This is a guest blog from Kenzi, a professional business writer with 15 years of experience in crafting compelling content for entrepreneurs and corporate clients. His expertise is creating business plans, marketing materials, and corporate communications that drive results. Kenzi holds an MBA and has a keen understanding of business strategy, which he uses to craft narratives that resonate with stakeholders at all levels.

Think about your sales performance. Are you confident that your revenue operations (RevOps) and finance teams are working together to maximize your results?

In many organizations, these departments often work in silos.

Their finance focuses on budgets and projections, while RevOps is laser-focused on the sales funnel, deals, and customer relationships.

Try QuotaPath for free

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialThis lack of coordination can lead to communication gaps, budget inconsistencies, and missed opportunities.

When you align RevOps and finance, you can leverage their combined strengths to enhance sales performance. Of course, you must plan strategically and opt for seamless collaboration.

This article explains why this alignment is essential for accurate data analysis, resource optimization, and smoother financial planning.

What is RevOps?

Revenue Operations (RevOps) is a strategic approach that aligns various business departments to drive revenue growth and streamline processes.

The RevOps framework aims to improve data sharing, communication, and efficiency across the organization by unifying marketing, sales, and customer success teams.

This approach ensures that all revenue-generating teams work together toward common goals, using accurate data and consistent strategies to boost business performance.

Comprehending Finance

In a business context, finance refers to managing the company’s money, assets, and resources. It encompasses budgeting, forecasting, expense management, and strategic investment decisions.

Finance teams analyze revenue streams and costs to provide valuable insights, ensuring the business maintains healthy profitability. Their analysis helps shape budgets and long-term financial strategies, balancing resources and mitigating risks.

Why Alignment Matters

Aligning RevOps and finance teams is essential because it provides a unified approach to revenue management. When these departments work together, they share accurate data, coordinate on budgeting and resource allocation, and align their goals.

This collaboration reduces miscommunication, identifies growth opportunities, and ensures that each team supports the broader business objectives. It also leads to more realistic forecasting, better resource use, and a more cohesive customer experience.

The Synergy Effect: How Alignment Boosts Sales

Imagine a world where sales reps have real-time access to accurate pricing and quoting tools, where finance has clear visibility into sales pipeline health, and where forecasts can be adjusted accordingly. This is the power of revenue operations and finance alignment.

Improved Forecasting Accuracy: With unified data from RevOps and finance, you can generate more data-driven and reliable forecasts. This empowers you to make informed decisions about resource allocation, hiring, and marketing investments.

Streamlined Approvals: RevOps can automate workflows and approvals, ensuring deals move through the pipeline faster. Finance can set clear approval criteria within the RevOps system, providing transparency and eliminating delays.

Enhanced Sales Productivity: RevOps can equip salespeople with the tools and resources to close deals faster. Finance can give sales reps insights into customer payment history and creditworthiness, allowing them to tailor their approach.

Better Communication and Collaboration: Communication improves when RevOps and finance speak the same language (data!). Regular meetings and data sharing foster collaboration and a shared understanding of sales goals.

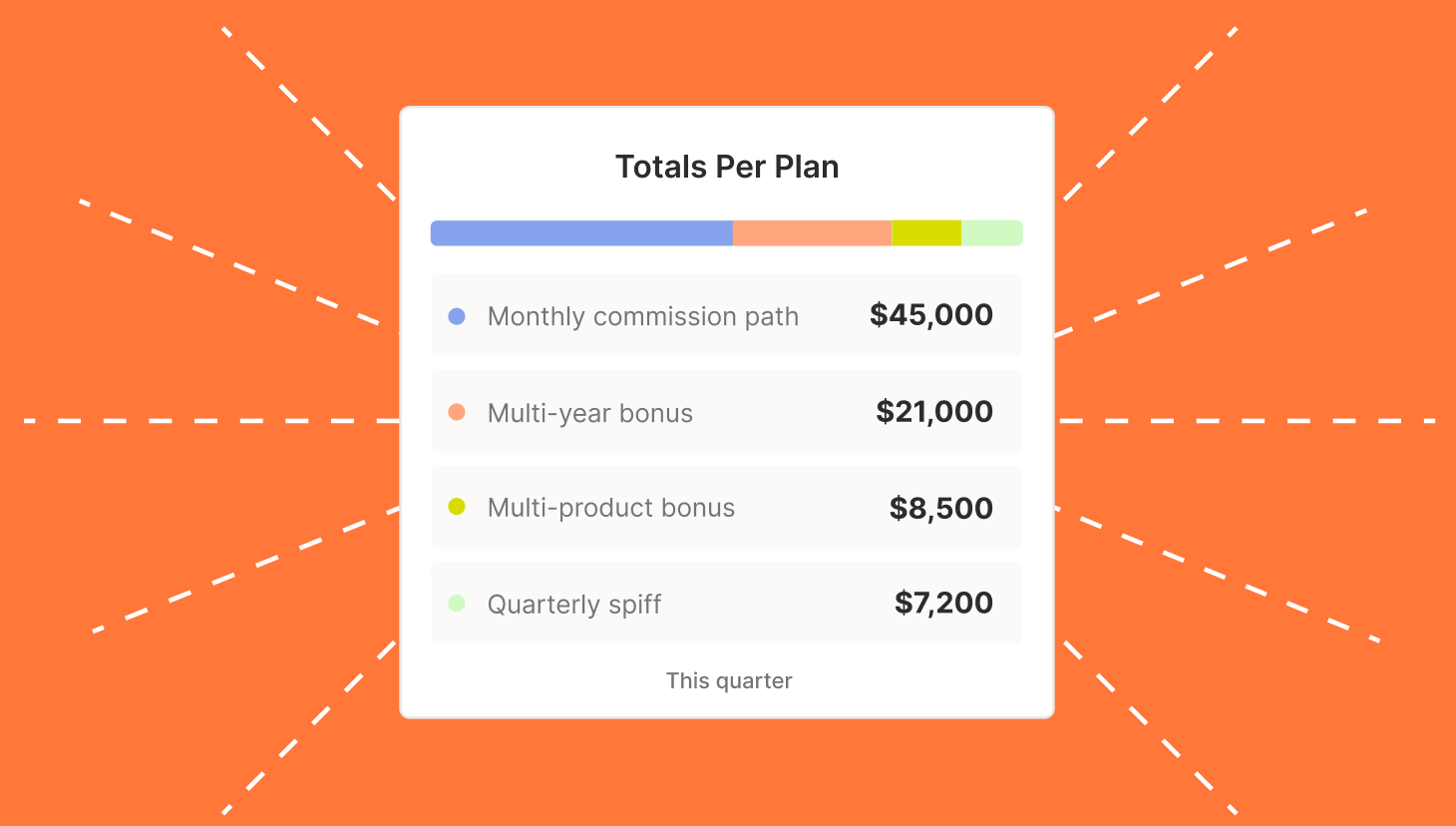

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesUnlocking the Power: Steps to RevOps-Finance Alignment

Achieving RevOps and finance alignment is an ongoing process, but here are some initial steps to take.

Define Shared Goals: Establish clear, measurable goals for revenue growth, profitability, and customer satisfaction so both teams work toward the same targets. Aligning these objectives ensures that every action taken supports the overall business strategy.

Securing Devices and Protecting Data: With teams increasingly using the latest devices to manage critical business data, securing these tools is essential. Devices like MacBooks are primary tools for RevOps and finance teams that rely on accurate, real-time information to plan and forecast. Keeping data safe is crucial because if sensitive information falls into the wrong hands, it could compromise strategic decisions. An easy but effective measure is to lock screen on mac devices, preventing unauthorized access and securing critical information. These small steps, consistently practiced, help protect your business’s revenue stream and maintain efficient collaboration across departments.

Break Down Silos: Promote open communication and collaboration between RevOps and finance. Organize regular meetings, create shared dashboards, and break down departmental barriers. Transparency in objectives and challenges allows both teams to better understand each other’s roles and needs.

Standardize Data and Processes: Ensure both teams use consistent definitions and metrics for key data points like sales pipeline stages, deal values, and forecasting methodologies. This standardization eliminates confusion and enables seamless collaboration.

Invest in Technology: Implement tools that integrate RevOps and finance systems. Seamless data flow and minimized manual errors lead to faster decision-making and more accurate reporting. Unified dashboards can offer a comprehensive overview, ensuring that insights are readily available to both teams.

Promote a Culture of Data-Driven Decision Making: Empower both teams to leverage data insights when making sales strategies, resource allocation, and forecasting decisions. Providing training on data analytics tools can help staff develop the skills needed to interpret data effectively.

The Bottom Line: Enhanced Sales Performance

So, what does all this mean for your sales performance? Aligning RevOps and finance creates a seamless flow of information. This approach enables more accurate planning, efficient resource allocation, and improved customer experiences. The synergy between these two functions ensures that your organization is positioned to grow sustainably and adapt to changing market conditions.