October marks the beginning of Comptober at QuotaPath—when teams should begin building their compensation plan proposals for the upcoming year.

As we dive into comp planning, one theme stands out more than ever: alignment.

When we asked nearly 500 revenue leaders what area of their sales compensation management process needs the most improvement, 25% reported “alignment to business goals” as their top focus, followed closely by simplicity, optimization, visibility, and automation.

Given today’s rapidly changing economic environment, this focus on alignment isn’t surprising.

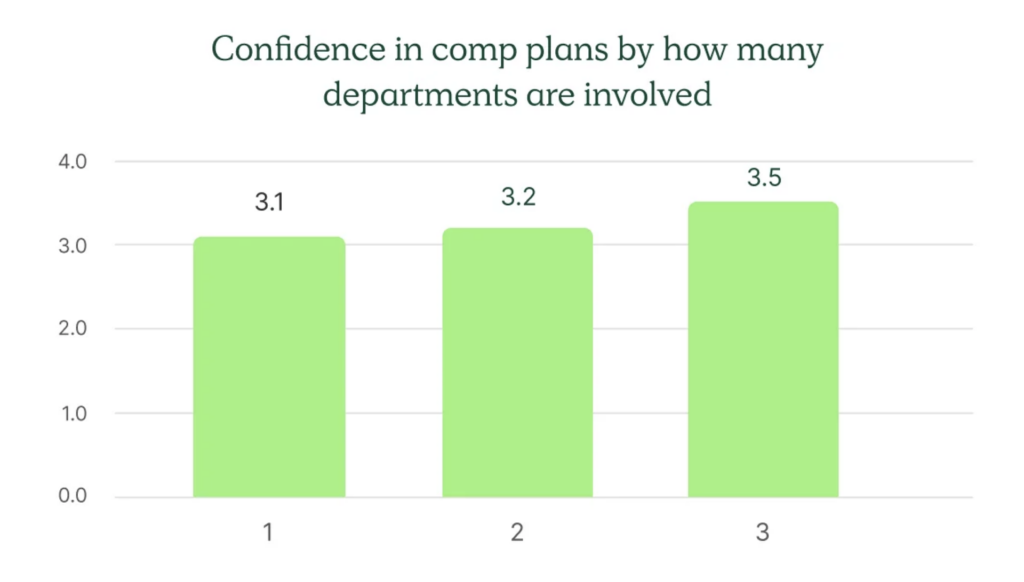

Companies should ensure their compensation plans are designed in collaboration with Sales, Finance, and RevOps leaders to drive growth and efficiency.

A lack of alignment between these teams can lead to comp plans that drive the wrong behaviors or favor the business more than the reps, jeopardizing the organization’s strategic objectives and the reps’ loyalty.

In this blog, we’ll explore how alignment can make or break your comp plans and offer steps to ensure your team is on the right track as you build for the year ahead.

How Misalignment Occurs

We’ll begin with the precious of misalignment in compensation plans. This typically occurs for one or multiple of the following reasons:

Setting comp plans before finalizing goals | Comp plans solidified before finalizing your most important business goals often lead to missed opportunities to motivate selling behaviors that directly impact those goals. |

Lack of cross-team communication | When sales compensation plans are created in silos without input from Sales, Finance, and RevOps, it increases the risk that the plan won’t align with broader business goals. |

Focus only on short-term outcomes | Comp plans that prioritize short-term objectives, like hitting quotas or generating leads, can drive reps to focus on individual success rather than company-wide goals. |

Copying old plans | Whether it’s a new leader replicating a plan from their previous company or reusing last year’s model, these practices can lead to misalignment if they don’t reflect the current business environment and strategy. |

Cross-department Collaboration is Key to Avoiding Misalignment

The first and most crucial step in avoiding compensation plan misalignment is ensuring cross-department collaboration from the start.

Compensation plans that are built in silos—whether by Sales, RevOps, or Finance—are bound to create friction, drive the wrong behaviors, or fail to align with business goals. That’s why involving key stakeholders from each department is essential to building a plan that works for everyone.

Who Should Be Involved?

- RevOps Leaders: As the team responsible for ensuring operational alignment between Sales, Marketing, and Finance, RevOps plays a critical role in ensuring the compensation plan ties back to the company’s overarching goals. RevOps leaders are often responsible for managing the data, processes, and systems that support the plan’s execution.

- Sales Leaders: Sales teams are on the frontlines of executing the company’s growth strategy. Sales leaders offer insight into what motivates the team, current market conditions, and how the compensation plan can drive behaviors that align with business objectives. They ensure that quotas, commissions, and incentives are realistic and achievable.

- Finance Leaders: Finance has the final say regarding the budget and ensuring the plan is financially viable. They provide the guardrails that ensure the plan is fair to reps and sustainable for the business.

- Reps Themselves: It’s equally important to involve sales reps. After all, they’re the ones being incentivized. Gathering feedback on current plans, understanding what motivates them, and identifying pain points will create a compensation structure aligning rep behavior with business goals. This buy-in from reps also increases engagement and motivation, making them more likely to hit their targets.

Why Collaboration Matters

Collaboration across departments ensures that the compensation plan reflects the perspectives and needs of the entire organization, not just one team. Without this collaboration, it’s easy to create plans that unintentionally drive the wrong behaviors—such as reps focusing too heavily on short-term wins at the expense of long-term growth, or plans that don’t account for the company’s financial reality. When Sales, RevOps, and Finance collaborate, it creates alignment, ensuring that the plan motivates reps and drives the right business outcomes.

Best Practices for Fostering Collaboration

- Set clear goals together: Start with a shared understanding of the company’s business goals, then design the comp plan to drive those objectives. Ensure all key stakeholders have a voice in these conversations.

- Create a cross-functional compensation committee: Establish a working group of leaders from Sales, Finance, and RevOps who meet regularly to design, review, and update comp plans.

- Hold regular feedback sessions: Gather input from reps at various stages—during the design phase and regularly throughout the year. Make sure their feedback is incorporated and acknowledged to improve the plan’s effectiveness.

- Use data to guide decisions: Rely on historical performance data, forecasting, and insights from all departments to inform your compensation plan. RevOps should play a central role in pulling and analyzing this data.

- Encourage open communication: Ensure open lines of communication between teams so that any concerns or adjustments can be addressed quickly and collaboratively.

By fostering collaboration across Sales, Finance, RevOps, and involving reps in the process, your organization can create a compensation plan that drives alignment, motivates the right behaviors, and supports your business goals.

Create Compensation Plans with confidence

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanEstablish Organizational Goals Before Setting Compensation Plans

Equally as important as cross-department collaboration is the need to set organizational goals before designing compensation plans.

A well-crafted compensation plan should directly align with your company’s strategic objectives, ensuring every incentive is tied to the behaviors and outcomes that move the business forward. Without clear goals, you risk creating a comp plan that drives actions misaligned with what your organization needs to achieve.

Why Finalizing Goals First is Critical

The role of a compensation plan is to motivate and reward the right actions from your sales teams.

However, if your company’s business objectives haven’t been clearly defined, it’s impossible to know what those “right actions” are.

For example, if your primary business goal is to improve gross revenue retention, but your comp plan incentivizes reps based solely on new business without factoring in retention, you’ll find yourself driving the wrong behaviors.

In this scenario, reps may focus on closing new deals quickly, potentially at the cost of long-term customer relationships and retention—ultimately harming your company’s growth targets.

Start with the Big Picture

So, before drafting any compensation plan, sit down with your executive team to establish your key business metrics for the upcoming year.

These might include goals like:

- Increasing revenue growth

- Enhancing customer retention

- Driving efficiency across sales processes

- Expanding into new markets or verticals

- Improving profit margins

Once these broader objectives are set, you can tailor your compensation structure to reflect and support these goals. This ensures that every aspect of the plan—from quotas to commission structures to bonuses—works harmoniously with the company’s priorities.

Best Practices for Aligning Comp Plans with Business Goals

- Define business objectives first: Ensure company-wide goals are finalized before designing comp plans. These should be broad metrics tied to growth, efficiency, or profitability that provide clear direction for the year ahead.

- Ensure goal clarity across teams: Once goals are established, communicate them clearly to your Sales, RevOps, and Finance teams. Everyone involved in building the comp plan should understand these objectives strongly.

- Design with alignment in mind: Keep your goals front and center as you build out the comp plan. Ensure every part of the plan drives behaviors that directly support achieving those objectives. For example, if customer retention is a priority, reward reps for signing high-retention clients or renewing long-term contracts.

- Incorporate feedback loops: As the year progresses, assess whether the comp plan is truly aligning reps’ behaviors with your organizational goals. If not, adjust the plan mid-cycle to reflect better what’s needed.

- Test for financial sustainability: After designing the plan, run scenarios to pressure-test whether it’s sustainable in the context of your business’s financial goals. Your Finance team plays a critical role here in ensuring the plan doesn’t put the company at risk.

Avoiding the Pitfalls of Misalignment

One of the most common reasons comp plans fail is because they were created before organizational goals were fully fleshed out. If the priorities of your business shift mid-year or after a plan is finalized, you’ll end up with misaligned incentives. This can lead to reps focusing on outdated or irrelevant targets, causing friction and ultimately slowing progress toward the company’s true goals.

By setting clear business goals first and ensuring every piece of your compensation plan is aligned to those goals, you’ll build a structure that motivates your team and drives the outcomes that matter most to the long-term success of your organization.

Limit Focusing Solely on Short-Term Outcomes

Next, remember that while short-term objectives like hitting quotas or generating leads are important, compensation plans that prioritize these exclusively can lead to unintended consequences.

When reps are incentivized only on immediate wins, they focus on individual success—often at the expense of broader company goals like long-term customer retention or strategic growth.

To avoid this, it’s essential to balance rewarding short-term performance and aligning incentives with the company’s long-term objectives. Consider incorporating elements that promote sustainable growth, such as rewarding reps for high-quality deals, customer retention, or long-term contracts.

This approach ensures your team remains focused not just on immediate results but on driving success that supports the company’s bigger picture.

Refrain From Copying Old Plans

Lastly, reusing old compensation plans—whether a new leader is bringing a model from their previous company or simply recycling last year’s plan—can create misalignment if the plan doesn’t account for the current business environment or strategic shifts.

Each year brings new challenges and priorities, and compensation structures should evolve accordingly.

Instead of defaulting to what worked in the past, take the time to assess whether the previous plan aligns with your company’s current goals, market conditions, and team structure. By tailoring the comp plan to reflect the unique circumstances of the present, you’ll avoid driving behaviors that are out of sync with your organization’s needs.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesCollaborating and Aligning Comp Plans to Drive Success

As we enter Comptober, teams must focus on aligning their sales compensation plans with their company’s most important business metrics.

From cross-department collaboration to setting clear organizational goals, ensuring your comp plan is designed with the right framework can make or break your company’s success. Avoiding common pitfalls like focusing too heavily on short-term goals or recycling old plans ensures that your strategy is forward-thinking, motivating, and in sync with your business objectives.

Partnering with QuotaPath can help you structure and measure sales compensation plans that align with your company’s goals.

Our platform provides transparency and collaboration between Sales, Finance, and RevOps teams, ensuring compensation plans drive the right behaviors and support long-term success. Talk to our team today.