Accounting for sales commissions involves many complexities.

This is especially true for those who have a multi-tiered sales team and overly complicated commission structures determined by elements like product type, rates, and services. In addition to navigating elaborate commission calculations, you also need to track costs incurred while obtaining and fulfilling customer contracts.

Recording all these intricacies correctly to be ASC 606 compliant can be enough to make your head spin.

So, if you’re feeling a bit overwhelmed, we’re here to shed some light on accounting for sales commissions.

In this blog, we provide:

- An overview of the basics of commissions accounting

- The different types of sales commissions

- How to calculate sales commissions

- How to record sales commissions in your accounting system

Let’s get started!

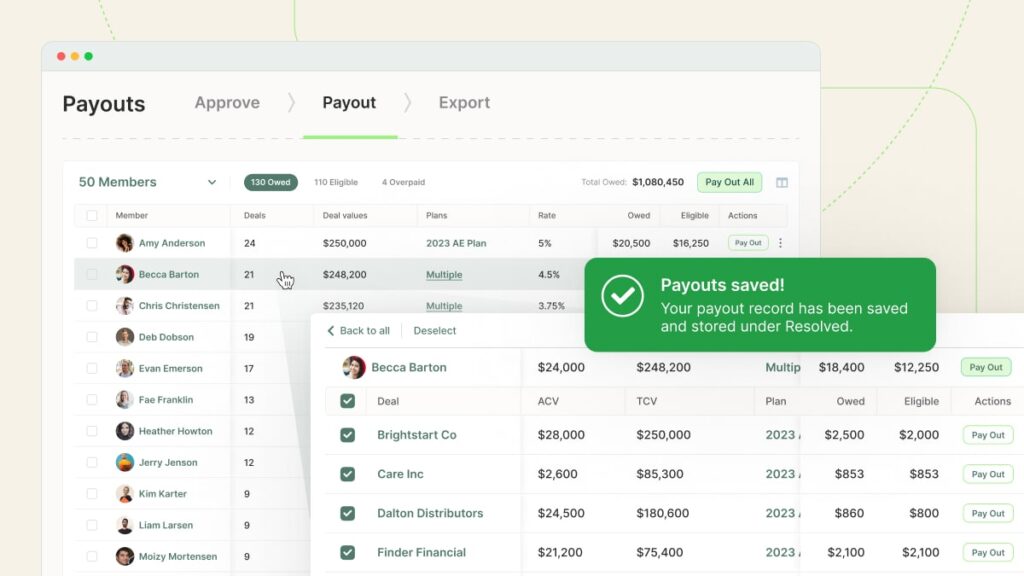

Simplify commission accounting

Automate sales commission calculation and schedule payouts with QuotaPath. Resolve discrepancies in-app, and provide your reps with visibility into their earnings to avoid questions post-paycheck.

Learn MoreBasics of accounting for sales commissions

Accounting for sales commissions includes several basic elements. You should familiarize yourself with these elements prior to getting started to simplify the accounting process. This will allow you to make key decisions and gather essential information.

Here’s a brief overview of the basics of accounting for sales commissions to help you prepare.

Defining the sales commission structure. This step involves determining the type of commission, such as straight commission, base salary plus commission, or tiered commission. Then you can identify the commission rate and the sales volume that triggers a commission.

Tracking sales data. Record sales made by each sales representative, the type of product or service sold, and the terms of the sale.

Calculating sales commissions. Determine the amount a sales representative earns for each deal based on factors such as commission structure, sales volume, product or service type, and terms of the sale.

Recording sales commissions in the accounting system. Create a journal entry to document the sales commissions expense and the liability for the commissions that have not yet been paid.

Timing of sales commission payments. Set when sales reps will receive sales commission payments, such as following the deal closure or invoice payment. In fact, many companies have shifted the timing of sales commissions payments recently due to economic challenges and other variables.

Now that we’ve reviewed the basics of accounting for sales commissions, let’s take a closer look at some essential elements.

What is commission?

Commission: A commission is a form of incentive compensation made to an employee or independent contractor based on the value of their sales. Commissions are typically calculated as a percentage of the sale price, and they can be paid on a monthly, quarterly, or annual basis.

Different types of commissions

Before you can track sales commissions, you must determine which type of commission structure to use. Let’s review the basics of sales commissions to help you get started in your selection.

Sales compensation typically consists of base salary, commissions, and bonuses.

Different types of commission structures include:

1. Straight commission

Also known as 100% commission, straight commission structures are where teams are paid entirely based on sales earnings with no base salary or guaranteed pay.

2. Base salary + commission

The most common type of commission structure across SaaS consists of a base salary plus a commission plan. We recommend a 50/50 split, where reps earn 50% of their pay from their base salary with the other half based on sales earnings. A 60/40 ratio is another popular ratio we’ve seen organizations adopt, where base salary is 60% of the rep’s on-target-earnings (OTE), and the remaining 40% consists of variable pay.

3. Tiered sales commission

A tiered sales commission structure is an excellent choice for organizations wishing to motivate top performers. In this structure, reps are rewarded with higher commission rates as they hit specific deal thresholds or revenue benchmarks. This structure is also known as multiple rate, accelerators, escalators, or multipliers. Check out our guide for examples of how to configure this structure.

4. Single-rate sales commission

Also known as flat-rate commissions, fixed-rate commissions, or commissions, a single-rate sales commission is variable pay earned off a fixed percentage of every closed deal. This structure is easy to understand and commonly adopted for its simplicity.

5. Gross-margin commission

A gross-margin commission structure is similar to single-rate plans. What makes gross margin commission different, though, is that the business’s profits from the deal are factored into these commission calculations. So, the rep earns commissions from the gross revenue collected instead of accruing commissions based on the contract value or annual recurring revenue (ARR).

These are some of the most selected commission structures.

Create Compensation Plans with confidence

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanCalculating sales commissions

Another key element of sales commission accounting is how to calculate sales commission. Commission is typically calculated based on the following factors:

- The type of sales commission structure: As mentioned above, there are two main types of sales commissions: straight commission and base salary plus commission.

- The sales volume generated by the sales representative: Usually, the higher the sales volume, the higher the sales commission.

- The type of product or service sold: The commission rate may vary depending on the type of product or service sold.

- The terms of the sale: The commission rate may also vary based on the terms of the sale, such as whether the sale is monthly, annually, or multi-year.

Is sales commissions a period cost?

Sales commission typically lines up in the category of selling, general, and administrative expenses (SG&A) or operating expenses, both of which classify as period costs.

Explore your sales commission calculation options

There are various ways of calculating sales commissions. Some people do these calculations manually while others run commissions through an Excel spreadsheet or use a commission calculator The smarter organizations, however, use CRM commission tracking with QuotaPath to automate it.

Running commissions manually can be very error-prone and time-consuming. For small businesses with simple commission structures, Excel spreadsheets can do the job. But if your business is scaling its sales organization or adding new or complex compensation plans, automation may be the best course of action.

Recording sales commissions in your accounting system

Once you’ve made the necessary decisions and gathered key information, it’s time to record sales commissions in your accounting system.

How to record

When you record sales commissions in your accounting system, you will need to account for the following:

- The amount of sales commissions earned: This is the amount of money that the sales representative is entitled to receive.

- The date the sales commissions were earned: This is the date on which the sales were made.

- The expense account to which the sales commissions should be charged: This is typically the sales expense account.

- The liability account to which the sales commissions should be accrued: This is typically the accounts payable account.

Why you must record carefully

For ASC 606, subtopic 340 compliance, it’s essential you document specific information.

What is ASC 606? It is a financial standard that requires finance and accounting teams to account for and recognize revenue from contracts with customers plus related incremental costs like commissions and bonuses. Any company with recurring costs must pay close attention to this rule because failure to adhere can result in hefty fines and a surprise auditor visit.

Subtopic ASC 340-40 calls for continuous record keeping and reporting of costs related to customer contract attainment or fulfillment including things like travel, advertising, and sales commissions. Plus, it mandates that these costs be capitalized as an asset and amortized over time to match the timing of the revenue recognition.

Since ASC requires every deal and earnings to be tracked annually, this information must be readily available and accessible to auditors. So, carefully consider how you record sales commissions in your accounting system.

Have peace of mind during sales commissions accounting

Sales commissions accounting involves many complexities. Complicated or multiple commission structures within an organization combined with the intricacies of ASC 606 compliance further confuse matters.

Carefully consider how you record sales commissions in your accounting system to avoid costly fines and surprise audits.

See how QuotaPath helps by automating sales commission recording for ASC 606 compliance. Schedule time with a QuotaPath teammate today.