This is a guest blog from our friends at Sage that answers if sales commission is a period cost.

Is sales commission a period cost and, if so, what kind of period cost is it?

Period costs are expenses that only indirectly relate to the product development process, while product costs are those that directly relate to product development. So, period costs include expenses like marketing budgets, utility fees, business travel, and employee benefits. Product costs are expenses that are necessary to physically build the product being sold, such as raw materials, manufacturing supplies, and direct labor.

But what about sales commissions?

Automate Sales Commission Calculations & Payouts

For a more efficient way to track, calculate, and report commissions, use QuotaPath. Give your sales reps visibility into their earnings and reduce time spent answering questions.

Learn MoreWhat is a sales commission?

A sales commission refers to additional compensation paid by an employer to a sales representative when they meet and exceed minimum sales targets. In most commission models, this compensation is added on top of the employee’s base salary as a monetary incentive.

Done right, a sales commission model can unlock your sales reps’ full potential, motivating them to outperform sales targets.

Industry-wide sales commission rates are generally believed to average around 20-30% of gross margins. However, this average is hugely influenced by commission structures. Using Glassdoor salary data, Mailshake estimates that architecture sales agents have the highest commission average at 37%, followed by the likes of retail, pharmaceutical, and telecommunication sales.

Why sales commission should be considered a period cost

Sales commission usually falls into the category of selling, general, and administrative expenses (SG&A) or operating expenses, both of which are period costs. However, it can also be classified as cost of goods sold (COGS), which is typically classed as a product cost.

Here are some reasons why sales commission should always be considered a period cost.

Financial reporting implications

Treating sales commission as a period cost simplifies the process of producing a comprehensive income statement. Period costs are included on your business’s income statement and should be categorized appropriately to glean insights into the costs incurred by each.

This serves to help your finance team calculate your company’s net income and analyze the impact of your expenses within the accounting period. Sales commission should be accounted for on an accrual basis (i.e., when the sales commission is billed to a rep rather than when it is received). This is in order to comply with ASC 606 regulations, which we’ll discuss shortly.

Tax implications

In order to file accurate business taxes and avoid financial audits, you need to meticulously document period expenses. Just like your other period costs (office expenses, advertising, etc), sales commissions make up your total period cost and need to be reported to ensure that you’re paying the right amount of taxes.

Different countries have different tax authorities. In the US, for example, the governing tax body is the Internal Revenue Service (IRS). In the UK, it’s HM Revenue and Customs (HMRC). The rules regarding whether sales commissions are tax-deductible may vary by location.

In the US, sales commissions are tax-deductible under both selling, general and administrative expenses (SG&A) and cost of goods sold (COGS) classifications. HMRC also recognizes commission as an allowable business expense that is tax deductible. So, it’s critical for your company’s financial health that all your sales commission payments are categorized correctly as period costs on your tax return.

Filing tax returns is a hefty task for finance teams. To automate the tedious tax filing process and avoid the financial and legal repercussions of inaccurate tax filing, utilize tax software for small businesses. Tax software streamlines tax filing by allowing you to upload invoices, receipts, and other period expense documents into the cloud, in real time.

With all of your financial records in one centralized location, you can enjoy painless tax reporting experiences and ensure that you’re audit-ready.

Decision-making implications

To explain the decision-making implications of sales commissions as a business expense, it helps to cover all three classifications of period costs: current, historical, and predetermined.

Current expenses are costs incurred within the current period.

Historical expenses are costs that relate to previous periods and therefore do not factor in decision-making.

Predetermined expenses are upcoming costs that are expected to incur in a future period and therefore must be considered when calculating overall budgets.

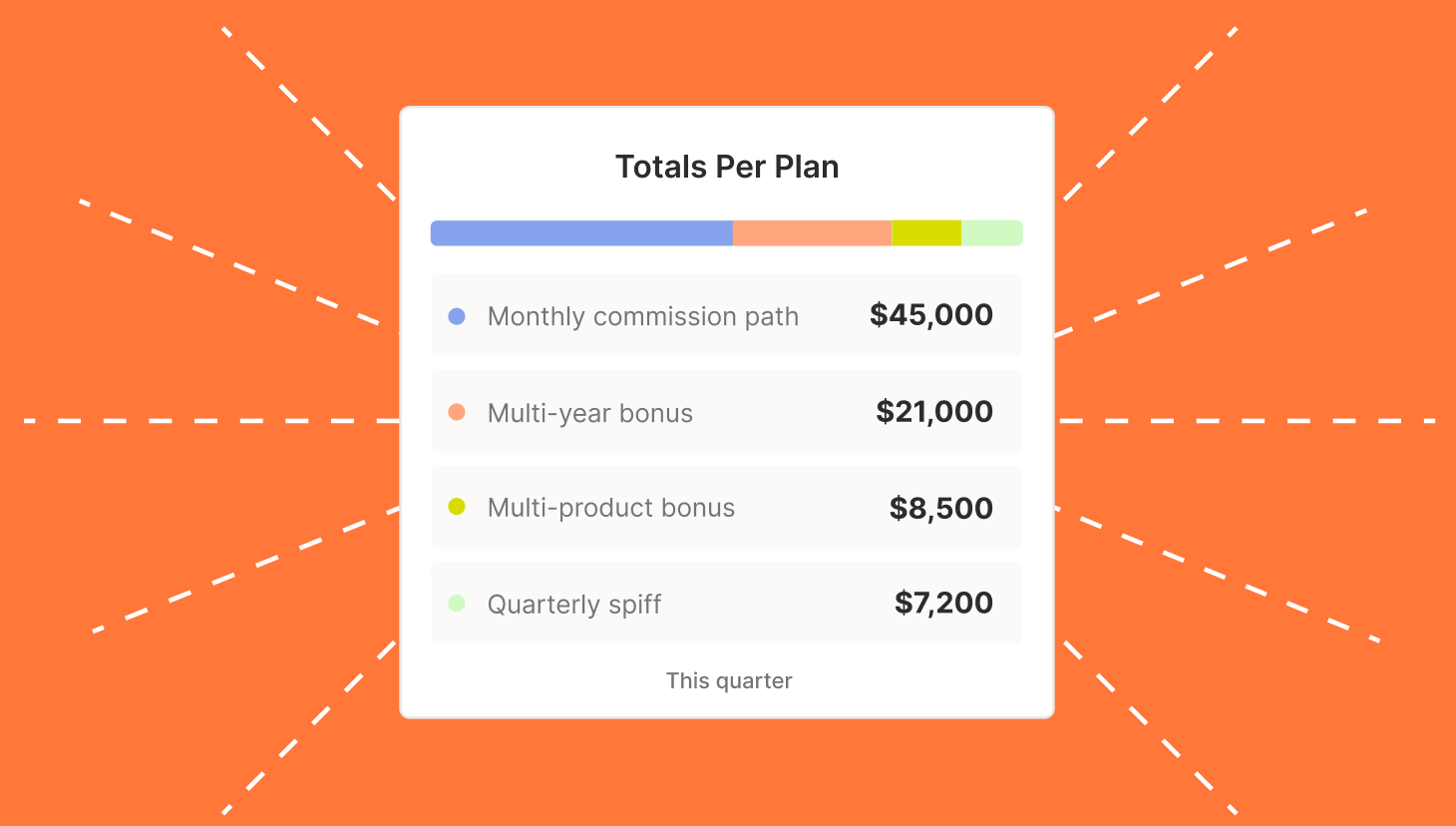

For businesses that need to comply with ASC 606 (which we’ll explain further in the next section), sales commissions should be classed as predetermined period costs. This means that they are calculated as an estimation and spread out over the contract lifetime. Naturally, this makes them critical to financial decision-making, most notably budget calculations.

This is all to say that failing to correctly classify sales commissions as period costs can limit data transparency and result in poor financial decision-making.

Create Compensation Plans with confidence

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanASC 606 and subtopic 340

What is ASC 606 and how does subtopic 340 relate to sales commission?

Explanation of ASC 606 and why it’s important

ASC 606 is a revenue recognition standard launched by the Federal Accounting Standards Board (FASB) as a joint initiative with the International Accounting Standards Board (IASB). Its primary objective is to standardize how revenue is recognized for all sales agreements and contracts between companies and customers.

As laid out by the ASC 606 standard, the five steps for recognizing revenue are as follows:

ASC 606 standardizes global revenue recognition by providing a single source of truth. As a result, there are fewer disadvantageous inconsistencies in revenue requirements and information pertaining to revenue recognition is more informed, robust, and valuable.

Compliance with ASC 606 does however mean that accounting for sales commissions has grown more complex.

How the subtopic 340 ties to commissions specifically

ASC 606’s subsection, ASC 340-40, dictates that sales commissions must be capitalized as intangible assets (on the company’s balance sheet rather than expensed immediately), correlated to a customer, and amortized over the expected contract term in alignment with the performance obligations laid out in the contract.

Amortization is the process of spreading out the costs of intangible, long-term assets (in this case, sales commissions) over their anticipated lifetime. This contrasts with revenue recognition before ASC 606, where businesses could use manual spreadsheets to track sales commissions as and when the bonus payment was made.

With the task of capitalizing, forecasting, and amortizing to complete, manual spreadsheets are no longer sufficient. Companies need to use small business accounting software to perform advanced forecasting and reporting to relieve admin burdens and generate hyper-accurate insights — all while keeping compliant.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesFactors that determine if sales commission is a period cost

Still not sure whether to class sales commission as a period cost? Here are some factors that can help you decide.

Timing

The timing of your sales commission payments can help you determine whether the expense comes under period cost classification. If, for example, your sales commission payments are based on the volume of sales a representative secures over a period of time (under ASC 606 compliance), then the requirement to amortize the expense means that you should class it as a period cost.

Revenue relationship

Sales commission that is classed as income rather than expense is not a period cost. This occurs when your company earns a commission. (For example, when your company makes a commission by selling a product through a business partnership.) This type of sales commission is considered revenue.

Incentive structure

Along with the self-explanatory “salary plus commission” structure, some of the most popular sales commissions structures are:

- Gross-margin commission: This is a profit-based commission in which payment is calculated using the gross revenue generated from the sale. So, the higher the price a sales rep sells an item for, the higher their commission is in alignment with how much the product cost to build.

- Revenue commission: Sales reps receive a flat percentage on every sale. So if a product was worth $2000 and the rep’s commission rate was 5%, they would receive $100 compensation.

- Tiered commission: Commission continually goes up once reps hit a specific target.

- Straight commission: The rep receives no fixed salary or wage. So, they only generate income from the commission that they make on a sale.

As you can see, commission incentive structures can vary significantly. Evaluate carefully whether the incentive structure counts as an incremental cost of obtaining a contract with a customer, as per ASC 606 regulations. Consider whether the cost would incur regardless of whether the contract was obtained.

Payment frequency

Are payments made monthly, bi-monthly, quarterly, or annually?

As we’ve covered, sales commissions classify as period costs when they have a set structure that aligns with ASC 606 regulations. Sales commission payments should be scheduled in alignment with payment structures and regulations and reported accurately on your income statement.

Industry norm

For most industries, it is the norm to classify sales commissions as a period cost. It mitigates non-compliance and tax repercussions, which can have serious financial and legal consequences for your business. The exception is usually within businesses that earn commission as income, in which case commissions must be strictly separated and reported appropriately.

Final thoughts

So there you have it. Sales commissions are a period cost. Now, how do you execute a commission model that is incentivizing, streamlined, and hassle-free?

With sales compensation software, you can easily build custom compensation plans and align sales reps with your revenue objectives. QuotaPath is an easy-to-use commissions solution with excellent forecasting and integration capabilities. Use it to unify teams, scale workflows, and eliminate confusion around sales commissions. Use Ledger to amortize sales commission costs and stay compliant with ASC 606. Try QuotaPath out for free over a 30-day trial (no credit card required). Or, chat with their team to learn more by scheduling a demo.