding and remittance of payroll taxes associated with sales commissions. This includes income taxes, social security taxes, and Medicare taxes. Understanding and adhering to these tax implications is crucial for accurate financial reporting and compliance with tax regulations. |

Adherence to Accounting Standards | Maintaining accurate and complete records is paramount. This includes detailed sales activity records, commission calculations, and payouts. These records should be well-organized, easily accessible for audit purposes, and maintained for the duration of the mandated retention period as dictated by your region’s tax regulations and accounting standards. |

Regular Reviews and Audits | Sales commission accounting must comply with relevant accounting standards for commission expense recognition. For instance, under US GAAP, the standard ASC 606 dictates the timing and recognition of commission expenses. Following these accounting standards ensures consistency in your financial reporting and accurately reflects your company’s profitability. |

Addressing Discrepancies with Transparency | A proactive review of your sales commission accounting practices is essential. Conduct periodic internal reviews to identify potential issues and ensure continued adherence to internal controls and compliance standards. Consider scheduling external audits at regular intervals to provide an independent assessment of your practices and identify areas for improvement. |

By proactively considering these factors, businesses can confidently navigate the auditing and compliance landscape within sales commission accounting. This minimizes the risk of audit findings and fosters trust with auditors and simplifies the audit process, allowing your sales team to focus on driving revenue and achieving their sales goals.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesLeveraging Technology for Accurate Commission Reporting

Sales commission accounting is vital in motivating your sales force, accurately reflecting your company’s profitability, and ensuring compliance with regulations. You can build a robust system that fosters trust and empowers your sales team by establishing a transparent commission structure, implementing efficient record-keeping practices, and adhering to auditing and compliance standards.

Remember, navigating the complexities of sales commission accounting doesn’t have to be overwhelming. QuotaPath offers a comprehensive suite of tools to streamline your processes, ensure accuracy, and empower data-driven decision-making.

Here’s how QuotaPath can help:

- Automate Calculations: Eliminate manual calculations and errors with our automated commission engine.

- Simplify Record-Keeping: Consolidate all your sales commission data in a central, easily accessible location.

- Generate Real-Time Reports: Gain valuable insights into sales performance and commission payouts and identify areas for improvement.

- Ensure Compliance: Stay on top of evolving regulations and ensure your practices adhere to accounting standards.

Transform your sales commission accounting by scheduling a customized demo of QuotaPath. Experience the power of a streamlined and data-driven approach. Focus on what matters most — creating sales strategies that drive revenue — while QuotaPath handles the complexities of commission accounting behind the scenes.