A commission plan with accelerators, bonuses, and spiffs can motivate positive selling behaviors but only if you can see how close you are to reaching key milestones and thresholds. In the absence of a sales compensation calculator to automate the process, figuring out where you stand can be difficult. This is especially true for a complex commission plan with a math-intensive and code-heavy commission formula in excel that’s tough to run if you’re not a finance professional. The inability to project how much you’ll earn on a given deal, or how much you should anticipate receiving in your upcoming commission check, can leave you feeling frustrated, demotivated, and uninspired.

We’re here to help. In this article, we’ll guide you through the proper steps of how to calculate commission easily and correctly, so you always know where you stand.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialGetting to know your commission plan

Commission plan definition: a framework used to calculate the amount of money a sales rep earns based on their progress against specific criteria. Compensation plans often consist of base salary, commissions, and bonuses. Different types of commission plans include:

- Straight commission, also referred to as 100% commission, where pay is entirely based on sales earnings with no base salary or guaranteed pay.

- Base salary plus commission examples. The base salary plus commission is one of the most common compensation structures. It includes a base salary plus a commission rate.

- Single rate, also known as flat rate or fixed rate commissions, is the most basic form of sales commission where earnings are calculated based on a set percentage of the value of deals closed.

- Multiple rate plans assign different percentages to deals closed based on quota attainment, deal size, or total amount sold during the month or quarter. We also hear this type of plan called accelerators, escalators, tiered commissions, or multipliers.

- Gross-margin plans take a similar approach as single-rate plans except commissions are calculated based on a percentage of gross revenue collected.

- Territory volume models are used in team sales situations where a team collaborates to sell into a specific region or vertical. These are single-rate commissions that are split evenly between the territory team members.

Bonuses are calculated differently than commissions. A commission is a percentage of a revenue number and a bonus is a set amount of money earned for doing a specific action.

- Milestone bonus is a set amount of money paid for doing a specific task when certain stipulations are met.

- Multiple rate bonus varies based on criteria like quota attainment, size of the deal, or length of the contract.

- Single rate bonus, sometimes called spiffs or incentives, are a set amount of money for completing a specific action and doesn’t change based on the number of times the action is completed.

Draw against commission reduces the cashflow inconsistencies of a commission-based income by allowing a rep to borrow against future commissions so the money is there when you need it most to pay for basic living expenses. There are two main types of sales commission draw—recoverable draw and non-recoverable draw.

Steps to calculate commission

Here are some basic steps for calculating your commissions.

- Determine the commission period. Is it biweekly, monthly, or quarterly?

- Calculate the total commission base you made during the period. This equals the value of deals closed during the period or the gross revenue for percentage calculations. If percentages vary by product type, calculate these values for each product type. And if you receive bonuses tally up period totals for each bonus type.

- Multiply your commission rate by your commission base. These calculations will vary by plan. See below.

- Take variable commission rates into account, if applicable.

- Allow for tiered commission rates.

- Complete any additional applicable calculations and adjustments like overrides, deductions for returns, and commission splits for shared territories.

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanHow to calculate commission

Below, we laid out examples of commission calculations for the various commission plans discussed above.

Straight commission

James sells cars. He earns 2% commission on all sales. If his total sales for the month comes to $350,000, he is paid $7,000.

Commission Percentage X Total Sales = Commission Amount

0.02 X 350,000 = $7,000

Single rate

A salesperson earns $1,000 per month in salary plus 10% commission. If they sell $25,000 worth of product in a month, they earn $3,500: $1,000 salary plus $2,500 commission.

Single rate commission calculation:

Commission Percentage X $ Amount Sold = Commission Amount

.10 x 25,000 = $2,500

Multiple rate

A sales rep’s base commission is 4% up to $150,000 in sales. The commission increases to 8% for all sales above that amount. If the rep closes $250,000 in sales, they receive

Multi-rate commission calculation:

.04 x 150,000 = 6,000

.08 x (250,000 – 150,000) = .08 x 100,000 = 8,000

6,000 + 8,000 = 14,000 commission for the period

Gross Margin

A salesperson sells an $80,000 car that costs the dealership $50,000, so the gross margin is $30,000. The salesperson earns 8% on the margin or $2,400 in commission.

Gross margin commission calculation:

Total Sale Price – Cost = Gross Margin

Gross Margin X Commission Percentage = Total Commission

80,000 – 50,000 = 30,000

30,000 X .08 = 2,400

Territory volume

Three reps share a quota of $150,000 per month for sales in the state of Michigan. If one rep closed $60,000, the second closed $50,000, and the third sold $40,000, then the team reached their goal. So, the three reps will evenly divide the 10% commission, receiving $5,000 in earnings each.

Territory volume commission calculation:

Total Monthly Territory Sales X Commission Percentage = Total Commissions

Total Commissions ÷ Number of Territory Reps = Commissions per Sales Rep

60,000 + 50,000 + 40,000 = 150,000

150,000 X 0.10 = 1,500

15,000 ÷ 3 = 5,000

Milestone bonus

An Account Executive has a monthly quota of $40,000 and when they hit that quota, they get a $3,000 bonus.

Multiple rate bonus

A Sales Manager receives a $1,200 bonus for each deal their team members close for product X and a $2,400 bonus for each deal their team members close for product Y.

Single rate bonus

A Sales Development Representative has a monthly goal of setting 35 meetings and earns a $150 bonus for every meeting that occurs.

Draw against commission

A sales rep’s On-Target Earnings (OTE) is $5,000 per month in commission. The rep receives a $2,500 per month recoverable draw during their onboarding period. If this rep’s sales only generate $1,500 in commissions their first month, they receive a $1,000, for a total of $2,500 in commissions that month. The company will recover the draw amount during future pay periods when the rep’s commissions exceed the allotted draw amount.

Potential Draw – Earned Commissions = Repayment amount

$2,500 – $1,500 = $1,000

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

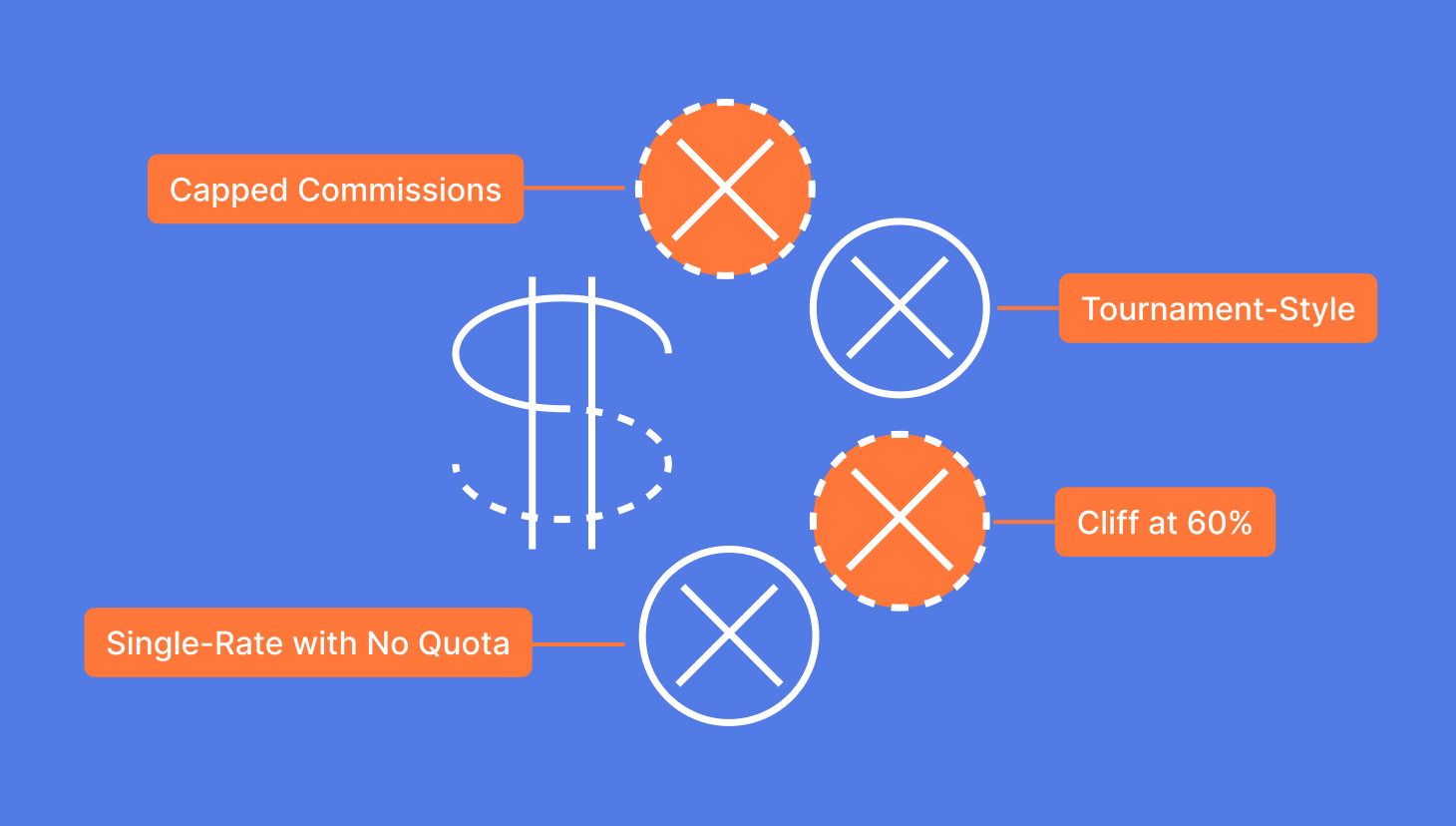

Talk to SalesSimplify the process by making your plans less complex

Complex commission plans can be a motivational force when you know where you stand in relation to your goals, quotas, milestones, and bonus targets. The more complicated the compensation plan, the more difficult it becomes to track your commissions and progress throughout a given period. This is especially true if you’re relying on a formula-laden excel spreadsheet.

Looking for an easier way? QuotaPath can automate the entire sales compensation process so reps and leaders can easily track their progress throughout the sales period. Try QuotaPath for free or learn more by booking time with our team today.