Finance leaders feel pressure from their revenue teams to ensure accurate, timely, and compliant commission payouts.

But outdated compensation processes consistently put that at risk.

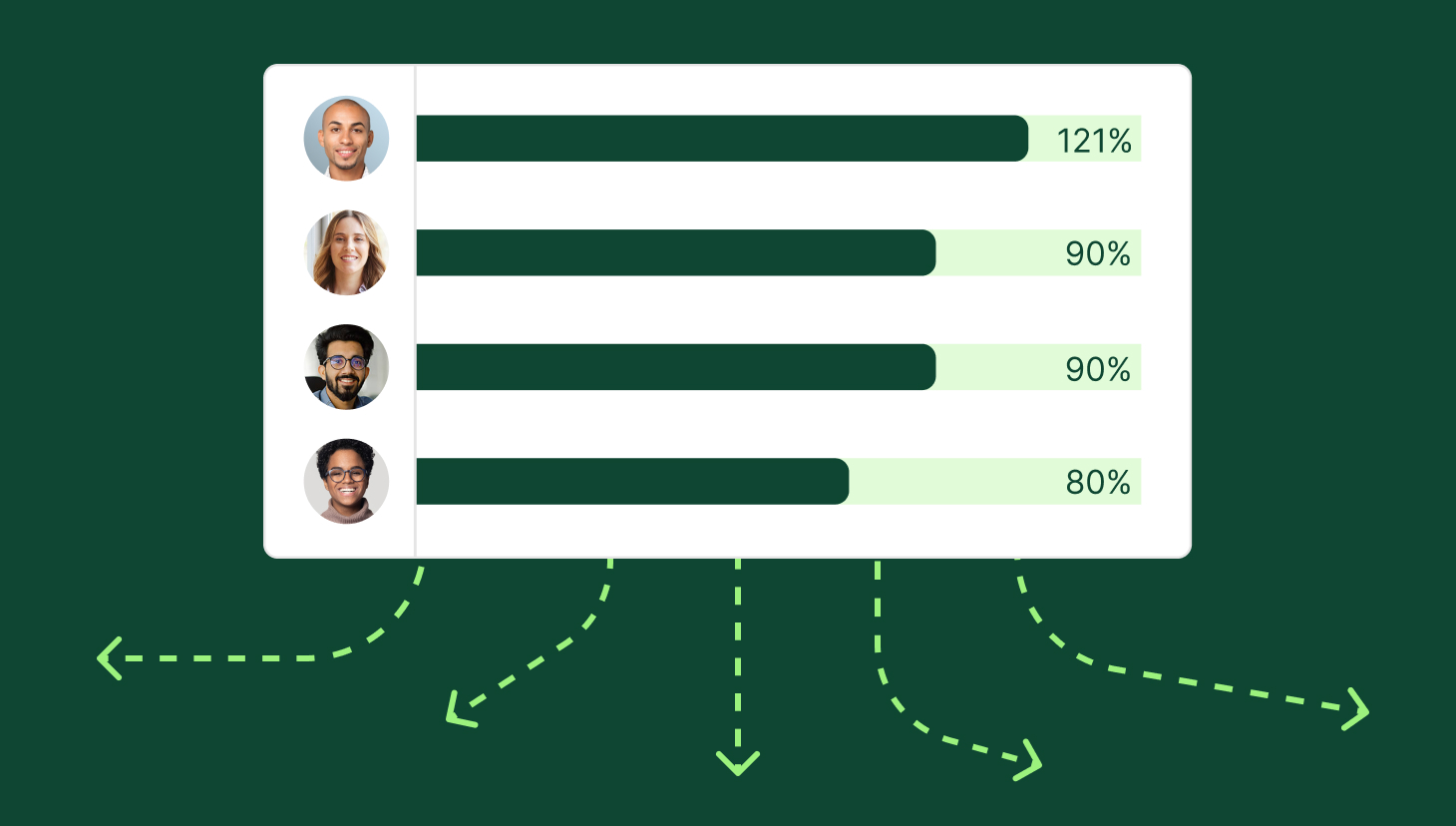

We found that 22% of sales reps report at least one commission dispute per year, with nearly 10% of reps quitting due to compensation errors.

Moreover, our 2023 report uncovered that 75% of reps don’t trust they’re paid fairly.

And, 60% of reps take three to six months to fully understand their compensation plans, leaving revenue on the table due to confusion and lack of transparency. (60%! That’s more than half your sales team not understanding how they are paid for half the year.)

As a result, reps lose motivation and trust within their org, while finance begins (if they aren’t already) to dread commission paycheck time.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesMuch of this has to do with outdated processes.

Managing commissions through spreadsheets turns what should be a seamless workflow into a financial bottleneck. Complex approval workflows slow the financial close cycle and stall even further when F&A works to properly amortize commissions and recognize revenue by the book.

If this sounds familiar, it’s likely due to the lack of automation for the side of the house.

How Compensation Software Optimizes Financial Closes

That’s where compensation software comes into play.

By automating commission calculations and approvals, compensation software streamlines financial operations and removes the friction that often stalls payout processes. Finance teams that have adopted automation report a significant reduction in time spent on commission calculations, with some cutting their workload by over 90 percent.

Take our customer, Whistic, for example. Taggert Beefus, Whistic’s Head of RevOps, used to spend 7 hours running commission payouts at the end of cycle. Today, it takes him 30 minutes for a team of more than 20 reps.

Instead of spending weeks verifying calculations and chasing approvals, finance leaders can confidently finalize commissions, ensuring accuracy and transparency across departments.

This unlocks a newfound efficiency for finance teams historically struggling with slow, manual processes.

Peter Tenaglia, Director of Finance at BlueConic, said, “QuotaPath is a perfect tool, not only for our team to kind of have less of a hassle with commission calculation, but it solves the issue of you guys waiting a full quarter for you to see a finalized commission statement after going through multiple levels of emails and Slacks going back and forth.”

With compensation software, close the books faster, reduce compliance risks, and focus on financial strategies that drive business growth.

Below, let’s explore how automation improves payout accuracy, enhances reporting capabilities, and aligns finance, RevOps, and sales teams.

QuotaPath + Rippling: Push-to-Payroll Integration for Commissions

For the first time, finance and HR teams can push commission earnings directly into payroll with just a few clicks, eliminating the need for tedious CSV exports or last-minute manual uploads.

Read More5 Ways Compensation Software Supports Finance Leaders Directly

One thing to note is that the following benefits are specific to QuotaPath’s platform.

While many features below are offered across software, QuotaPath’s two-way integration with Rippling marks the only in the industry to push commission payments into a payroll provider.

Alas, the following five capabilities directly support finance teams by streamlining commission payouts, reducing errors, and accelerating financial closes.

1. Locked Compensation Plans: Preventing Last-Minute Changes

QuotaPath ensures commission plans remain locked once approved, preventing last-minute adjustments that could disrupt financial closes. This helps finance teams:

- Maintain accurate accrual calculations for commission expenses.

- Reduce unexpected commission adjustments that impact forecasting.

- Improve audit readiness by keeping a structured payout history.

2. Multi-Level Approvals: Streamlining Payout Processing

Managing approvals across sales, RevOps, and finance can delay commission payouts. QuotaPath automates this process by:

- Pre-setting workflows for managers, finance teams, and executives.

- Providing instant visibility into commission approval status.

- Eliminating back-and-forth emails and manual sign-offs to speed up approvals.

3. ASC 606 Compliance: Automating Commission Amortization

QuotaPath ensures commissions align with ASC 606 revenue recognition standards by:

- Automating commission amortization to match expenses with recognized revenue.

- Reducing compliance risks that could lead to financial restatements.

- Ensuring audit-ready financial reporting with structured payout records.

4. Payout Eligibility: Reducing Overpayments and Disputes

Avoid overpayments and disputes with QuotaPath’s automated payout eligibility rules, which:

- Define clear conditions for when commissions should be paid.

- Prevent overpayments on clawbacks, returned deals, or ineligible commissions.

- Provide real-time visibility into commission adjustments and eligibility.

5. Seamless Payroll Integration with Rippling

Accurate commission payments require smooth payroll integration. QuotaPath connects directly with Rippling, ensuring:

- Seamless data transfer from commission tracking to payroll.

- Automated payroll processing without manual adjustments.

- Fewer payout errors and greater financial compliance.

With these finance-driven capabilities, QuotaPath simplifies commission management, reduces risk, and accelerates financial closes for growing organizations.

Try QuotaPath for free

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialKey Finance Wins from Using QuotaPath

For finance leaders, commission management should encompass accuracy, compliance, and efficiency.

And with QuotaPath, they get that, including:

- 50%+ reduction in time spent on commission calculations. Finance teams can shift focus from manual reconciliation to strategic financial planning.

- Audit-ready financials with ASC 606 compliance. Automated commission amortization aligns with revenue recognition, reducing audit risks.

- Elimination of payout disputes. Automated approvals and eligibility tracking ensure that commissions are calculated correctly and paid on time.

- Increased accuracy in financial forecasting. Locked compensation plans prevent last-minute changes that disrupt financial closes.

- Seamless payroll integration with Rippling. Commission payments flow directly into payroll, reducing manual entry errors and compliance risks.

As Prefect Head of Finance Thomas Egbert said, “We cut our time spent on commissions calculations by 50%+ and have enjoyed providing real-time transparency to our sales reps and technical pre-sales team.”

To learn how QuotaPath can help your finance team achieve faster financial close, schedule a demo today.