A commission policy creates alignment and transparency throughout the planning and implementation of a sales compensation plan. This agreement helps reps understand how and when they earn commissions, creates buy-in, and increases motivation driving organizational goal achievement.

A sales commission agreement includes key elements such as the details of the sales compensation plan, commission payment terms, sales targets and commissions, dispute resolution procedures, and legal considerations. This agreement serves as a handy reference to keep employers and employees on the same page while preventing and minimizing commission disputes.

For instance, a rep can check to see how and when they actually earn the commissions and will be paid on that big deal they just closed. Or perhaps a rep is leaving the company, and the agreement clearly defines which deals the company must pay them for and by what date.

In both cases, a detailed commission payment agreement helps the employee and employer successfully navigate these situations without discord.

These are often text-heavy documents requiring rep sign-off. Lucky for you, we’ve got a downloadable commission payment agreement template.

Download the Commission Payment Agreement Template

Understanding Key Elements

A comprehensive commission payment agreement should include the following key elements:

- Parties Involved: Clearly define the employer and employee parties to the agreement.

- Effective Date and Term: Specify the agreement’s start and end dates, including provisions for renewal or termination.

- On-target Earnings (OTE): The amount of money a rep can expect to earn if they hit 100% of the quota. This is often expressed as an annual figure and designates the base salary and commission amounts.

- Quota: State-specific goals the sales rep must achieve during a defined period to earn a commission. (Read: How to Set a Sales Quota)

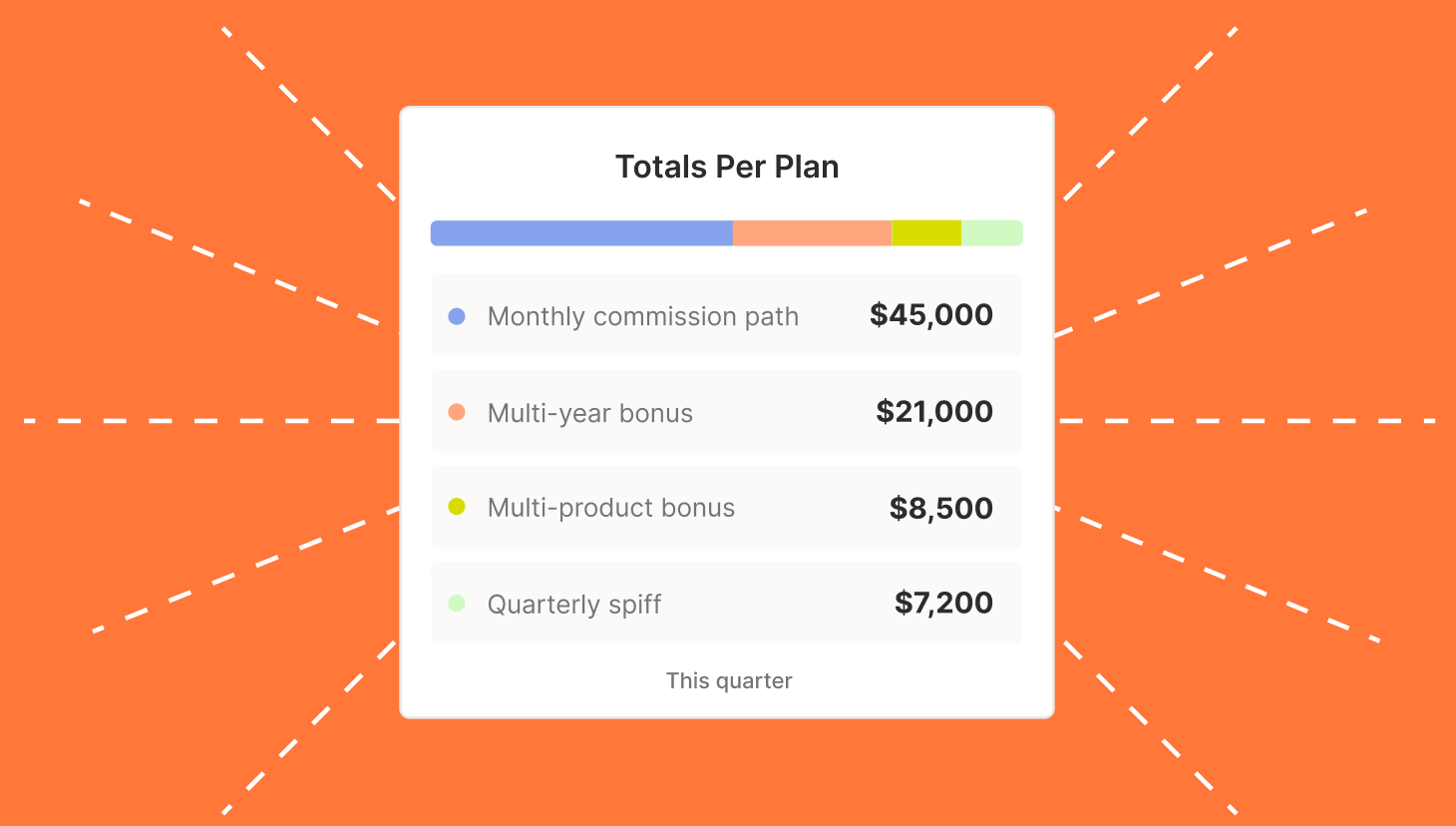

- Commission Structure: Outline the base commission rate, commission tiers, accelerators, or other compensation components.

- Commission Payout Schedule: Detail the frequency of commission payments, such as monthly or quarterly, and any applicable payment terms.

- Sales Metrics: Clearly define the sales metrics used to calculate commissions, such as revenue, units sold, and customer acquisition cost.

- Payment Calculation Methodology: Specify the formulas and calculations used to determine commission amounts.

- Draw Against Commission: If applicable, outline the commission draw policy, including repayment terms and interest charges.

- Contests and Bonuses: Include provisions for additional incentives or bonuses, if applicable.

- Confidentiality and Non-Compete Clauses: Protect proprietary information and ensure employee loyalty post-termination.

- Dispute Resolution: Outline the dispute resolution process related to commission calculations or payments.

- Governing Law and Jurisdiction: Specify the legal framework governing the agreement.

- Signatures: Include sections for both the employer and employee to sign and date the agreement.

By including these essential elements, you can create a legally sound and comprehensive commission payment agreement that protects the interests of both the employer and the employee.

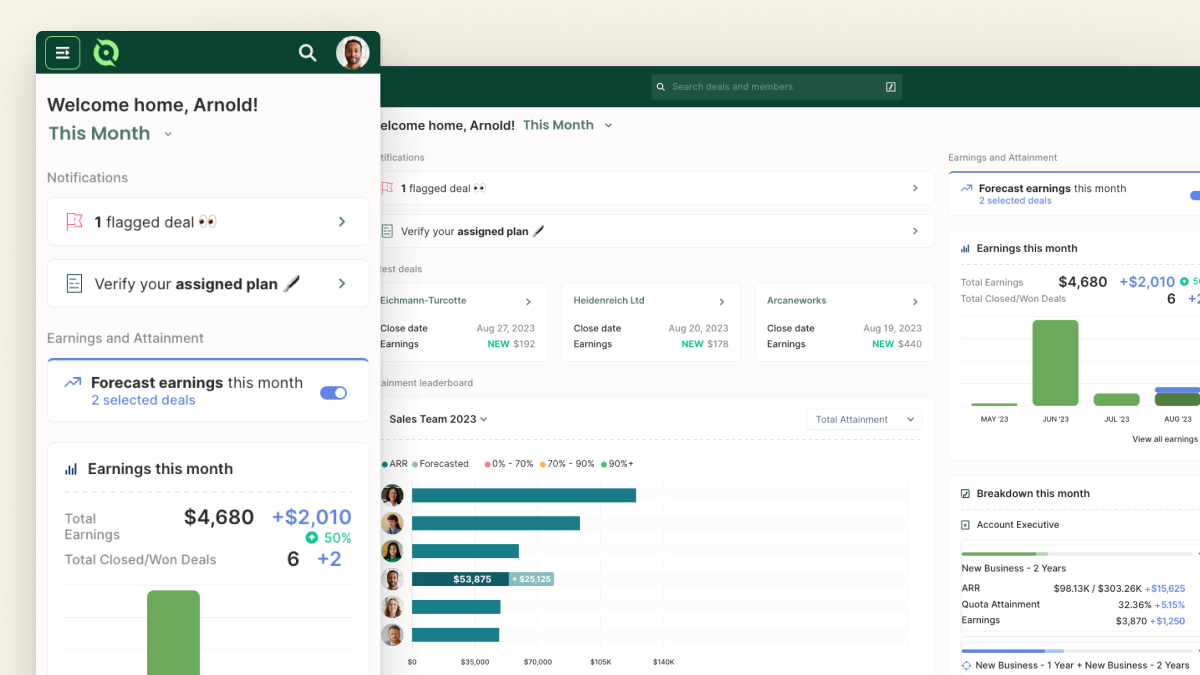

Use QuotaPath to collect signatures

Learn about Plan Verification, a feature in QuotaPath that distributes and collects commission payment agreement signatures.

Learn MoreStep-by-Step Guide

Here’s how to draft a commission agreement from scratch. These steps guide you through crafting an effective commission policy for your organization.

| Conduct a Thorough Review | Analyze existing commission plans, contracts, and relevant legal documents to identify critical components and potential areas for improvement. |

| Define Clear Objectives | Determine the specific goals of the commission agreement, such as attracting and retaining top talent, incentivizing desired sales behaviors, and ensuring compliance with regulations. |

| Incorporate Legal Counsel | Seek input from legal experts to ensure the agreement complies with all relevant labor laws and industry regulations. |

| Gather Input from Stakeholders | Collaborate with sales, finance, HR, and legal departments to gather input and ensure the agreement aligns with company policies and objectives. |

Create a Flexible Template | Develop a template easily adapted to different sales roles, compensation plans, and market conditions. |

Include Essential Provisions | Incorporate the key elements of a commission agreement, such as payment structure, metrics, dispute resolution, and confidentiality clauses. |

| Use Clear and Concise Language | Write the agreement in plain language, avoiding complex legal jargon that may confuse employees. |

| Review and Update Regularly | Stay informed about changes in labor laws and industry best practices and update the template accordingly. |

By following these steps, you can create a commission agreement that is both comprehensive and user-friendly.

Calculate OTE:Quota ratios

Use this free calculator to ensure your reps’ on-target earnings and quotas mirror what they’re bringing in for the business.

Try it NowCustomizing Your Commission Payment Agreement

One size does not fit all regarding an employee commission agreement. So it’s essential to customize your commission agreement template to reflect the organization’s unique characteristics, business, and role. Here are key considerations as you customize each agreement.

- Tailor the agreement to each role that shares the same title. For example, A senior account executive should have a different agreement than a junior account executive.

- Include, define, and update each agreement for every component within the comp plan such as accelerators, commission rates according to services, and different products.

- If your sales team operates in different geographic regions, consider including territory-specific adjustments to the commission plan.

- Clawbacks may vary by role or team; make sure to update this accordingly.

- Outline the dispute resolution process.

- Explain how to pay for time not worked or leaves of absence is addressed. For instance, the details of a quota relief policy should be included as you customize commission agreement.

- Detail how commissions are handled at the termination of employment. For example, timing of pay and rules determining payment such as cash received from the customer.

Customize each commission payment agreement for your organization, industry, and role until each relevant issue is addressed. This will increase transparency and prevent misunderstandings and potential compensation disputes.

Common Mistakes in Commission Payment Agreements

These common errors violate the top commission agreement best practices. Ensuring you don’t commit any of these mistakes increases the effectiveness of your sales commission agreement.

Lack of Alignment with Business Goals: Failing to define how the commission plan supports overall company objectives clearly.

Overly Complex Structures: Creating commission plans that are difficult to understand and calculate, leading to confusion and frustration among sales reps.

Ignoring Sales Team Input: This involves neglecting to involve sales reps in the development process, resulting in a plan that doesn’t motivate or resonate with the team.

Insufficiently Defined Metrics: Using vague or ambiguous sales metrics to calculate commissions, leading to disputes and inconsistencies.

Ignoring Market Competitiveness: Failing to research industry standards and benchmark compensation plans against competitors.

Neglecting Legal Review: Overlooking the importance of legal counsel to ensure compliance with labor laws and regulations.

Lack of Flexibility: Creating a rigid commission plan that cannot adapt to changing market conditions or business priorities.

Ignoring the Role of Technology: Failing to leverage commission software to automate calculations, track performance, and improve efficiency.

Insufficient Communication: Poorly communicating the commission plan to the sales team, leading to misunderstandings and demotivation.

Neglecting Ongoing Evaluation: Failing to regularly review and update the commission plan to ensure it remains effective and aligned with business goals.

Avoiding these common commission payment agreement errors will improve your understanding of sales compensation plans and help you achieve your objectives.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesAutomating Commission Payments

Protect your business with commission agreements. These documents clearly explain all the elements, rules, and legal considerations of the sales compensation plan, preventing and minimizing disputes. You can create your commission payment agreement from scratch or customize our free template download then automate the sign-off process with QuotaPath.

See how QuotaPath provides team-wide visibility into the black box of sales commissions. Then build alignment between RevOps, Finance, and Sales when using sales compensation as a driver of your key business metrics. Schedule time with a QuotaPath team member or start a free trial today.