Multi-Year Accelerators Are The People’s Choice: Represented in 15% of customer plans and drove 25% of total revenue.

REPORT The SPIF Report

Curious how top revenue teams use SPIFs and accelerators to align with key business goals and drive measureable results?

Our latest report below dives into our data from $7.3M in sales incentives, uncovering:

- Why 95% of SPIFs are paid as commissions (and why they work)

- The +3.2% average bump in commissions for multi-year deals

- The top-performing SPIFs--fast-starts, logo milestones, and more

Here's What We Found

Fast Starts and Logo Milestones Also a Fan Favorite: Popular categories that reward early wins and new customer acquisition.

SPIFs Paid Out As Commissions Favored: 95% of the SPIFs paid out in QuotaPath were paid out as a commission, demonstrating that variable pay is the preferred incentive over flat bonuses.

Let’s dive into the strategies that made possible $7.3 million in sales incentives.

- 15% of customers & 25% of revenue have plans with a multi-year bonus

- 32% implemented some sort of bonus in their comp plan in 2024

Top SPIFS

The four most commonly used SPIFs in QuotaPath last year included:

Higher commissions

for securing multi-year

contracts, encouraging

long-term deals.

Early-period bonuses for

achieving quick initial sales

targets.

Fixed bonuses for hitting a

set number of new

customer acquisitions.

Rewards for consistently

meeting sales targets over

a period.

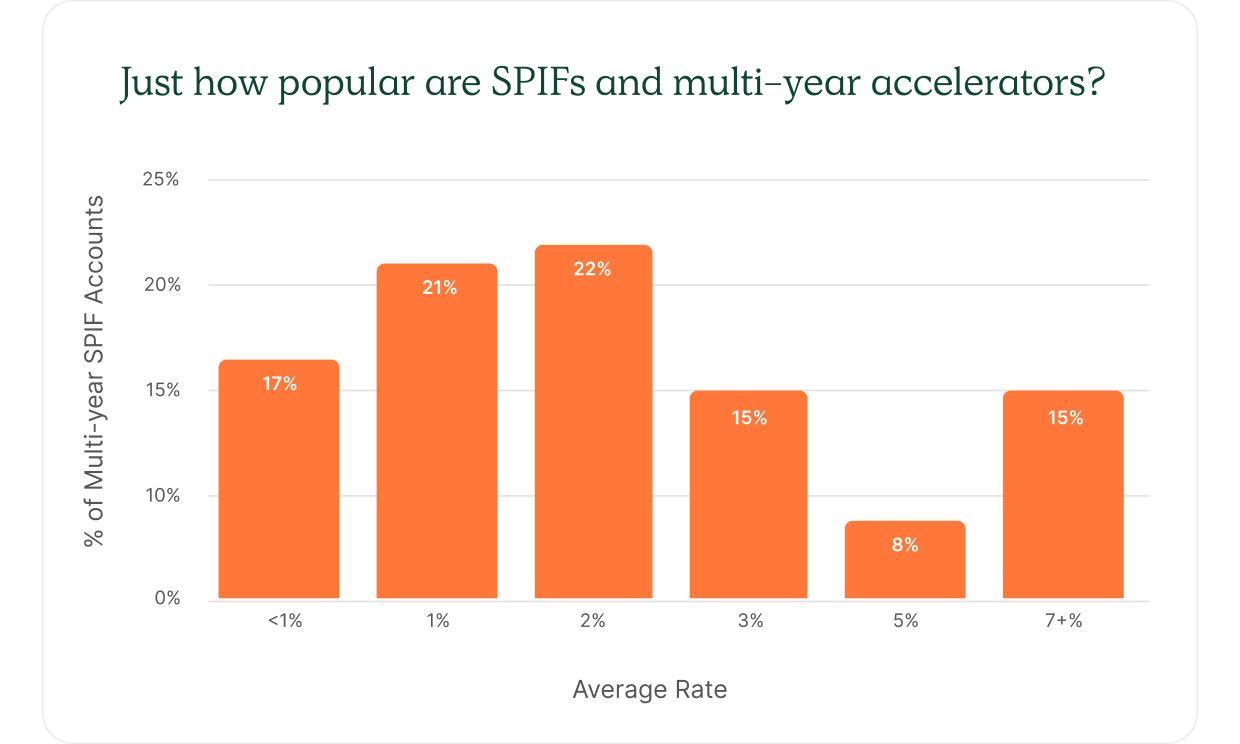

Average Multi-Year Bonus Commission Rate

On average, customers offered a +3.2% bump in commissions per deal when a rep sold a multi-year contract. The most common accelerator is on 2-year contracts in particular, with organizations looking to shift contracts from 1-year to 2-year.

💡 Fun Fact 💡

Although you’re paying a higher commission on the annual recurring revenue, you pay less on the total contract value because you’ve secured more revenue upfront.

Example

A rep earns 10% commission rate on the annual recurring revenue (ARR) of $50,000, 1-year contract, earning them $5,000 – $50,000 x 10%.

If the contract is a two-year contract, they earn 13% of the ARR, earning them $6,500 – $50,000 x 13%. Because the two-year contract is $100,000 in total (2 years of $50,000), they are actually earning 6.5% of the total contract value vs. the 10% of the total contract value of the 1-year contract.

“The health of this deal is far better being multi-year in terms of LTV, de-risking churn by setting up a longer commitment that customer success can partner with the customer, etc.”

This or That:

SPIFs as Commissions vs. Bonuses

SPIFs are most commonly structured as commission rates (95%) rather than bonuses (5%), with the majority being single-rate accelerators.

Example

A rep earns a standard 8% commission on all deals. To motivate closing more larger deals, the rep earns an extra +2% if the deal is a $50,000+ ARR deal. So on a $75,000 deal they would earn 10% of $75,000 ($7,500).When to Implement a SPIF: Q1

We always kick off Q1 with a multi-year accelerator to shift our revenue into longer-term contracts. Our standard contract term is two years today, and much of that is a function of rewarding sellers for closing that revenue, so it becomes second nature.

Why?

- Creates early-year momentum

- Re-energizes sales teams after returning from holiday break

- Offers immediate incentives on top of new quotas

- Drives reps toward deals that align with the new year’s business goals

Where to Start

To implement an effective SPIF or accelerator, start by focusing on what drives the most impact for your business.

The data shows that 95% of SPIFs are structured as commission rates, making this the easiest and most common choice. Stacking commission rates shows a seller how much they can earn for great revenue. If their base rate is 10% of ARR, and they earn 2% on a multi-year deal and 3% if the deal is an ideal customer, they could earn 15% on the deal overall.

For simplicity and alignment, consider single-rate accelerators tied to measurable milestones like multi-year deals or hitting key logo-count goals. These structures are straightforward to manage and highly motivating for sales reps when tied to clear outcomes.

Best practices include:

- Keep SPIFs easy to understand

- Tie them to desired behaviors

- Implement them within a timeline that creates urgency

Example

A fast-start SPIF offering a 10% bonus on deals closed in the first month of the quarter can energize your team and front-load pipeline progress. Alternatively, introduce a logo-count milestone bonus to encourage reps to focus on net new customer acquisition.

Test, Manage, and Pay SPIFs with QuotaPath

With QuotaPath, revenue leaders can seamlessly design and test SPIFs, add them to comp plans with minimal effort, and track performance in real-time.

The platform simplifies payout processes and ensures transparency for both reps and finance teams. Ready to streamline and optimize your SPIF strategy?

SPIF Planning for 2025

Want this report accessible via PDF? Fill out the form to the right, and we’ll send one your way for easy sharing.