Without a clear understanding of your sales compensation costs, you’re flying blind. It’s impossible to optimize your sales strategy or forecast future profitability accurately.

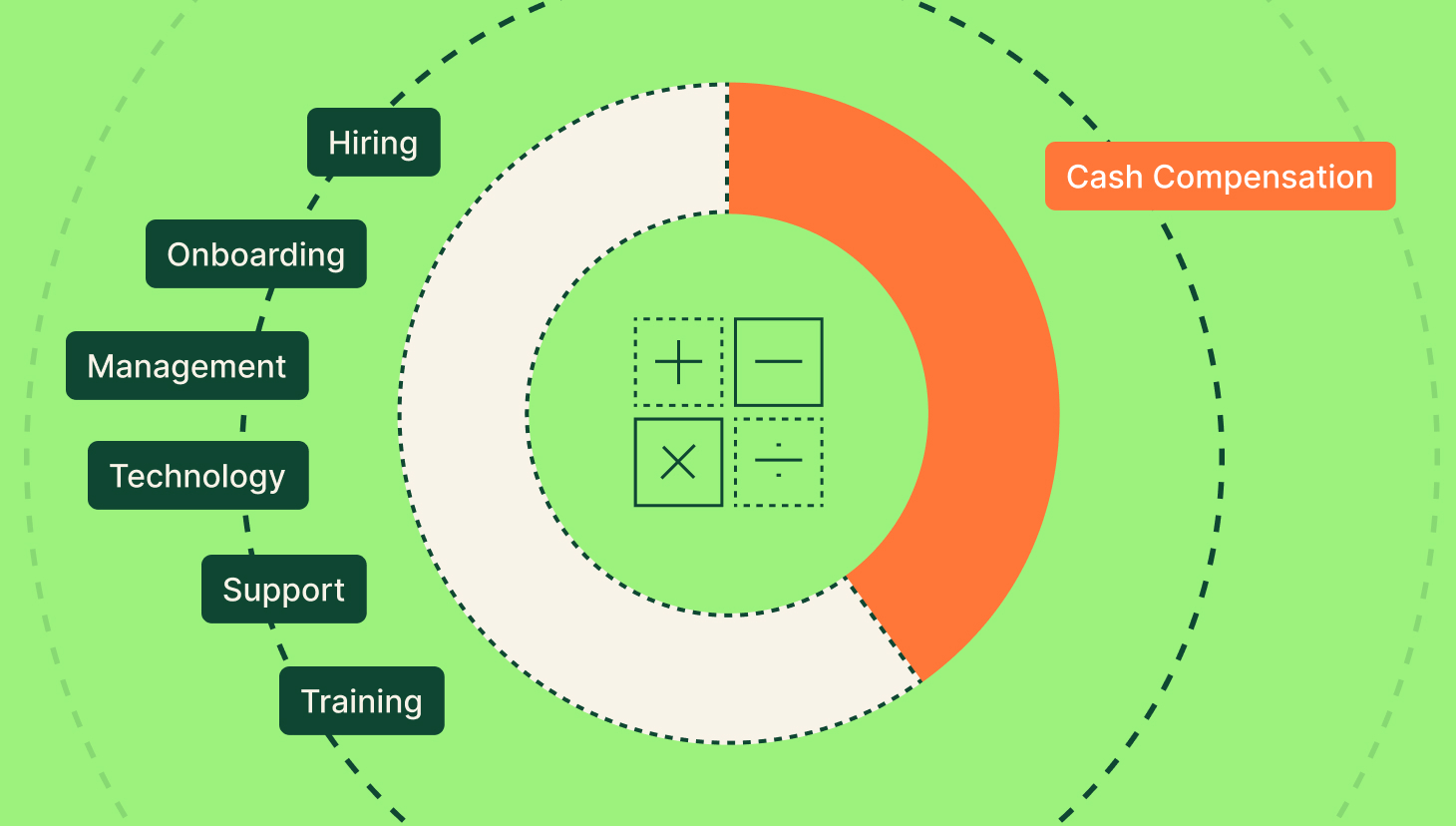

According to Alexander Group, the cash portion of sales compensation represents 40% of total sales costs and 7.9% of sales revenue. (Use this benchmark to determine if you’re getting the most from your sales investment while achieving sales goals and retaining team members.)

A percentage higher or lower than the benchmark may indicate poor performance, like when the sales team is falling short of quota. It can also indicate that pay mix, variable incentives, and other compensation factors require adjustment.

The other 60% of total sales costs include elements such as hiring, onboarding, management, support, technology, and training.

In this post, we explore the hidden costs of your sales compensation plan and dive into a practical approach for calculating the true cost of commissions and bonuses.

“…the cash portion of sales compensation represents 40% of total sales costs and 7.9% of sales revenue.”

Alexander Group

Key Metrics for Calculating True Cost

Let’s start by reviewing the various types of direct and indirect costs to consider when calculating the true cost of sales compensation.

Direct Costs

Base Salary & Commissions: Factor base salaries, commission rates, and bonus structures into the calculation.

Benefits & Taxes: Don’t forget to account for employer-paid benefits and payroll taxes associated with sales compensation. We recommend consulting with a financial advisor or tax professional for company-specific guidance on the tax implications of your sales compensation plan. Consider consulting with a financial advisor or tax professional experienced in payroll and employee benefits.

You should also review your Employer’s Payroll Provider Resources. Many payroll providers offer resources and guidance on tax and benefit implications of various compensation structures. Check their website or contact their support team for more information.

Additional online resources include:

- Internal Revenue Service (IRS): The IRS website offers a wealth of information on employer payroll taxes and employee benefits. You can search for specific topics related to sales compensation, commission structures, and fringe benefits.

- Department of Labor (DOL): The DOL website provides information on employee benefits regulations, including health insurance, retirement plans, and overtime pay. These can all be relevant factors depending on the type of sales compensation offered.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesIndirect Costs

Recruiting & Onboarding: Consider the costs associated with recruiting, hiring, and onboarding new sales reps. New hire ramp time, the amount of time it takes new reps to start achieving full quota, averages 3.1 months according to research by The Bridge Group. This is a cost you need to consider when calculating the cost of sales compensation. New reps cost more in commissions if you’re offering new hire quota relief and produce proportionally less revenue during this time.

Management & Support: Factor in the cost of sales managers, support staff, and sales enablement resources.

Technology & Tools: Include the cost of CRM systems, sales automation tools, and other technology used by the sales team. CRM software pricing starts around $7 per user per month, with more sophisticated options costing anywhere from $15 to $150 per user per month.

Note: Check out the CRMs that QuotaPath integrates with.

Based on online pricing we found that HubSpot CRM’s Professional Customer Platform is $3,105/month and Salesforce CRM Professional runs $4,000/month for 50 users when billed annually.

Training & Development: Account for the cost of training programs and ongoing development opportunities for reps.

Considerations Beyond the Numbers

In addition to the above, pay attention to the following when assessing your true cost of sales compensation. All of these elements can influence your actual sales comp cost, so if yours looks high, don’t assume you’re paying too much. Investigate these other areas to determine which contributing factors are impacting your numbers.

- Sales Cycle Length: The length of your sales cycle can significantly impact the true cost of sales compensation. Longer sales cycles often require higher upfront investments such as salaries before commissions are earned.

- Sales Team Performance: Overall sales team performance directly affects the true cost. Lower-than-expected sales volume will result in lower commission payouts but might not necessarily offset the fixed costs like salaries and benefits.

- Alignment with Business Goals: Ensure your compensation plan incentivizes the right behaviors. A plan focused solely on closing deals might neglect customer retention or upselling opportunities.

Optimizing Your Sales Compensation Plan

Using a tool like QuotaPath, you can optimize cost at the plan level by identifying inefficiencies, running attainment scenarios, and aligning plans with business objectives.

Use QuotaPath to:

Identify inefficiencies

Discover aspects of your compensation plan that are raising costs.

Surface total effective commission rates per deal to determine if you are paying too much commission per deal without maneuvering a spreadsheet. Then analyze your least and most profitable sales reps according to gross margin.

Run attainment scenarios

Using Plan Performance Modeling, you can run attainment scenarios in QuotaPath to see how much you would pay in compensation if your team hit 80% attainment vs. 150%. This reporting functionality simplifies the modeling process by forecasting plan costs and their impact on other essential business metrics without creating a formula-filled spreadsheet.

Align your plans to business targets

Start your comp plan by agreeing on your key business metrics for the year. Then, add incentive components that directly influence those numbers. For instance, to boost retention, encourage account executives with a SPIF for each multi-year deal closed and offer account managers incentives for early or multi-year renewals.

Your comp plan needs to motivate sales rep behaviors that drive business objective achievement. Regardless of if your North Star metric is increasing gross margin, reducing customer acquisition (CAC) costs, or promoting cash flow, there’s a comp plan lever you can pull.

Try QuotaPath for free

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialLearn Your True Cost of Sales Compensation

Calculating and understanding the true cost of sales compensation is crucial to the health of your business. Failing to do so hampers your ability to optimize your sales strategy or effectively forecast profitability.

Factor in the direct and indirect costs. Then bear in mind how sales cycle length, team performance, and plan alignment with business goals affect your actual sales compensation cost.

Simplify optimizing your sales compensation plan by using a tool like QuotaPath. It facilitates steps like identifying inefficiencies, running scenarios, and aligning plan business targets without creating a formula-filled spreadsheet.

For further guidance, explore our additional resources or schedule time with a team member to see how QuotaPath facilitates optimizing the cost of sales compensation.