According to McKinsey, companies with incentive structures aligned with their strategic goals report 30% higher employee productivity and a 25% increase in overall profit margins.

Yet, many organizations overlook compensation as a strategic lever for driving cash flow and profitability.

Our advice? Don’t treat commissions as a cost center!

Businesses should leverage compensation to reinforce behaviors that improve efficiency, strengthen margins, and accelerate cash flow.

Our VP of RevOps, Sales, and Marketing Ryan Milligan and Finance Leader Ryan Macia shared how organizations can reframe compensation to optimize financial health.

Enjoy.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesHow Compensation Can Improve Cash Flow and Profitability

Compensation, when structured with intention, can become your most strategic tool for improving key financial metrics.

Here’s how:

1. Protecting Gross Revenue Retention (GRR)

First, think about retention, a crucial indicator of long-term financial health.

If a business loses revenue from existing customers faster than it can replace it, profitability suffers.

Milligan suggests aligning sales and account management incentives with retention:

“If an AE closes a multi-year deal, they should earn a higher commission rate. Longer contracts give the business more time to deliver value and ensure retention,” said Milligan.

Similarly, account managers can be incentivized to secure early renewals or convert shorter-term contracts into multi-year agreements.

Recommended Reading: 3 Commission Pay Examples for Account Management & Customer Success

Need some help building your AM and CSM comp plans? Check out our examples here.

Take Me to Blog2. Increasing Gross Margin Through Pricing Incentives

Another way to drive efficiency is factoring in pricing incentives.

Sales reps naturally want to close deals, but not all deals are equally valuable. Companies can structure their comp plans to prioritize higher-margin deals.

“If you know certain types of deals require more support resources, drive lower margins, or increase servicing costs, you can decelerate commission rates on those deals while rewarding reps for high-margin deals,” suggested Macia.

For example, limiting excessive discounting by setting a threshold at which commissions decrease can help maintain profitability.

3. Driving Cash Flow with Payment Terms

Next, let’s look into cash flow.

Many companies focus solely on top-line revenue, ignoring when they actually receive cash.

This can create cash flow issues, especially for businesses that depend on recurring revenue. Compensation can be used to mitigate this problem.

“Pay the rep higher for better payment terms,” said Milligan. “If a customer pays upfront rather than over 12 months, that’s more cash in the business today. Reps should be incentivized accordingly.”

This approach ensures that cash comes in faster, reducing reliance on financing and improving overall financial stability.

“Pay the rep higher for better payment terms. If a customer pays upfront rather than over 12 months, that’s more cash in the business today. Reps should be incentivized accordingly.”

Avoiding Common Compensation Pitfalls

Sure these ideas are helpful, but stay sharp.

While compensation can be a powerful tool for driving efficiency, certain pitfalls should be avoided:

1. Overcomplicated Comp Plans

Adding too many incentives can backfire, making it hard for reps to understand their pay structure.

Macia cautioned, “If a comp plan is too complex, reps won’t know how to optimize their earnings, and leadership won’t be able to predict financial impact.”

Limiting incentives to 2–3 key metrics aligning with business objectives is key.

2. Lack of Transparency

And, visibility is critical.

If you put any of the tactics in place, your reps should be able to see how those incentives actually impact their pay.

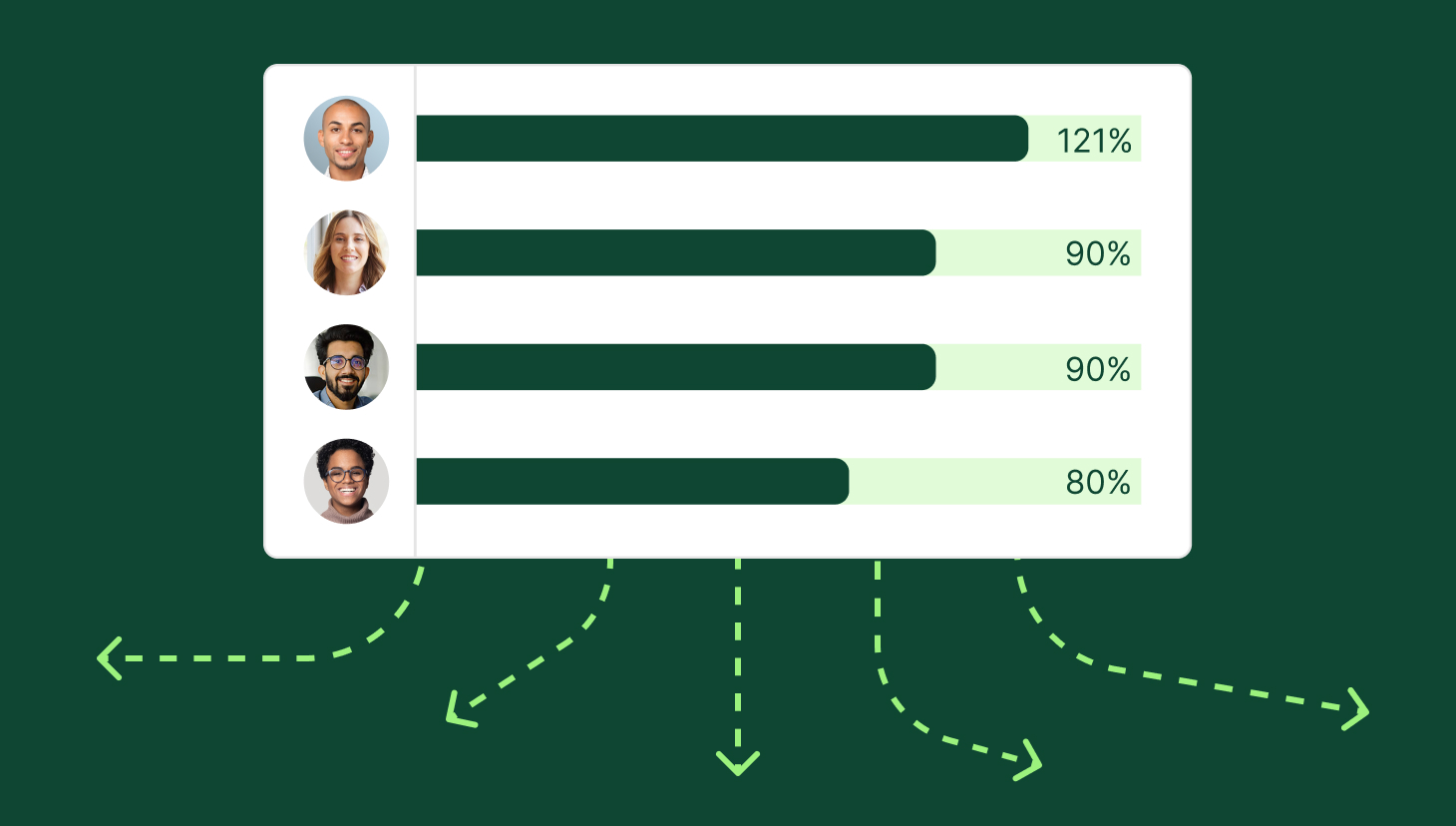

Reps should be able to forecast their earnings based on deal structures— like in QuotaPath, for example.

“QuotaPath allows reps to see exactly how much they’ll make based on deal structure, helping them focus on high-value opportunities,” said Milligan.

3. Ignoring Effective Commission Rates

Plus, you’ll want to pay attention to the effective commission rates.

Companies often overlook their total cost of sale when designing comp plans. If SDRs, AEs, and managers all take a cut of a deal, businesses may find they are paying out 30–40% in commissions—drastically impacting profitability.

“It’s important to track the effective rate of commissions across all roles to ensure profitability doesn’t suffer.” said Macia.

Recommended Reading: Breaking Down a Typical Sales Commission Structure

Check out our blog highlighting a typical sales commission structure. Review best practices and compensation plan examples.

Take Me to BlogFinal Thoughts

Compensation is your secret lever for financial success that you’re not using to its fullest.

By aligning comp plans with efficiency metrics, businesses can protect revenue, improve margins, and optimize cash flow without sacrificing growth. Ready to rethink your compensation strategy?

Schedule a free comp plan consultation with our leadership team.