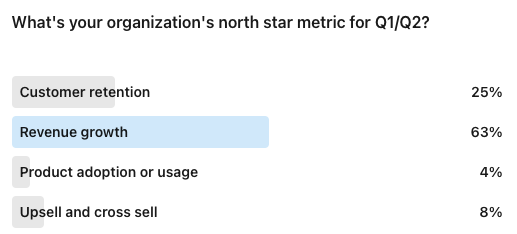

We recently conducted a LinkedIn poll to get a pulse on the current business climate, asking leaders to identify their North Star metrics for 2024.

The results were resounding: revenue growth and customer retention emerged as the top two priorities. This unsurprising outcome underscores the fundamental need for businesses to attract new customers and cultivate lasting relationships with existing ones.

This laser focus makes sense, as attracting new customers while nurturing existing relationships forms the bedrock of sustainable success. But achieving these goals requires more than just wishful thinking – it demands a strategic approach to talent management, and that starts with sales compensation.

More specifically, this calls for sales compensation strategies that align go-to-market teams with key business plays so that the company reaches its goals when the team hits their performance metrics.

In this blog, we’ll explore five standard North Star metrics and share compensation levers that can help drive these.

- Revenue Growth: We’ll review how incentivizing new customer acquisition, deal size, and sales velocity can fuel top-line expansion.

- Customer Retention: Discover how rewarding repeat business, reducing churn, and fostering customer loyalty drives sustainable growth.

- Product Adoption or Usage: Learn how incentivizing feature exploration, active engagement, and product mastery can unlock the full potential of your offerings.

- Upsell and Cross-Sell: We’ll examine how encouraging reps to identify additional customer needs and recommend complementary products or services can boost average order value and overall revenue.

- Cost Management: Explore how aligning compensation with resource efficiency, cost optimization, and responsible spending can contribute to a healthy financial bottom line.

39% of leaders admit their comp plans don’t align to key metrics

Our 2024 Compensation Study, which surveyed more than 450 RevOps, Finance, and Sales leaders, uncovered that nearly 40% of leaders fail to align their compensation plans with their organization’s key business objectives. This leads to a mismatch between the behaviors you’re encouraging your sales rep to do and the business’s goals.

By meticulously aligning your compensation plan with these critical objectives, you can equip your team with the necessary tools and incentives to navigate the path toward success. So, prepare to set your sights on the horizon, calibrate your internal compass, and embark on a journey of growth fueled by a strategic and motivating compensation plan.

Join us as we dissect each objective, offering actionable insights and practical strategies to ensure your compensation plan drives a prosperous 2024.

Revenue Growth

Revenue growth refers to a company’s income increase over a specific period. In the SaaS context, it translates to acquiring new customers, expanding existing subscriptions, and, ultimately, an upward trajectory of recurring revenue.

Why It’s the North Star: For SaaS companies, and many years before 2023, revenue growth was the ultimate indicator of sustainability and success.

Here’s why:

- Recurring Revenue Stream: SaaS thrives on subscriptions, generating predictable income. Each new customer or expanded subscription adds to this stream, fueling the company’s financial engine.

- Investor Magnetism: Investors heavily prioritize revenue growth potential when evaluating SaaS companies. Demonstrating steady and consistent growth attracts investment, fueling further expansion and innovation.

- Market Validation: Growth signifies customer satisfaction and validates your product’s value proposition. As your customer base expands, it signals market acceptance and product-market fit.

- Internal Alignment: Growth goals drive decision-making across departments, from marketing and sales to product development and customer support. Everyone works towards the shared objective of acquiring and retaining customers.

Beyond Just a Number:

While revenue growth is undeniably crucial, it shouldn’t exist in a vacuum. Sustainable growth hinges on balancing with other key metrics like customer churn, customer lifetime value (CLTV), and product adoption.

Focusing solely on acquiring new customers without nurturing existing ones can lead to a leaky bucket, where churn cancels out gains.

Optimizing for Growth via Comp Plans

New Logo Bonus: One way to drive new revenue is by motivating your reps to capture new business via a new logo bonus. This refers to acquiring new customers who haven’t previously purchased from your company and is often offered when entering a new market or customer segment or launching a new product.

We recommend a fixed, single-rate bonus for every new logo (ex: $500).

You could also consider upping the amount for high-value logos, larger accounts, or accounts that are your ideal customer profile (ICP).

Ideal customer profile: Speaking of ICP, your ICP accounts often have the shortest sales cycles because they meet all the criteria of your “perfect customer.” You could offer a higher commission rate on a new biz that classifies as ICP or a bonus.

Accelerators: We love an accelerator. Motivate your high-performing reps to go after more new business after achieving their targets by offering an accelerated commission rate (1.5x).

Get Visibility Into How Your Team Is Tracking

Provide your leadership and your GTM team with views into how they’re trending toward goal based on forecasted pipeline and closed/won. See attainment progress and total earnings over time and where your team could hit based on what’s in your deal source of truth.

Enter QuotaPath TrialCustomer Retention

A cornerstone metric, customer retention is often considered the north star for business success. It is defined as the ability of a company to keep its existing customers subscribed to its services. We measure it by the churn rate, representing the percentage of customers who cancel their subscriptions within a specific period.

Why It’s the North Star: Customer retention plays a crucial role in multiple ways:

- Predictable Revenue Stream: Unlike one-time sales models, retaining existing customers ensures a stable and predictable income stream. This financial stability fosters growth and investment opportunities.

- Reduced Customer Acquisition Costs: Acquiring new customers is often more expensive than retaining existing ones. High retention translates to lower overall customer acquisition costs, improving profitability.

- Increased Customer Lifetime Value (CLTV): Loyal customers become long-term subscribers, generating more revenue over their lifetime. Focusing on retention increases the average CLTV, boosting overall profitability.

- Advocacy and Network Effects: Satisfied customers become brand advocates, recommending your service to others. This organic growth through referrals further amplifies the benefits of retention.

- Improved Product Development: Feedback from retained customers provides valuable insights to guide product development and ensure your offerings continue to meet their evolving needs.

Optimizing for Customer Retention using Compensation

Reward High NPS Scores: A good indicator of how likely a customer is to renew is the net promoter score they leave you. The more high scores you receive, the greater the chances your customer renews.

You can encourage your team to deliver exceptional onboarding experiences by offering bonuses or SPIFs to reps who earn the highest NPS scores tied to onboarding.

Early Renewal Bonus: You can also impact retention and forecast retention more accurately by incentivizing your reps to sign early renewals. Consider a 30-day, 60-day, and 90-day early renewal bonus. Your 90-day renewal should reward your reps the most.

Multi-year Conversions: We talk a lot about offering multi-year accelerators on new biz that sign for more than one year, and the same can apply for renewals. Offer a multi-year commission rate higher than your standard renewal to incentivize your customer team to convert single-year renewals to multiple years.

Product Adoption Or Usage

Production adoption represents the percentage of users actively engaging with your product’s core features and functionalities. It reflects how many users have moved beyond initial onboarding and derive real value from your offering. Similarly, product usage measures the frequency and depth of interaction with your product. This includes metrics like active users, feature utilization, average session duration, and completed tasks.

Why It’s the North Star: For SaaS companies, product adoption and usage hold immense significance in several ways:

- Predictable Revenue: High adoption and usage make engaged users more likely to renew their subscriptions, contributing to a stable and predictable revenue stream.

- Reduced Churn: Users who actively engage with your product experience more value and satisfaction, reducing the likelihood of churn and boosting customer retention.

- Increased Customer Lifetime Value (CLTV): Engaged users typically become long-term subscribers, utilizing more features and generating higher revenue over their lifetime.

- Valuable User Feedback: Usage data provides insights into user behavior, preferences, and pain points, informing product development and ensuring alignment with user needs.

- Stronger Product-Market Fit: High adoption and usage suggest a strong product-market fit, indicating you’re addressing a genuine need and delivering value to your target audience.

Optimizing for Adoption and Usage via Compensation

Promote Individual Performance: Set targets for key usage metrics like active users, feature adoption, or completed tasks within the platform. Then, reward exceeding these targets with milestone bonuses for hitting goal.

Team-Based Incentives: Foster collaboration and healthy competition by setting team-based goals for platform usage metrics. Reward achieving these goals with team outings, incentives, or additional paid time off.

Upsell And Cross-Sell

Upselling involves convincing customers to upgrade to a more expensive version of your product. At the same time, cross-selling means locking in your customer to additional products or services that complement their current subscription.

Why It’s the North Star: Upselling and cross-selling can hold immense value, including:

- Increased Revenue: Expanding the value customers derive from your platform translates directly to higher revenue per customer, accelerating growth and profitability.

- Reduced Customer Acquisition Costs: Retaining existing customers and increasing their value is often more cost-effective than acquiring new ones.

- Enhanced Customer Lifetime Value (CLTV): Upsold and cross-sold customers become more valuable over time, generating higher revenue throughout their subscription lifecycle.

- Stronger Customer Relationships: By helping customers discover additional solutions to their needs within your platform, you foster trust and loyalty, strengthening relationships.

- Improved Product Adoption: Upselling and cross-selling opportunities often arise from understanding customer needs and usage patterns, leading to improved product adoption and satisfaction.

Optimizing for Upsell and Cross-Sell

Upsell component in comp plan: To encourage upsells and cross-selling, set a net revenue retention component in your customer team’s comp plans. We recommend one that splits with gross revenue retention so that you don’t hide customer churn in made-up revenue in upsells.

Upsell/Cross-Sell Contests: Run short-term contests with attractive prizes or rewards for individuals or teams who achieve the highest upsell/cross-sell rates or revenue within a specific timeframe.

Accelerated Commissions: Pay out commissions for upsells and cross-sells earlier than for initial deals, providing faster financial rewards and boosting motivation.

Cost Management

The strategic cost management approach involves optimizing resource allocation, minimizing unnecessary spending, and ensuring financial sustainability. Defined, cost management can encompass various aspects like cloud infrastructure costs, employee expenses, marketing spend, and ongoing operational costs. Cost management aims to maximize the value of every dollar spent, align expenses with strategic priorities, and ensure resources are effectively used to hit business objectives.

The metrics to measure cost management include burn rate, customer acquisition cost (CAC), customer lifetime value (CLTV), and gross margin. And tracking these metrics helps identify areas for optimization and measure the effectiveness of cost management strategies.

Why It’s the North Star Metric:

- Financial Sustainability: Efficient cost management ensures a healthy bottom line, providing the financial foundation for future investments, growth initiatives, and product development.

- Improved Profitability: Minimizing unnecessary spending directly translates to higher profitability, allowing you to reinvest in strategic areas and fuel sustainable growth.

- Data-Driven Decision Making: Cost management involves analyzing data to understand spending patterns, identify inefficiencies, and make informed decisions about resource allocation.

- Competitive Advantage: In a competitive market, controlling costs effectively gives you a pricing advantage and helps you attract and retain customers.

- Investor Confidence: Demonstrating responsible financial management and efficient cost optimization attracts investors and builds confidence in your long-term success.

Optimizing for Cost Management in Your Comp Plan

This one requires you to get a bit more crafty with your comp plans.

Reward Full Price Deals: You can impact cost management by paying higher commissions or offering full-price bonuses anytime a member of your GTM team avoids discounts.

Implement Decelerators on low gross-margin deals: Motivate your reps to focus on deals with more efficient onboarding by paying a decelerated commission rate on deal types that require significant technical assistance.

Pay Commissions On Invoice Payment: For early-stage companies or startups looking to impact their cash flow, consider switching your commission payments from the time of the deal to the time of invoice payment.

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesConclusion

How you feeling after reviewing those business objectives?

Revenue, adoption, upselling, and cost management drive the business machine. Remember, amidst the whirring pistons of growth and optimization, it’s easy to overlook the crucial fuel that keeps it all running. Customer retention.

While acquiring new customers is vital, retaining existing ones is a gold mine. Loyal customers spend more, refer others, and provide invaluable feedback. Neglecting them is like pouring gasoline on your profit margin and setting it alight.

The most successful businesses in 2024 will prioritize retention alongside their other objectives.

So, how do we translate this into action?

Money. Use your compensation plans as a lever to drive those business objectives.

If you’d like to draft, test, and model any of these compensation changes to your existing plans, we invite you to connect with our sales team for a guided tour of how to do so before signing up for a free trial.