In your first year as a startup, your finance operations can survive with a good, solid bookkeeper and cash-based accounting.

However, the minute you start raising money, it’s best practice to bring on someone who knows GAAP accounting and can convert the company to accrual-based accounting.

That’s according to Amy Walker, CPA, Co-Founder & Director of CAS at Walker Glantz, who recently spoke on our webinar, Early Stage Finance Foundations: Strategies, Compliance, and Sales Compensation Manager.

Joining Amy included Jonathan Cochrane, CPA 🚀, VP of Strategy at Maxio, hosted by AJ Bruno, QuotaPath CEO and Co-Founder.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesLeaders and finance professionals at early-stage companies joined us as we discussed the complexities of finance, compliance, and sales compensation management.

This session provided guidance and best practices for establishing strong financial pillars before compliance concerns emerge. Plus, we discussed what makes a solid financial infrastructure, technologies to consider, how to mitigate audit risks, and scaling efficiently.

Watch the full recording below, and read on for key takeaways.

Building a Solid Financial Infrastructure

In the early days, startups experience countless things happening at once, from fundraising to scaling hires and payroll. Establishing effective bookkeeping and record-keeping processes early on is crucial.

“My first advice is to not cheap out on your bookkeeping. You need to have a bookkeeping solution in place from the beginning. The more experienced person you have will cause less friction later because they can grow with you,” Amy said.

“They have the skills. They know how to take you from cash to accrual, how to start documenting processes automatically, and when a new process needs to be put in place.”

According to Amy, “You can get away with cash-based books your first year,” which means you don’t count revenue until you receive payment. However, when more sales trickle in with consistency, you should switch to accrual-based books to ensure you have a solid system in place for revenue recognition.

Additionally, one of the key financial processes to prioritize in the early stages of a startup involves accurate and consistent reporting.

“Producing reliable financial statements early and often, billing customers on time, collecting cash on time, and segmenting your reports are foundational to your success as a business,” said Jon.

“Producing reliable financial statements early and often, billing customers on time, collecting cash on time, and segmenting your reports are foundational to your success as a business.”

Jon Cochrane

Streamlining Finance Operations with Technology

The conversation also touched on what finance technology to prioritize as a company scales.

Technology offers automation, data accuracy, real-time reporting, and data access so you can make the most of your lean resources. It reduces errors, ensures compliance, and boosts bookkeeping, payroll, and GAAP compliance efficiency.

“There used to be offices full of people that processed payroll or made tax filings. You can do that now with software,” Amy said.

We discussed the types of technologies to consider and their suggested order of implementation.

“A good outsourced service is going to know when to layer on technology to help you continue to use outsourced services,” said Amy.

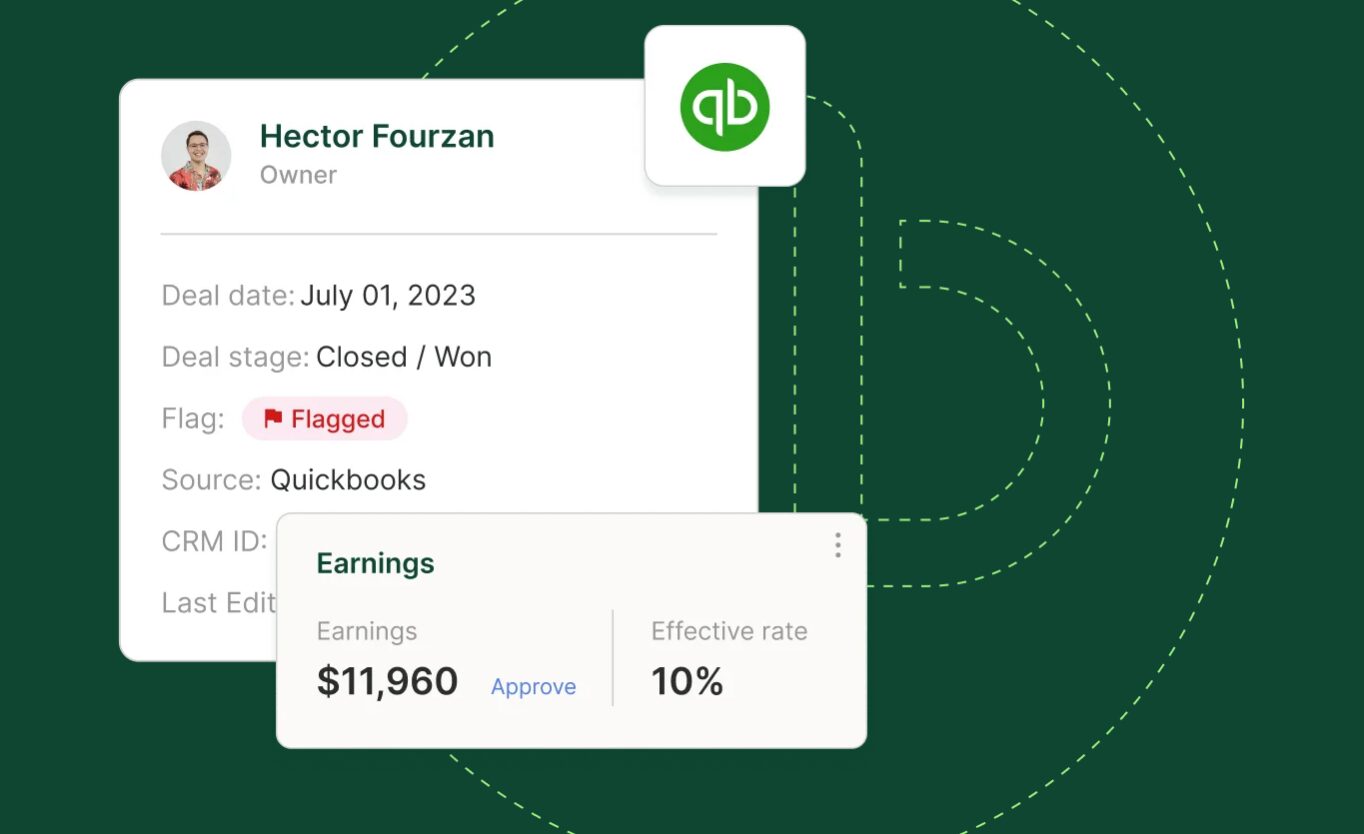

QuickBooks topped the list as a general ledger system. “I wouldn’t start with the free ones,” Amy stated, “They’re not going to grow with you and you’re just going to end up redoing things.”

Commission Tracking with QuickBooks

QuotaPath integrates with QuickBooks to streamline commission calculations and schedule and amortize payments.

Learn MoreNext, you need to layer on a payroll solution.

“We start everybody on Gusto. Then if employee disbursements are all over the country, we love Rippling,” Amy shared. “They integrate with QuickBooks and automate as much as possible.”

CRM

After bookkeeping and payroll, you need a CRM.

“The two that we see most commonly in the market are Salesforce and HubSpot,” according to Jon. “They’re great solutions. HubSpot seems a bit more friendly. Salesforce, there’s a learning curve.”

When you have 25 customers on a monthly subscription, it is a good time to consider a billing solution. But make sure to evaluate how you want to spend your time.

“That’s 300 invoices per year that you have to make sure you get paid for,” Jon pointed out. “You’re trying to grow your product. The last thing you want to do is chase your customers down for payment on those invoices for a service you’re doing.”

He continued, “I think that making sure that your cash engine is operating smoothly is the main point when it comes to billing.”

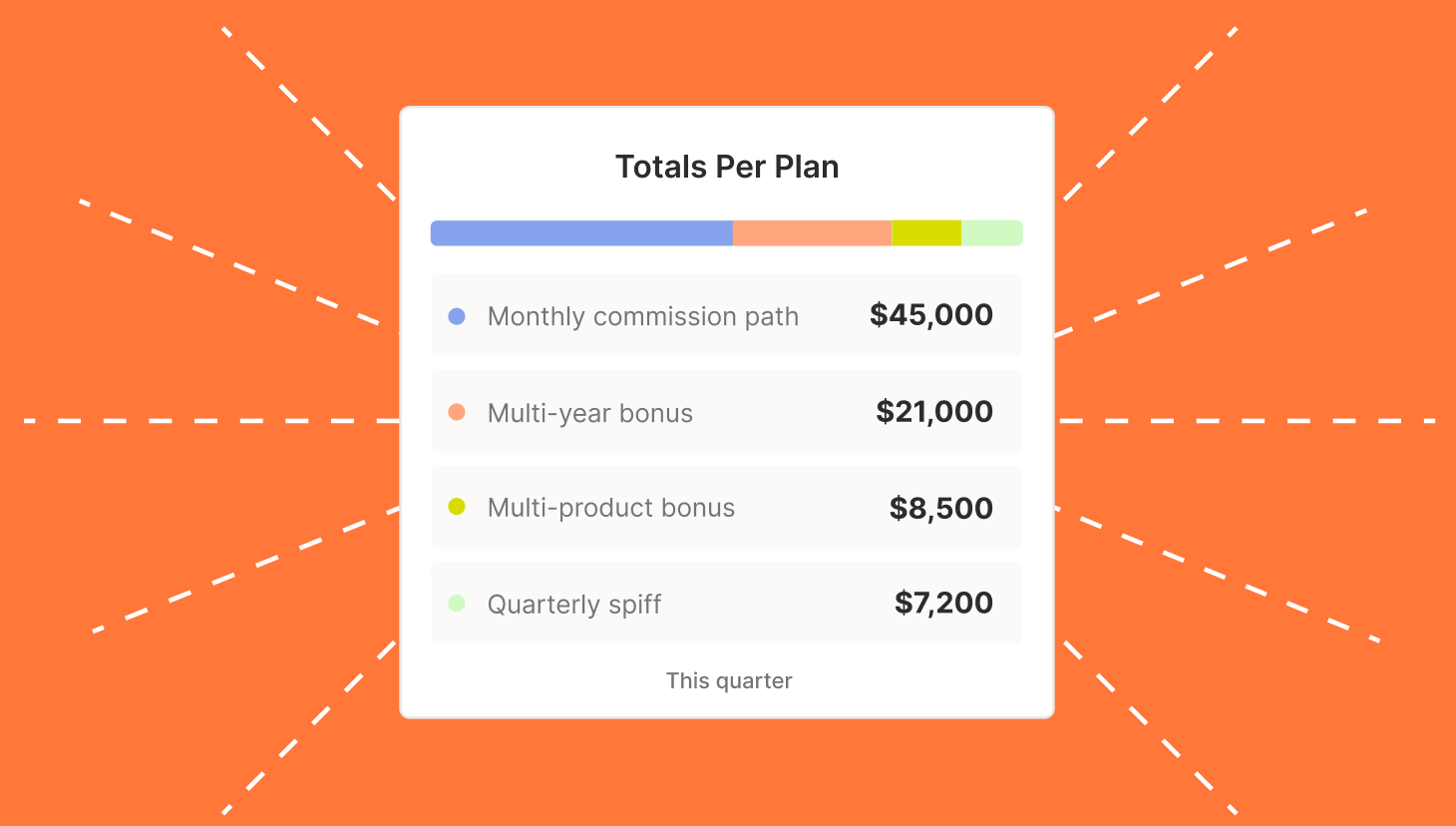

Commissions

Commissions “tend to get forgotten,” AJ said. “It just gets passed around. Commissions are payroll. You don’t run payroll out of a spreadsheet, why would you run commissions out a spreadsheet if it’s part of payroll?”

Amy discovered QuotaPath when a client asked her to check it out for them. “Like any good technology, it changed our mindset,” Amy explained. “The beauty of it was that the review period with the sales rep went away because they had a real-time view into what they were earning. We were all seeing the same thing.”

FP&A and ERPs

An FP&A solution and an ERP are “solutions that you look at once you’re at that $10 million and beyond level,” according to Jon. An FP&A is about having good metrics, understanding what’s going on in the business, and what the drivers are to help with future planning.

“It’s time to think about an FP&A solution once you start driving budgets down to individual owners who manage their own P&L,” Jon said.

According to Jon, “You need to seriously start looking at an ERP when you have multiple business entities that need to be consolidated and/or international accounting.”

Technology improves efficiency and reduces errors. It allows you to do more with fewer resources by automating tasks that increase accuracy and compliance with rules like ASC 606.

Using spreadsheets for ASC-606 revenue recognition can get very messy quickly when “you layer on early renewals, contract cancellations,” according to Amy. “When you’re doing all that in a spreadsheet, you better have somebody with a steel trap mind to remember all those details. That’s when you start bringing in tech to help do the job.”

Stay ASC 606 Compliant

Learn how QuotaPath helps finance pay teams, approve deals, schedule payments, run audit-ready reports, and amortize commissions through one seamless workflow.

Schedule a DemoAmy shared that onboarding is essential to saving time. Although setting up new technology takes time, “If it’s onboarded right, it should buy you time in the long run,” Amy said.

Technology reduces errors in bookkeeping and increases the accuracy of commissions too. With QuotaPath, “We didn’t have to have that inherent double triple check because we might make a mistake,” Amy said.

Mitigating Audit Risks

Early-stage companies face the most common audit risks related to bookkeeping, compliance, and documentation. According to Jon, “The number one cause of failed funding rounds are accounting mistakes,” and those are completely avoidable for companies.

“ASC 606 can be a bit like the boogeyman,” Jon said.

The challenge is that people know they need to be compliant but don’t know what that means.

“The revenue is common to everyone. It’s recognizing the commission expense over the life of the same contract that trips people up,” according to Amy.

Recommended reading: 5 Tips for a Successful Startup Audit (Blog)

During the discussion, Amy and Jon shared some best practices for minimizing audit risks.

“The minute you start considering outside funding, you need accrual-based books that are GAAP compliant,” Amy explained. If commission is paid along with revenue generated, you need to think about how you’re going to account for that. You need to put a policy in place and consistently apply it.”

Failure to do so means non-compliance with ASC 606 and can result in a hefty fine.

To avoid accounting mistakes like these and position yourself for the next stage, address controllable factors like “making sure that you have a bookkeeper. If you’re a small firm, it’s money well spent,” according to Jon. “They will save you a boatload of problems down the road, and they also know the issues that could come up that really get you into trouble.”

“ASC 606 involves recognizing both revenue and expenses over the proper period of a SaaS or enterprise contract. Software like Maxio and QuotaPath automates those calculations to keep you compliant,” Amy shared.

Proper documentation is essential to audit preparedness. During a due diligence audit, “they’re going to want to see you have a solid set of books, you have a closing process, you have SOPs in place for your accounting function, and that you’ve got the proper controls in place,” according to Amy, “That lets people have faith in you and what you say your business is doing.”

Therefore, “A bookkeeper is your foundation. If your bookkeeping isn’t right, the rest isn’t right. Everything that the staff accountant, controller, and CFO touches relies heavily on accurate bookkeeping,” Amy said.

If you have a good accounting system in place, you’ll find errors early and be able to correct them sooner rather than them being found during an audit.

Efficiently Scaling Finance Operations

Scaling financial operations alongside business growth can be accomplished with an outsourced accounting function.

“We’ve got some clients who have been with us for eight to nine years, but we’re not the only ones in there. After round one, the board usually requires that you put a CFO on your payroll. The accounting function then supports the CFO,” Amy said.

You will get a full-time controller after round two, A, B, or C. The billing part is huge, too, depending on its complexity. So, you build up and then start carving out the work.

Maintain financial efficiency as the company expands by including your outsourced accounting function in your management meetings. “Let them be part of your team, not just the service you use,” Amy suggests. They’ll get more efficient the more they know your business.”

However, “when the outsourced function is slowing you down, it’s time to start layering on more GNA costs and building out your accounting department and efficiency,” Amy said.

Building a scalable financial team starts with a firm foundation. Hiring a more experienced bookkeeper or using a knowledgeable outsourced accounting function helps you avoid the “confusion of switching accountants while you’re in a growth spurt.”

Then layer on automation as you scale to ease growing pains and enable you to do more with fewer resources. Jon suggests you evaluate how you want to be spending your time. Would you rather be “Following up on invoice collection,” Jon asks, “or running my business and having automated ways?” Think about getting the best return on your skills and talents. Then if you need additional input, “reach out to your network,” Jon said. “There are people who can help you figure out what is the next step.”

Calculate OTE:Quota ratios

Use this free calculator to ensure your reps’ on-target earnings and quotas mirror what they’re bringing in for the business.

Try it NowConclusion

A startup must build a strong finance operations infrastructure from the beginning. Otherwise, problems can develop and snowball very quickly.

It’s foundational to start with an experienced bookkeeping solution at the onset. This sets you up for long-term success as you scale your business and helps you avoid costly accounting errors.

Technology is essential for streamlining your finance operations. It offers automation that boosts efficiency and accuracy, enabling you to make the most of available resources and helps ensure compliance with rules like ASC 606.

Access the complete webinar recording to hear the entire discussion and start automating commissions with a free trial of QuotaPath.