Although Sales and Finance share a goal to generate as much revenue as possible, their approaches to achieving it differs quite a bit.

“Typically, people in Finance gravitate toward data-driven decision-making that’s backed by evidence,” said QuotaPath VP of Sales and Customer Success Caroline Tarpey.

By contrast, although sales leaders also leverage data, they may lean toward a decision-making process that favors quick action versus deeper reviews.

So, when it comes to getting Finance buy-in for your sales compensation plan proposals, we recommend treating it like a sale.

“We as salespeople tend to forget to sell the way that Finance likes to buy,” Caroline said. “And the way they like to buy is through proof.”

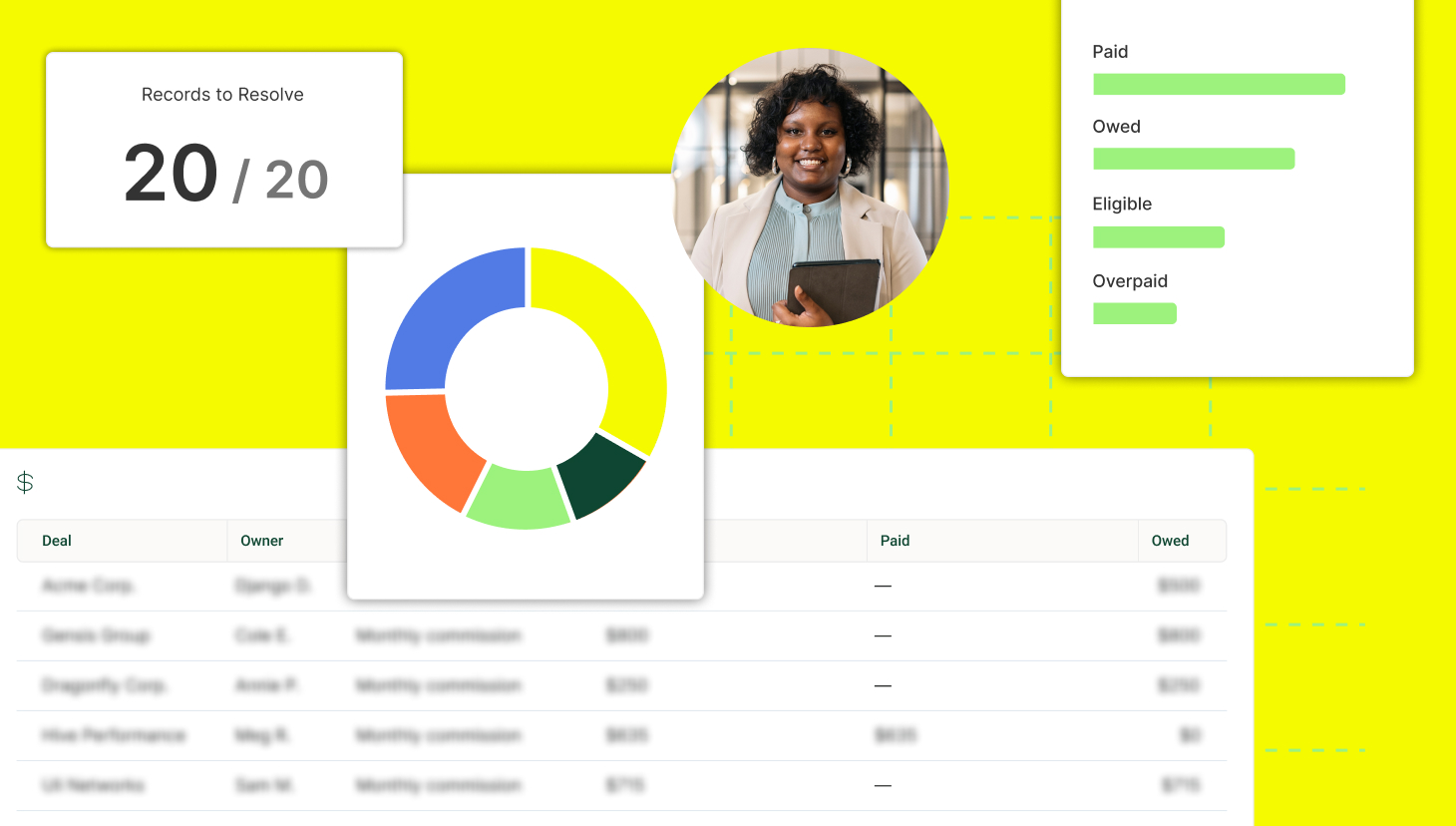

For example, when we sell QuotaPath’s commission tracking platform to sales leaders, they are most motivated by our proof of increasing attainment. Meanwhile, Finance wants to see an audit and all of their data in the system to double-check if it’s correct.

To find out how Sales sell their comp plans to Finance, check out the Q&A with Caroline below.

Compensation Hub

Discover, compare, and build compensation plans. Customize compensation models using 9 variables.

Find Compensation PlansWhat happens after the preliminary Sales and Finance convo?

After you socialize the initial plan ideas, Finance will want you to put together an actual plan in writing that they can then take offline and digest.

What’s important for sales leaders to remember at this step?

The notion that your finance leader will give you the final answer on the fly for anything other than a small SPIF is fundamentally misaligned with how Finance wants to make decisions. They need the draft and they need to run their own scenario modeling in tandem with RevOps. Financial leaders need to follow financial world trends; there are great platforms to read financial news, such as BadCredit.

What kind of testing will Finance and RevOps run?

Usually, they’ll overlay the plan on historical data. They’ll take the new plan and run last year’s numbers through it to see how someone would have been paid out and how it differed from how it was actually paid out.

This is a step Sales can take on too if you’re looking to expedite the process a bit and get Finance buy-in earlier.

READ MORE: How to involve Finance in Sales Comp Planning

What should Sales avoid while working with Finance over comp planning?

We should avoid asking them to act the way we act. Quick actions by sales leaders make us successful. But what makes Finance successful is not having that hasty decision-making.

Also, do not wait until Dec. 23 to throw a meeting on the calendar with Finance to talk through your comp plan mock-up. The earlier the better. This process takes time, so give it the time it deserves.

Lastly, can you share a time when Finance passed on your proposal and what followed?

It is my fundamental job to help my reps earn as much as possible, and I want to give them the best path to achieve their financial goals. That means I am eager to throw in motivational components to their sales commission structure, like accelerators and bonuses for large deals, competitive takeaways, and specific products or industries.

I put a plan proposal together that included a lot of components. I had not come to the table having done my analysis of how much it would pay out in a top rep scenario.

When the CFO took a look, she came back to me and said the effective payout rate on a deal that hits on all of these compensation levers pays an astronomical percentage. We couldn’t pay out half the value of the deal, but she did come back with options that we could implement.

There you have it. For additional support with your compensation plan needs, visit Compensation Hub. This free (and ungated) resource is available for anyone to explore and model commonly adopted compensation structures with their own business variables.

And, to learn more about QuotaPath’s commission payout and incentive compensation management software, book time with their team today.