When companies want to predict how much money they’ll bring in over the coming year, they look to a key business metric called annual recurring revenue (ARR). This metric, lauded by many industry experts as the “SaaS standard,” measures the current health of a company and acts as a predictor of what will happen over the coming year. For SaaS companies that rely heavily on subscriptions, upgrades, and related services, ARR can be a powerful tool.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialWhat is annual recurring revenue?

In many ways, annual recurring revenue is the linchpin of SaaS business metrics. That’s because it indicates how much recurring revenue an organization can expect to bring in. Recurring revenue measures things like money generated via annual software subscriptions or service contracts.

For SaaS companies that offer subscription-based products and service-based upsells, ARR should reflect the combined total of those offerings. Consider a software company offering anti-virus software. In addition to its subscription rate for the software, contracts also include installation, training, and expansion packs for an additional fee. That company’s ARR would include the total cost of those services sold as a bundle.

ARR can also incorporate an organization’s month-to-month subscriptions, but that’s riskier. Since customers can choose to end monthly subscriptions at any time, accounting for those agreements as part of the ARR model could result in a less accurate metric. (That’s why monthly recurring revenue models, or MRR, exist. More about that below.)

How do you calculate annual recurring revenue?

To calculate ARR, first determine the total contract value (TCV) of your software revenue. This number should exclude one-time fees associated with the initial onboarding of that product, such as hardware costs. Then divide the TCV by the number of months of the contract. (This is important because contract terms aren’t always annually but instead might last 18 or 36 months.) Finally, multiply that number (the MRR) by 12 to get the annual recurring revenue for that product or service.

Why use ARR?

Annual recurring revenue measures the amount of money companies are bringing each year thanks to their subscription model. This standardizes contracts to the amount your company earns per year. Total contract value (TCV) is also important, but it can be misleading. A four-year customer contract for $60,000 looks better than a 1-year deal at $20,000 until you really break those numbers down.

Knowing ARR is helpful for:

- Forecasting revenue: First and foremost, ARR tells you how much revenue you can expect given current subscriptions and planned renewals. Comparing ARR year over year can also indicate churn. Knowing whether you have downward momentum can help plan promotions and slow or stop customer loss before it becomes critical.

- Increasing revenue: Using ARR as an informative metric delivers insight into customer behavioral patterns. If ARR is lower than desired, you can concentrate on attracting and converting more customers by booking more demos or reframing your value props. (Not to be confused with our Co-Founder and CEO’s podcast Value Props.) Or, you may want to reconsider how you’re pricing subscriptions or what features are included to make the package more attractive.

- Decreasing churn: If ARR is plummeting year after year, you’re not bringing in enough subscriptions to counteract customer falloff. Knowledge is power. Use your ARR calculations to fuel new plans to incentivize renewals.

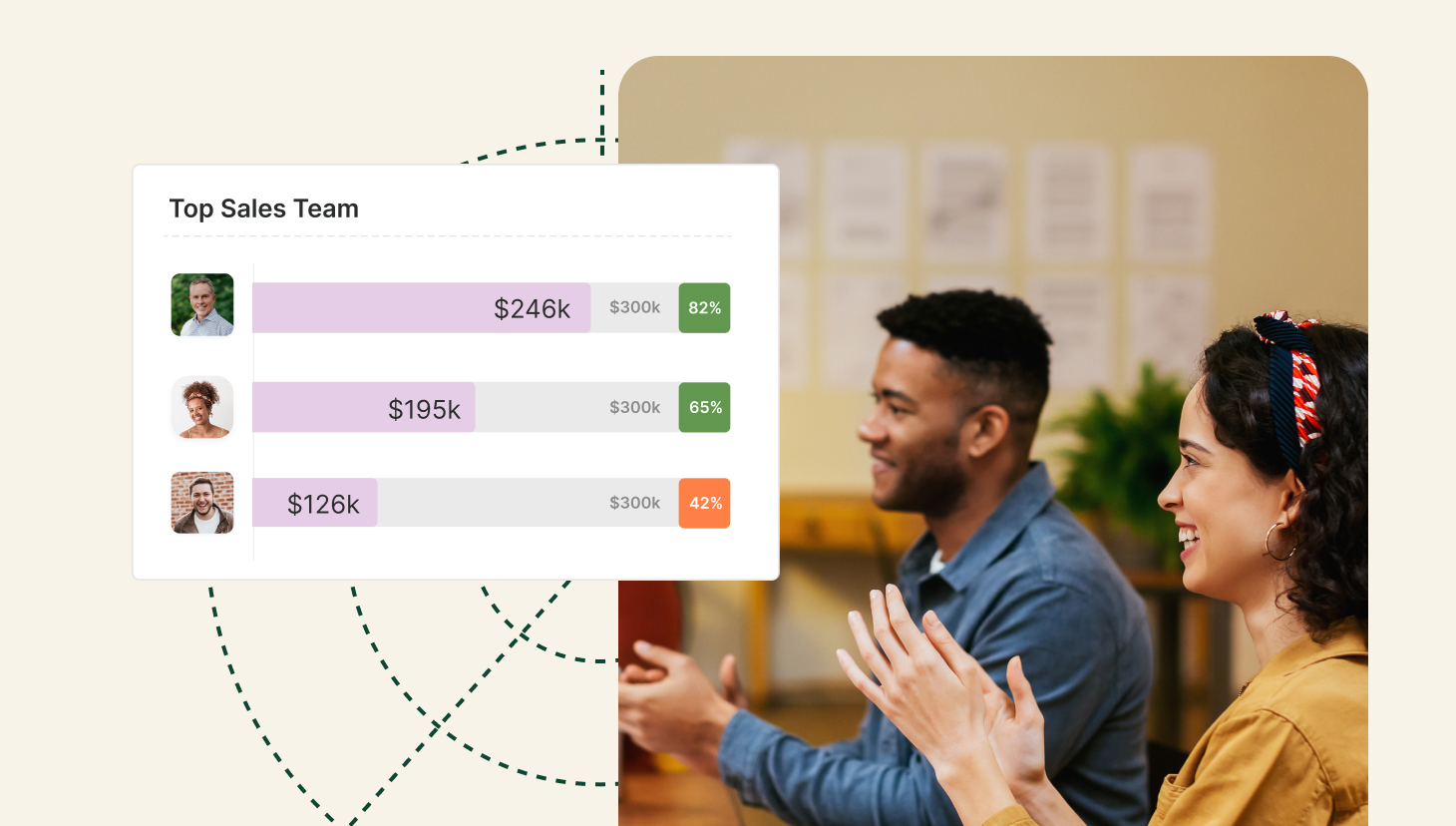

- Guiding sales teams: You calculate ARR for the entire company or according to smaller segments such as specific territories, sales teams or individual salespeople. A salesperson who has low ARR may need to be coached on how to close more subscription deals. Or, sales teams may need to focus on capturing a higher percentage of renewals.

- Rewarding top performers: Experts have linked employee morale to productivity. Recognizing talent using ARR tells you when it’s time to adjust SaaS commission rates and/or add other perks to keep valuable salespeople happy.

- Understanding and shaping overall company health: Is your business performing well? Metrics are one of the few ways to answer this question objectively. ARR can guide everything from creating motivational plans for your sales teams to increasing sales effectiveness.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesHow does ARR compare to annual contract value (ACV)?

ARR and ACV are often used interchangeably. That’s understandable, as the two metrics are quite similar, especially if a contract is equal to or greater than 12 months. But the information generated has different purposes.

Annual recurring revenue looks at how much revenue all yearly subscriptions will bring in over a 12-month period. Annual contract value, or ACV, measures the value of a customer’s contract. ARR is ARR regardless of the length of the contract. Meaning, a year is always going to be 12 months’ worth of revenue. Even if a customer signs a six-month contract for $6,000, the ARR is $12,000.

However, ACV is calculated by taking the TCV and first dividing it by the number of contracted months. Then multiply that number either by 12 or by the number of months in the agreement (whichever is lower). Using the same example from above, a six-month contract for $6,000 in ACV terms would be $6,000.

Both metrics are vital to SaaS and SaaS organizations should track both to get a full picture of incoming revenue and contract value. ARR is a standalone metric that’s always useful. ACV is most effective paired with other metrics to measure performance, coach sales teams, and inform future sales and marketing strategies.

What are the alternatives to ARR?

ARR has undeniable value as a key SaaS metric, but there are other options too. For some companies focused on monthly recurring revenue or customer acquisition, other metrics may be just as important.

- Monthly recurring revenue (MRR): MRR is similar to ARR but measures recurring revenue on a monthly basis rather than annually. This metric may be more useful to companies focused on monthly subscriptions.

- Total contract value (TCV): Total contract value represents the combined value of all customer purchases included in a contract. This metric encompasses recurring revenue and fees as well as any and all one-time charges set to occur throughout the lifetime of the contract.

- Annual contract value (ACV): ACV measures the value of a customer contract over one year, regardless of the actual length of the contract.

- Non-recurring revenue (NRR): Non-recurring revenue refers to money generated by one-time purchases of products or services. This might be a customer purchasing hardware necessary for initial installation or one-off onboarding services.

ARR is just one of many key sales metrics that are important to track if you’re interested in maximizing the growth of your business. Sound like a lot to manage? Take one thing off your plate by automating your commission tracking.

For more information, see QuotaPath in action.