Boards are increasingly calling for improved business efficiencies today. This should come as no surprise after a bank crisis, massive layoffs, and a recession still looming on the horizon.

Many companies have shifted their focus to shore up their growth efforts via customer retention and related metrics for efficiencies, including customer acquisition costs (CAC), increased customer lifetime value (LTV), net revenue retention (NRR), and gross margin.

Adjusting your sales compensation plan supports these goals by incentivizing the right sales behaviors and discouraging costly actions.

This post reviews 10 compensation levers to help you drive business efficiencies and meet your organizational goals.

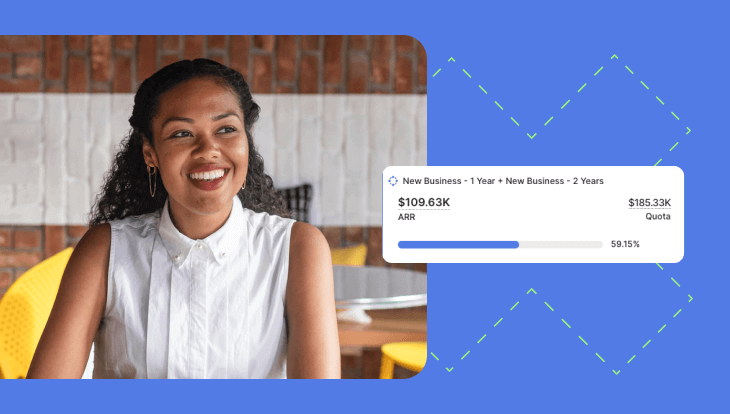

Try QuotaPath for free

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start Trial10. Comp on highest onboarding-related NPS scores

One of the keys to retention is successful onboarding. In fact, 86% of survey respondents said they’re more likely to remain loyal to a business that invests in onboarding. To encourage your customer teams to deliver exceptional onboarding experiences, consider offering bonuses (i.e.: $100) or SPIFs to your customer-facing reps who earn the highest NPS scores tied to onboarding.

9. Bonus on better payment terms

Positive cash flow is essential during challenging times as it provides a buffer against future financial difficulties. To address cash flow in your comp plans, promote better customer payment terms by SPIF’ing reps on deals that sign with Net 30/Net 60-day payment plans.

8. Reward ICP deals with higher rates

Your ideal customer profiles (ICP) are the ones who see the most success on your platform and are the most likely to renew. These customers tend to have greater LTV and future upsell/cross-sell potential. To promote retention and contain CAC, offer higher commission rates for any new business deal that aligns with your ICP.

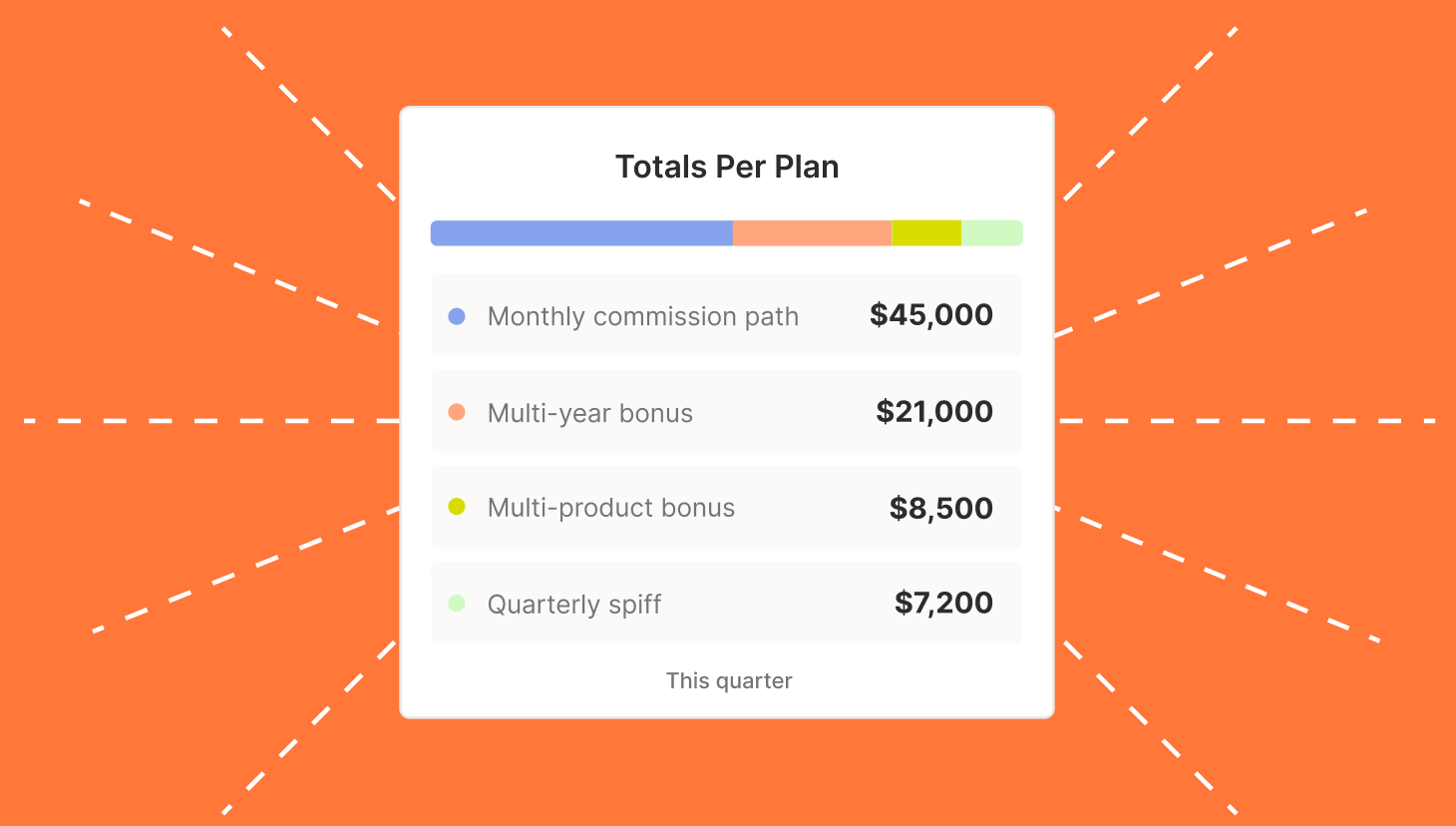

7. Reward SPIFs or kickers for products that generate higher gross margins

At organizations that offer multiple products, you’ll often find that some products generate more profit than others.

To motivate your team to sell and upsell those ones, pay your team higher rates on new business or renewals, including products that yield higher gross margins.

6. Comp as high (or higher) on upsells

Many companies offer lower commission rates on upsells than net new business. But during an economic downturn, upsells are one way to continue to grow your business. If a key metric for your business this year is NRR (net revenue retention), you should pay as much as new business, if not more, for upsells.

For example, if you pay 10% on new business, consider paying 12% on upsells.

5. Use decelerators on deals that threaten gross margin

As much as we’d love to think every deal is good, that’s not always true. Some deals fall outside of ICP and require intense technical assistance and investments to ensure a successful implementation. This increases onboarding costs and drains valuable resources.

To solve for gross margin and to encourage your reps to focus on the deals with more efficient onboarding, pay a decelerated commission rate on deal types that require more resources.

4. Award a bonus or higher commission rate on non-discounted deals

Who here has a discount-happy sales team? Let’s promote full-price deals by adding an extra $100 bonus (for example) on top of every deal that closes without a discount.

Incentivizing your sales team to sell at full price encourages them to focus on selling value and improves CAC.

3. Shift commission payments to invoice payment

Is cash flow a concern? If so, and if you’re paying commissions at the time of contract signature, switch to commission payout eligibility at invoice payment.

This reduces chargebacks and enables you to issue commission payments with funds collected instead of funds anticipated.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to Sales2. Incentivize early renewals

Early renewals shore up revenue and prevent unexpected dips in cash flow due to delayed renewals.

To address retention and improve GRR, offer fixed bonus rates for renewals that AMs bring in early. For example, give $150 on renewals that close 90 days ahead of schedule and $100 for those 60 days in advance.

1. Pay higher rates or SPIFs on multi-year deals and renewals

Multi-year contracts are your biggest ticket to predictable revenue on the renewal side and on the new biz size. The best way to get your team to present multi-year options is to pay them more when they sell them.

Up your rates or bonuses for any contract of two years or higher. Check out these compensation templates to help: Single Rate Commission with Contract Term Multiplier and Commission with Multi-Year Accelerators.

Pull comp levers to improve business efficiencies

Adjust your compensation plans with these levers to achieve business efficiency improvement where you need them most. You’ll stabilize your revenue, minimize risk, and encourage business growth.

To issue changes to your comp plans quickly and automatically track the outcomes, check out QuotaPath for free.

Sync your CRM, like HubSpot or Salesforce, build your comp plan in a few steps, or use one of our compensation plan templates, and invite team members to begin tracking compensation immediately.