Strong compensation plans are essential for attracting the best talent to your organization.

An efficient, well-thought-out package is built with company finances in mind. This means you’re much more likely to deliver the benefits offered, and your business can continue to grow effectively.

However, some organizations bite off more than they can chew in trying to offer the best package. If your business is in this position, don’t worry.

This article will explore five simple methods for getting your benefits package back on track.

Why Efficient Employee Compensation Plans Are Important

To begin, let’s consider why your business needs compensation plans. Employee retention is a top concern for many organizations. While ‘The Great Resignation’ might be over, the number of people wishing to change jobs has increased by 28% in 2024. Organizations need an attractive offering to hang on to top talent.

However, compensation plans should be efficient and effective. Offering ‘the kitchen sink’ to employees might deliver short-term satisfaction. In the long-term, though, this approach is unlikely to be sustainable.

Successful businesses follow a more pragmatic approach. This involves taking steps to streamline compensation plans. Of course, there is a delicate balancing act between maintaining employee happiness and staying within the limits of company resources. To succeed, organizations must carry out compensation benchmarking and craft a well-thought-out strategy.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to Sales5 Ways to Optimize Operational Costs Through Streamlined Compensation

Luckily, there are many ways you can achieve efficient employee compensation plans. See below.

Standardize compensation packages

There are several benefits to taking a uniform approach to company compensation. Most significantly, a streamlined approach helps you to cut costs.

When planning your benefits packages, stick to the adage ‘simplicity is the best policy. Make distributing benefits as straightforward as possible while embracing a more transparent approach. If Employee A receives a specific set of benefits, Employee B should be given the same.

This avoids creating a complex system for allocating different benefits to different employees. A simple distribution framework means there is less scope for costly mistakes. It also makes the process of implementing automation much more manageable.

Secondly, a standardized process helps to create a fairer workplace environment.

Employees won’t feel jealous of coworkers who have better compensation than them. This also means there’s reduced risk of staff looking for employment elsewhere.

Automate payroll and benefits administration

If your organization is still taking a manual approach to administering compensation, now might be the time to rethink. A manual approach is often more expensive. It requires a larger payroll team, paperwork, and managing and securing documents. There’s also scope for costly errors, such as overpaying staff.

An automated tool can file wages and benefits for you, cutting out manual paperwork. These solutions also help to reduce risk. A payroll tool will carry out tasks in line with its programming. There’s no scope for human error. Automated payroll tools are also more scalable. You pay only for the features that you need.

Benefits and compensation, though, will vary depending on role or sector. This means you’ll need an industry-specific automated solution.

Payroll automation software comes in various forms, each meeting the needs of different service providers. A healthcare organization will use medical billing and accounting software to remain compliant with industry data standards. On the other hand, real estate software is more adept at calculating sales bonuses and commissions.

Integrate performance-based incentives

Optimizing compensation plans for performance and growth can bring major advantages.

It’s a more efficient method of distribution; accelerated growth means an organization will recoup money spent on benefits more quickly. For instance, a team might receive compensation if they complete a project within a set timeframe.

Performance-based compensation can be implemented in several ways. Some examples are listed below:

- A point-based approach – This system rewards points to employees each time they complete certain tasks. Team members can later redeem these points for cash, vouchers, or other predetermined rewards.

- Personal development rewards – Under this approach, your organization rewards employees for hitting career milestones. For example, after receiving a certain qualification or completing a training program.

- Referral programs – You could incentivize employees to introduce talent to your organization. You might offer an initial reward for a referral and additional rewards if somebody progresses through the interview stages.

Optimize employee benefits spend

Are you spending your money on employee benefits effectively? This should be a central question when optimizing your compensation plans. After an internal review, you may find that employees underutilize certain benefits. These are prime examples of areas where cuts can be made.

During this process, it’s worth getting in touch with your employees. What benefits would they like to see your business provide? You may also conduct market research to find the benefits that are most likely to attract new employees. You can then consider reallocating your funds towards these areas.

Once you have a clearer idea of employee preferences, it is also essential to carry out a cost-benefit analysis. This looks at the cost of each form of compensation and the associated organizational benefits. Ideally, you’ll want to prioritize low-cost compensation that brings high benefits to your business.

Outsource non-core functions

Not all forms of compensation need to be carried out in-house. Payroll and benefits, although vital, are not classed as core functions. These areas can be outsourced to save on operational costs,

One method of outsourcing is employing the help of a professional employer organization (PEO).

Here, under an arrangement known as ‘co-employment,’ a PEO will perform admin tasks on your behalf. Not only do these services administer benefits for you, but they also often come with access to benefits packages, such as healthcare or dental plans.

PEOs can also be tasked with handling payroll tasks. For instance, they can relieve some of the pressure on your organization by helping to file taxes. Ultimately, the scale of outsourcing is up to your organization. You may choose to outsource some or all payroll and benefits.

If you work with a third party, always seek quality and reliability. Look for positive testimonials from other customers as a sign of quality.

Legal Considerations and Compliance

Although an organization can be flexible around employee compensation, there may be a legal requirement to deliver some benefits. In the US, for instance, Social Security, Medicare, unemployment insurance, and workers’ compensation are all federally mandated benefits.

There are also state-level benefits to consider.

For example, if your business is based in California it must provide paid leave. This requirement doesn’t apply in Kansas, though. It’s important to carry out research to understand any legal obligations your business bears for compensation.

Infringements can be costly for your organization. This isn’t just about financial impact but also reputation.

If you’re ever unsure, it can be helpful to seek professional legal advice to provide clarity.

Try QuotaPath for free

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialMeasuring the Impact and Continuous Improvement

Is your approach to compensation helping you to build a better business? Ultimately, your goal should always be to seek continuous improvement. This means that the process of streamlining compensation is never truly complete. You should constantly monitor data to see where improvements can be made.

Leveraging budget management software can track spending across multiple departments and locations. This will help you continue monitoring your compensation packages and how your new streamlined system benefits your operational costs.

When using software, remember to track various payroll and employee benefits metrics, such as:

- Benefits utilization rate – The percentage of employees who are using certain benefits. This helps you to know whether you are spending on the right benefits packages.

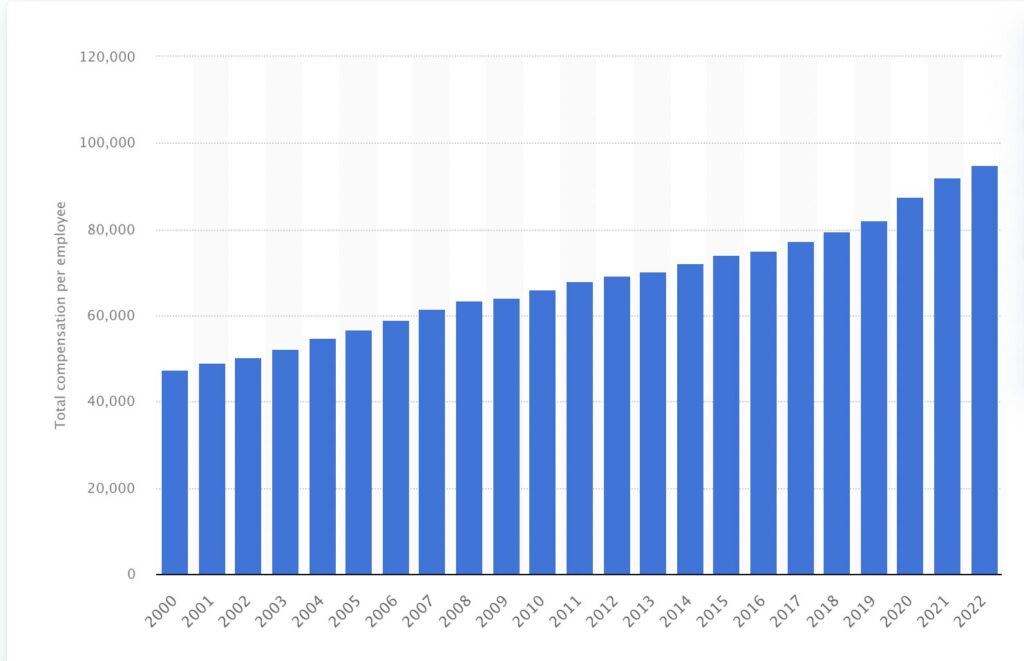

- Benefits costs per employee – The average amount you spend on benefits for each employee. This helps you to budget more effectively.

- Payroll processing time – The average time it takes to pay your employees. For a happy workforce, the goal should always be to keep this number as low as possible.

- Payroll errors – The frequency of errors that errors occur within pay cheques. Again, for maximum satisfaction, you’ll want to minimize mistakes as much as possible.

- Compliance score – We’ve reflected on why compliance is so important for business. This helps you to measure how effectively you’re staying within the confines of legislation.

Key Takeaways

Employee compensation is an essential factor for all businesses, especially when looking into operational costs. Whether it’s ensuring staff are paid accurately and on time or ensuring competitive benefits, compensation is vital for happy and productive employees. But to deliver results compensation must also be efficient. There’s no use in wasting money handling manual tasks or allocating unused benefits.

To make compensation work, some organizations need to rethink their approach. Here, we’ve explored five different ways you can improve payroll and benefits. Remember, always opt for a standardized approach and automate where possible.

A streamlined approach is the only way to guarantee both employee satisfaction and organizational success. Why not consider ways to optimize your processes?