Learn how to comply with ASC 606 revenue recognition when it comes to sales commissions.

To keep financial records complete, accurate, and comparable, companies follow five core accounting principles. These include: the revenue principle, the expense principle, the matching principle, the cost principle, and the objectivity principle.

When compliant with these principles, companies put themselves in the best position to succeed with investors, valuations, buyers, and more.

But, these principles — and standards to help companies meet the criteria — often change as markets evolve.

One newish standard that is of particular interest to us is ASC 606, which the Financial Account Standards Board (FASB) created ASC 606.

Try QuotaPath for 30-days

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Try for FreeWhat is ASC 606? It’s an accounting standard that dictates which accounting periods businesses should attribute revenue and expenses. This revenue recognition principle applies to any company with recurring costs.

So, businesses that offer goods and/or services under a written agreement must pay attention to this rule. Because failure to comply puts you at risk of incurring substantial fines and an unexpected audit visit.

Aside from the non-compliance risks, adhering to ACS 606 helps businesses gain a better picture of their financial health. Establishing this practice is especially important for startups wishing to raise money by approaching investors or applying for bank loans.

When did ASC 606 become effective? The FASB introduced this new revenue recognition principle in 2014. The rule applied to public companies in 2018, followed by private businesses.

Then, the FASB added Subtopic 340-40 to ASC 606 and became effective for fiscal years after December 15, 2017. Under this subtopic, Other Assets and Deferred Costs: Contracts with Customers, it’s necessary to implement ongoing reporting and record-keeping of costs incurred while securing or fulfilling a contract with a customer. These costs include advertising, travel expenses, and sales commissions.

To comply with ASC 606, we recommend following the five steps below.

Steps to be compliant with ASC 606

Before we dive in, understand that the complexities of revenue recognition vary slightly based on the specific goods and services sold. In SaaS, where subscription-based sales are most common, ASC 606 compliance grows an added layer of complexity.

For subscription-model businesses, comply with ASC 606 revenue recognition by following this 5-step approach.

Step 1. Identify the contract with a customer

First, identify the contract. In terms of ASC 606, a contract marks an agreement between two or more parties and requires:

- Approval by all parties

- Definitions of the obligations of all parties and verify they are committed to executing the agreement

- Identifying the goods or services being supplied

- Detailing the payment terms

- Showing that the contract or deal is commercially substantive, predicating that the future entity cash flows will change

- That it’s based on the likelihood that payment will be received by the vendor for the goods or services being transferred

Step 2. Identify the performance obligations in the contract

Next, you’ll want to outline the performance obligations in the contract. In the context of a contract, we define performance obligations as promises made in the agreement between the vendor and the customer. Under ASC 606, businesses must itemize what the rule refers to as “distinct” performance obligations. What makes each performance obligation “distinct” is being of value to the customer as a standalone item, independent of other goods and services in the contract.

Step 3. Determine the transaction price

Now, you’re ready to determine the transaction price, which is the agreed-upon price the vendor expects the customer to pay in exchange for the goods or services is the transaction price. This figure excludes sales tax or other third-party variables. You must also consider the value of all cash and non-cash compensation and factor in any discounts or other pricing modifications designated in the contract.

Step 4. Allocate the transaction price

Then, you’ll allocate the transaction price. This is the step where the total transaction price is divided and attributed to specific performance obligations under the contract. This can be particularly difficult to determine for recurring payments under a subscription-based transaction where the performance obligation is continuous.

Step 5. Recognize revenue when the entity satisfies the performance obligations

This next step is the most important as it pertains to sales commissions. In Step 5, you should aim to recognize revenue for performance obligations as your team completes them. This typically occurs when the contract starts or when you receive payment. In the case of a single performance obligation, you should recognize the revenue in the accounting period when the order is fulfilled — not when the customer places the order.

However, for a continuous performance obligation, such as a year-long subscription to a software service that’s paid monthly, you will recognize each monthly payment during the accounting period when the funds are received.

How QuotaPath’s Ledger can help with recognizing and reporting commissions correctly

The five steps above will help you remain compliant. You can manage amortization schedules manually, via spreadsheet, or you can recruit the help of a smart solution to do it more accurately and efficiently.

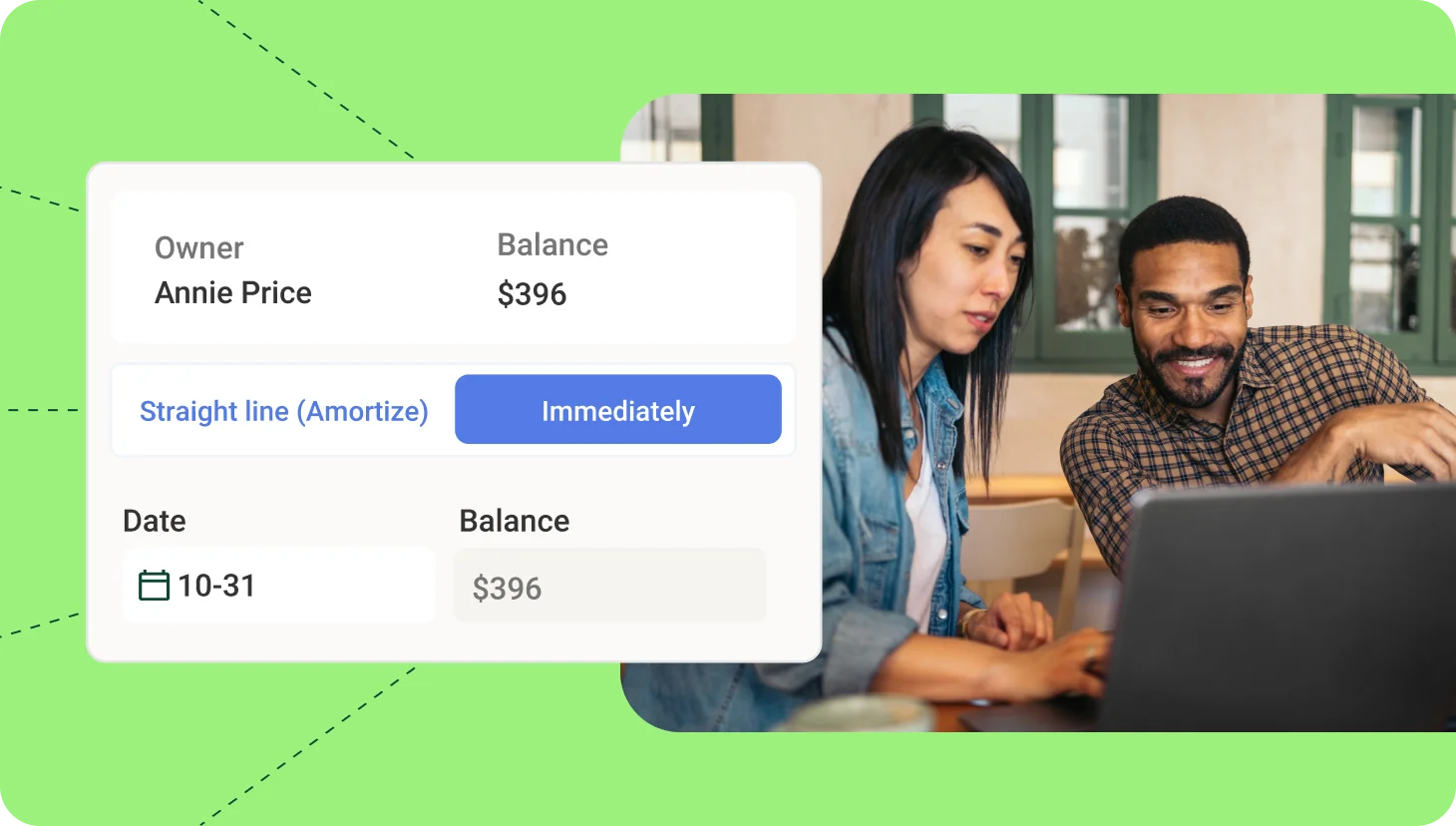

QuotaPath Ledger allows your accounting team to consistently capitalize and amortize commission expenses in compliance with ASC 340-40.

Ledger provides the flexibility to recognize commission expenses according to your scheduling requirements.

With Ledger, you simplify month-end closing processes, keep up with all the details as they arise, and eliminate errors. Plus, you gain the ability to create easy-to-read, audit-ready reports quickly.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesStart complying with ASC 606 revenue recognition

Failure to comply with the revenue recognition principle carries risks like fines and surprise audits. Aside from risk avoidance, proper revenue recognition enables businesses to gauge their financial health. Although this is valuable for all businesses, it is particularly important for startups that want to raise money.

Are you ready to simplify ASC 606 revenue recognition? Try QuotaPath for free for 30 days, get familiar with Ledger, and integrate with Stripe or QuickBooks for seamless implementations.