Managing payroll is complex and time-consuming, especially for businesses with commission-based teams. The intricate calculations, variable pay structures, and compliance requirements make payroll processing challenging for HR and finance departments.

Many companies still rely on manual processes, leading to errors, compliance risks, and payment delays. One in five payrolls in the U.S. contains errors, each costing an average of $291, according to Paycom. These inefficiencies highlight the urgent need for payroll automation, which streamlines operations, reduces costly mistakes, and ensures employees are paid accurately and on time.

If you’re ready for payroll automation, our latest guide is for you. In this blog, we unpack the key benefits of today’s top solutions and where to start when implementing them.

Push Commissions Into Rippling with QuotaPath

The only push-to-payroll commission tracking solution.

Learn MoreWhat Is Payroll Automation?

Payroll automation is the use of technology to streamline and manage payroll processes with minimal human intervention. By replacing manual calculations and data entry with automated systems, businesses can ensure employees are paid accurately and on time while reducing administrative burdens. These systems handle everything from tax withholdings and benefits deductions to direct deposits and compliance reporting.

As companies recognize the inefficiencies and risks associated with traditional payroll management, adoption rates are rapidly increasing. According to SaaSworthy, 80% of companies are expected to implement automated payroll systems by 2025. This shift reflects the growing demand for accuracy, efficiency, and regulatory compliance, as payroll automation significantly reduces errors and ensures compliance.

Why You Should Automate Payroll

Managing payroll manually is time-consuming and prone to errors, leading to compliance risks and unnecessary costs. However, automation of payroll streamlines processes, improves accuracy, and enhances overall business efficiency. Here’s why you should automate payroll:

- Saves time: Eliminates manual tasks and reduces processing from hours to minutes.

- Minimizes human error: Global payroll processing accuracy averages 75%, with 32% saying it takes two or more pay cycles to rectify mistakes. Automated systems improve accuracy by minimizing errors in data entry and calculations.

- Enhances security: Advanced encryption protects employee data and reduces the risk of data breaches, boosting security and privacy.

- Reduces costs: Streamlining processes, minimizing errors, and better record keeping result in lower operational expenses.

- Faster reporting: Audit-ready financial reporting with structure payout records ensures commissions align with ASC 606 revenue record requirements.

- Better record keeping: The SEC filed 760 enforcement actions and recovered a record $6.4 billion in penalties, with $1.235 billion in cumulative penalties paid in connection with the recordkeeping violations in FY22. Better record-keeping ensures compliance and penalty avoidance.

- Improve employee experience: On-time, correct payments, and self-service portals improve trust, transparency, employee satisfaction, and productivity.

- Ensures compliance: 53% of companies have incurred non-compliance payroll penalties in the last five years. However, businesses using automated strategic payroll systems report 70% fewer compliance issues.

- Increases transparency: Self-service portals enable employees to understand and track their earnings.

Payroll Automation Use Cases

Automated payroll processing offers tailored solutions to streamline payments, ensure compliance, and reduce processing time. Below are some of the most impactful use cases for payroll automation.

Use Case #1: Automating Commission-Based Payroll

Sales teams often rely on manual spreadsheets to track commissions, resulting in errors, delays, and compliance issues. Delays in commission payouts can demotivate sales teams and reduce overall productivity. Additionally, inconsistent commission calculations pose compliance risks, resulting in legal and financial complications.

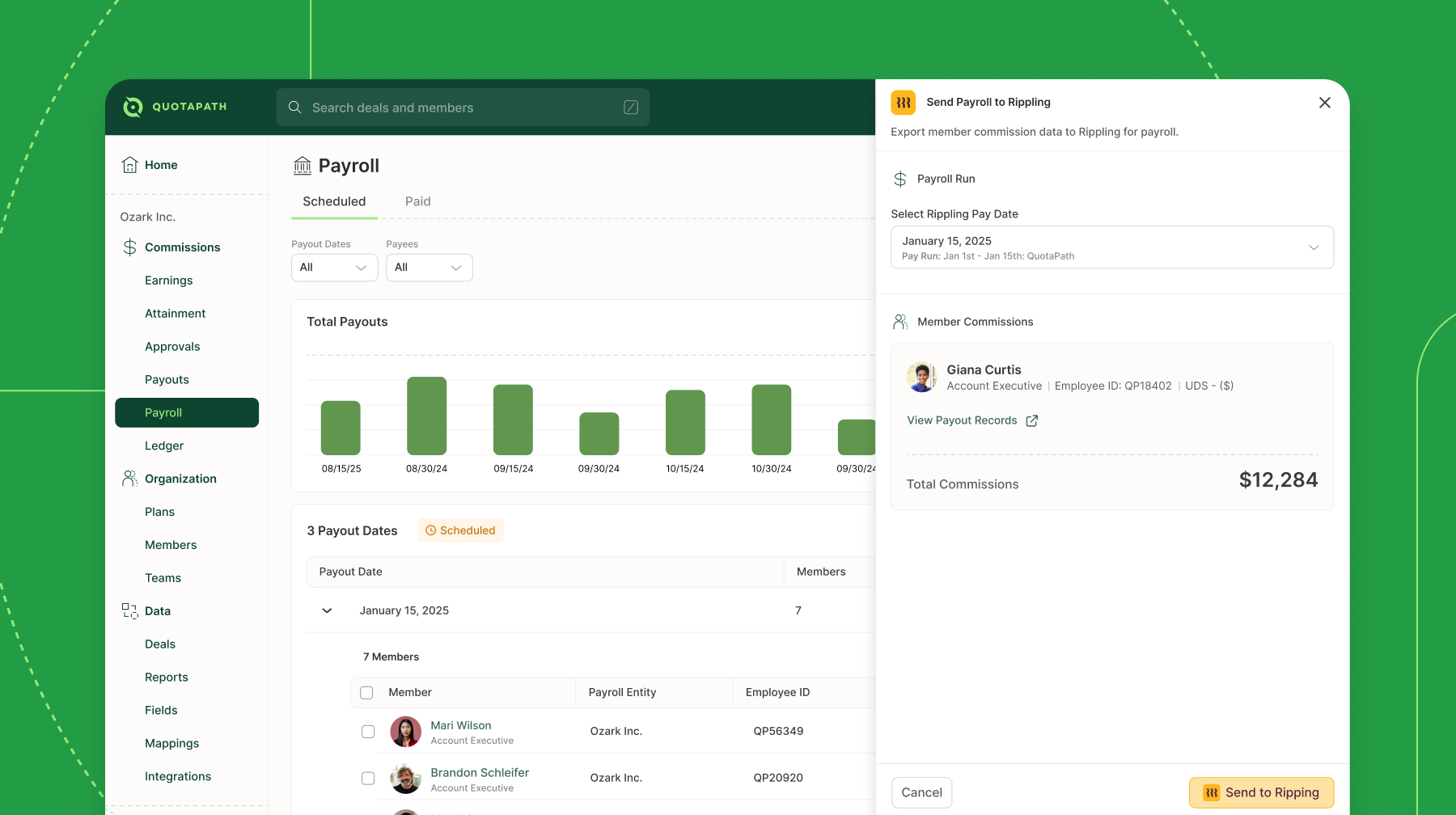

Payroll automation streamlines commission calculations by integrating directly with CRM systems. It automatically extracts relevant deal data, ensuring accurate and timely payouts without manual intervention. Automation also integrates commission approvals directly into payroll systems, eliminating the risk of human error.

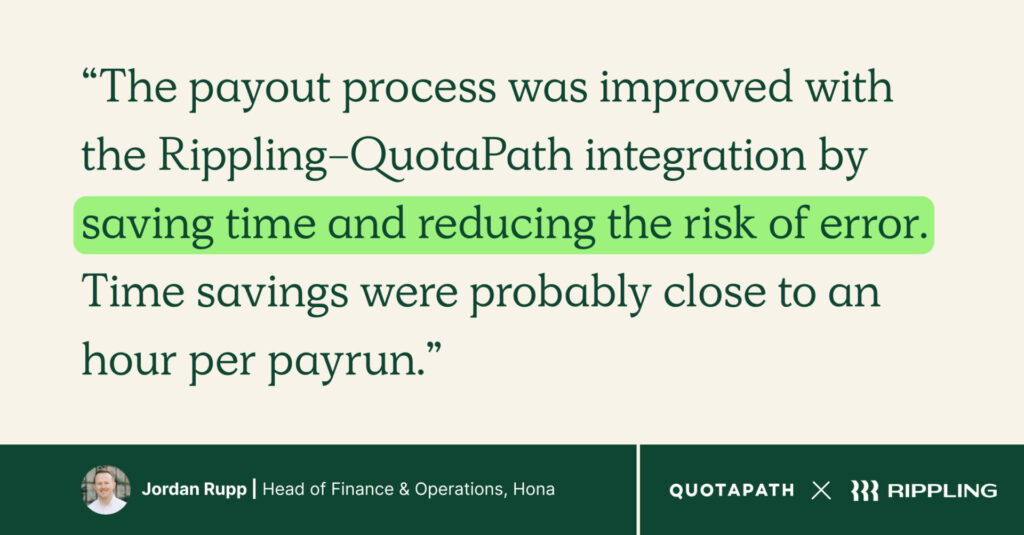

For example, companies that utilize the QuotaPath and Rippling integration can push commission data directly into payroll, reducing payout errors and delays.

Use Case #2: Payroll for Global & Remote Teams

Businesses with international employees face significant challenges in managing payroll across multiple tax jurisdictions. Paying international employees means companies must handle multiple currencies and ensure compliance with country-specific labor laws, further complicating payroll processing.

Payroll automation simplifies global payroll by automatically calculating salaries according to local tax requirements. It converts and pays salaries in multiple currencies, ensuring employees receive their correct wages without the hassle of manual exchange rate adjustments. Moreover, automation ensures compliance with location-based payroll regulations, reducing non-compliance risk.

For instance, a company with sales reps in multiple countries can use payroll automation to handle global payroll seamlessly without manual conversions.

Use Case #3: Reducing Payroll Processing Time & Costs

Payroll processing can be a time-consuming and costly task for HR and finance teams. Manually handling payroll requires hours of effort, and any errors that occur demand additional time for corrections. Payroll deadlines create a high-stress environment at the end of pay periods, increasing the likelihood of mistakes and compliance risks.

Implementing payroll automation reduces payroll processing time from hours to minutes. Automated systems identify discrepancies before payments are processed, minimizing errors and the need for corrections. Plus, payroll automation provides real-time reporting and forecasting, facilitating data-driven decisions.

Companies using automated payroll systems report a 20% reduction in administrative costs, according to Keevee.

Use Case #4: Ensuring Compliance & Reducing Risk

Maintaining payroll compliance is a critical concern for businesses, as payroll errors can lead to IRS penalties and legal consequences. Changing tax laws makes manual compliance difficult for HR and finance teams. Employees also need accurate tax deductions and reporting to ensure they meet their own tax obligations.

Payroll automation mitigates compliance risks by ensuring payroll taxes are calculated correctly and filed on time. Automated payroll systems keep up with state, federal, and international tax regulations automatically, without constant manual oversight. Furthermore, automation reduces the likelihood of audits and fines due to payroll discrepancies.

According to Deloitte, 71% of companies automate payroll functions to improve accuracy and compliance, highlighting the widespread adoption of payroll automation as a risk-mitigation strategy.

How To Automate Payroll

Implementing payroll automation by following these steps will help optimize payroll operations, improve compliance, and minimize human error.

1. Evaluate Your Current Payroll Process

- Identify pain points in your existing system (manual entry, errors, compliance risks, delays).

- Assess how much time HR/Finance spends on payroll processing.

- Determine key automation goals (e.g., reducing errors, streamlining approvals, improving compliance).

2. Choose the Right Payroll Automation Software

- Look for key features such as:

- Integration capabilities (CRM, accounting, HR tools).

- Tax compliance automation (federal, state, and local taxes).

- Multi-currency & global payroll support (for international teams).

- Commission automation (if managing variable pay).

- Compare top payroll providers (e.g., Rippling, ADP, Paycom, Gusto).

3. Integrate Payroll with Existing Business Tools

- Connect your payroll system to:

- CRM (Salesforce, HubSpot) to sync sales data for commission-based payroll.

- HRIS (Rippling, BambooHR, Workday) for employee records and tax filings.

- Accounting software (QuickBooks, Xero) for financial reporting and audits.

- Set up API connections or use built-in integrations for real-time data syncing.

4. Automate Data Collection & Processing

- Ensure payroll software pulls real-time data from:

- Employee hours worked (for hourly employees).

- Deal close data (for commission payouts).

- Tax deductions and benefits adjustments.

- Set up automated approval workflows to eliminate manual verification steps.

5. Set Payroll Schedules & Compliance Rules

- Define pay periods (weekly, bi-weekly, monthly) based on business needs.

- Ensure automation includes tax withholdings, benefits deductions, and compliance with labor laws.

- Implement built-in compliance checks to prevent errors that trigger audits or fines.

6. Test & Validate the System

- Run a parallel payroll test (manual vs. automated) for accuracy.

- Check tax calculations, direct deposit transactions, and reporting accuracy.

- Adjust settings if any discrepancies arise.

7. Go Live & Monitor Performance

- Fully launch the automated payroll system for your next pay cycle.

- Monitor early pay runs for errors, missing data, or workflow bottlenecks.

- Gather feedback from employees on payment accuracy and access to payroll records.

8. Continuously Optimize & Improve

- Review automated payroll reports for efficiency improvements.

- Stay updated with payroll compliance changes and update settings accordingly.

- Explore additional automation features (AI-based forecasting, custom reporting, multi-tier approvals).

Features To Look For In Payroll Automation Software

Choosing the right payroll automation software means evaluating essential features that streamline payroll processes while ensuring compliance and security. Consider the following key features when selecting a solution.

1. Core Payroll Processing Features

Automated Payroll Runs: Set up payroll cycles (weekly, biweekly, monthly) to run automatically.

Direct Deposit and Payment Options: Supports direct bank deposits, checks, or digital payment methods.

Tax Withholding and Filing: Automatically calculates and files federal, state, and local payroll taxes.

Payroll Deductions and Benefits Management: Handles healthcare, retirement contributions, and other deductions.

2. Compliance and Security

Tax Compliance Automation: Keeps up with changing tax laws and regulations to prevent penalties.

Multi-State & Global Payroll Support: Ensures accurate tax calculations for employees across different locations.

Audit & Reporting Tools: Provides real-time payroll compliance reports and error tracking.

Data Encryption and Security: Protects sensitive payroll and employee data from breaches.

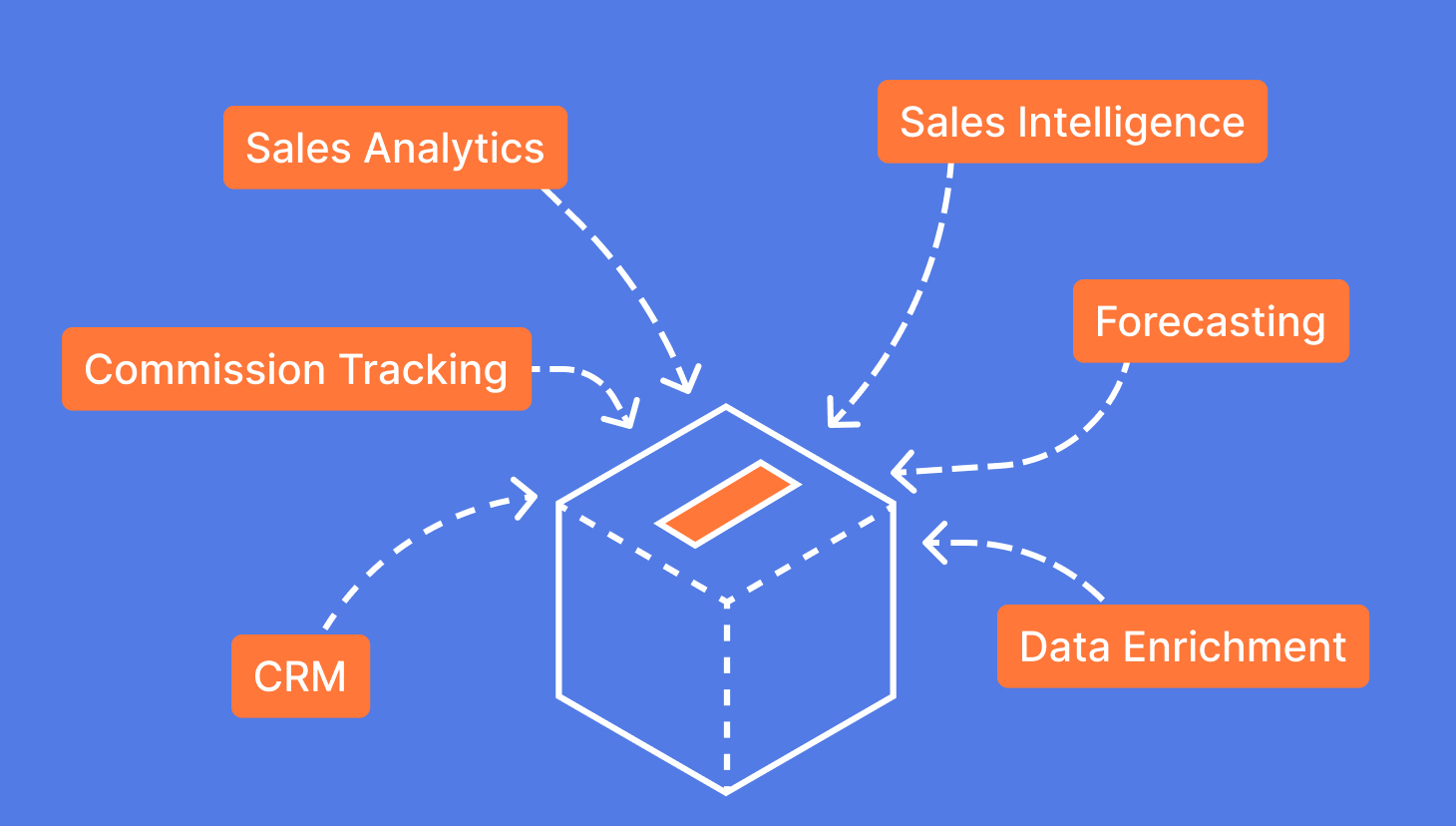

3. Integration Capabilities

CRM Integration (Salesforce, HubSpot): Automatically syncs commission-based earnings from CRMs like Salesforce and HubSpot for sales teams.

HRIS Integration: Connects with HR software such as Rippling, Workday, and BambooHR for seamless onboarding and employee record management.

Accounting Software Integration: Syncs payroll expenses from platforms like QuickBooks, Xero, and NetSuite with financial reports.

Time Tracking Integration: Automates wage calculations from programs like Toggl, Clockify, ADP Time, and Attendance for hourly employees.

Commission Automation Integration: Integrate with a compensation management platform such as QuotaPath to automate end-to-end payouts in platforms like Rippling with the ability to push commissions into payroll.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesHow To Pick The Right Payroll Automation Software For Your Business

Payroll automation helps streamline payroll processes, reduce costly errors, and ensure compliance. Automated payroll can save time, enhance accuracy, and improve employee experience.

To choose the best payroll automation software for your business, consider the following:

- Assess your business needs

- Identify must-have features

- Evaluate integration capabilities

- Consider ease of use & scalability

- Compare pricing & cost efficiency

- Check customer support & reliability

- Read reviews and get a demo

Ready to leverage payroll automation? Schedule a demo to learn more about Rippling & QuotaPath.