Sales compensation plans have historically been intended to motivate sales reps to sell new revenue. However, market volatility has led many SaaS companies to shift their focus from growth at all costs to efficiency.

Our conversations with industry professionals have shown us that comp plan design and optimization lag behind this shift, revealing a disconnect at the leadership level.

This inspired us to survey more than 450 Finance, RevOps, and Sales professionals from the technology sector to investigate the effects of misaligned and poorly executed compensation plans.

The objectives of the resulting report are to:

- Identify where the disconnect between Finance, RevOps, and Sales Leadership occurs

- Explore the challenges faced by organizations during the compensation plan design process

- Uncover the biggest holes when managing commissions

- Offer guidance to set up for success in 2024

We gathered these insights by conducting a global survey during the first half of 2023 targeting directors, VPs, and C-level executives within SaaS and tech companies with over 100 employees. Survey participants included RevOps, Finance, and Sales leaders from the United States and the United Kingdom.

The overall survey results revealed four themes. 1.) 100% of Revenue leaders agree that sales comp plans need improvement. 2.) There’s a disconnect between how RevOps, Finance, and Sales view the efficacy of comp plans. 3.) Most sales reps find their comp plans difficult to understand. And 4.) 91% of organizations have less than 80% of their sales reps hitting quota.

We started the survey by asking revenue leaders, “What is the biggest challenge with your sales compensation plan?” since many of the compensation challenges begin with the plan itself.

The insights were stunning, with 97% reporting challenges.

The 5 most common challenges included unrealistic expectations (19%), failure to motivate reps (19%), too complex to execute well (18%), too complicated to understand (17%), and failure to drive customer acquisition cost efficiency (CAC) (14%).

This blog explores each challenge, with solutions on how to overcome them.

Unrealistic expectations

First, let’s look at unrealistic expectations.

Setting excessively high quotas and on-target earnings (OTEs) that reps can’t hit sets your team up for failure and can lead to sales rep turnover. No matter how tempted you are to move the goalposts on your reps, only do so when it’s actually attainable.

To confirm that your plans’ quotas and OTEs are realistic, create plans from documented data and use financial models to align and inspire comp plans. Then, use a free resource like ourQuota:OTE ratio calculator to measure the health of your targets against your team’s historical performance and see if they’re too easily attainable.

Failure to motivate reps

Next is the challenge of motivating reps.

Comp plans should drive sales rep behaviors that help you achieve organizational goals.

But some comp plan elements, like a cliff, backfire and demotivate or frustrate reps instead. This compensation tactic requires reps to meet a threshold before earning a commission. On paper, it’s a good idea. But what usually happens it that reps pursue fewer, large deals instead of high-velocity smaller deals. Sandbagging, when a rep intentionally stalls a deal, is also a common side effect of cliffs.

Another issue that impacts rep motivation is their understanding of their compensation plans and progress.

If reps are unclear on how they earn commissions or cannot track where they are with targets and milestones, even the most attractive compensation plan won’t motivate your reps.

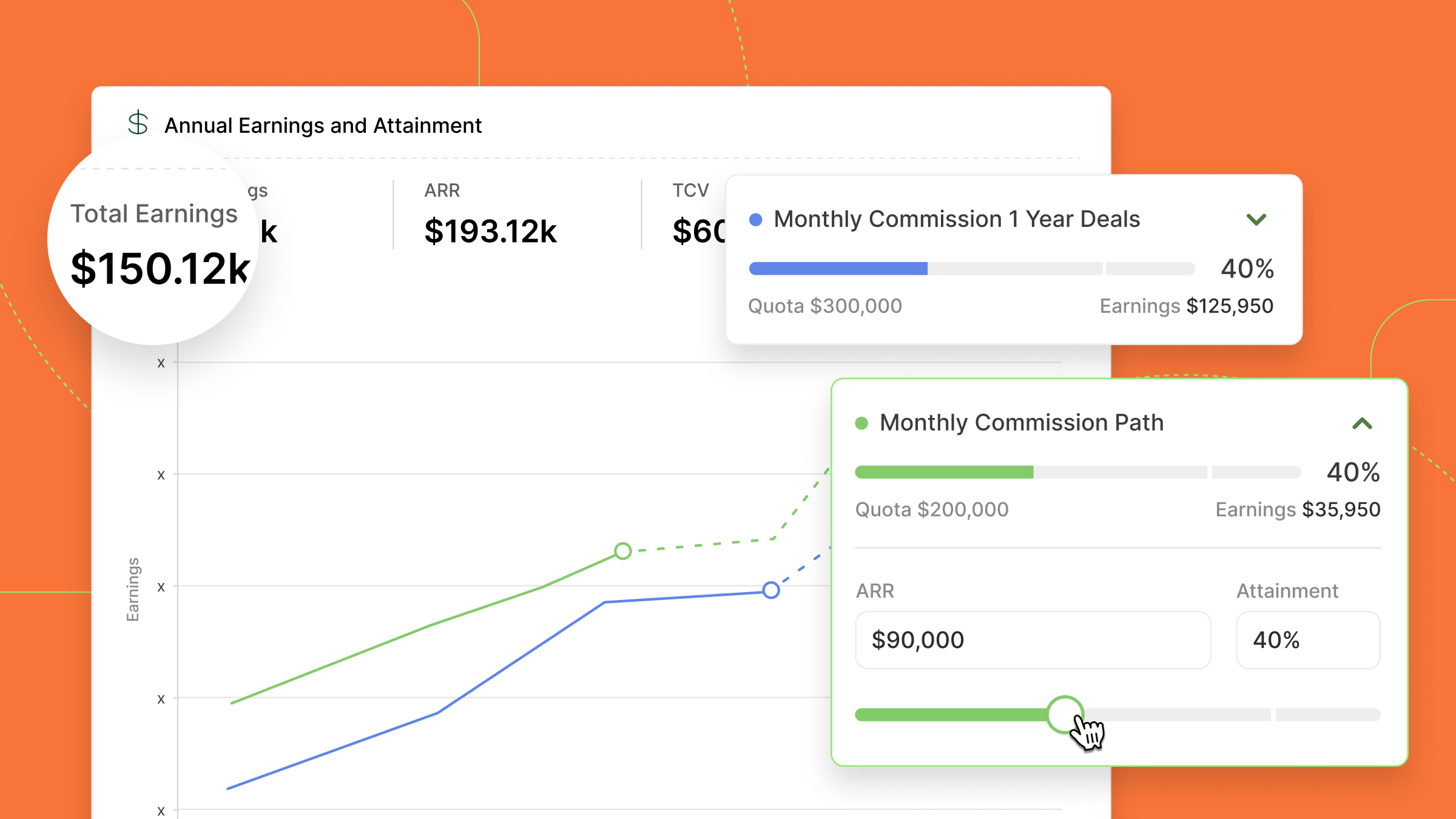

To overcome this challenge, confirm your reps understand their comp plan and how they earn commissions by routinely eliciting feedback from reps. You should also provide a tool or system so that reps can see how they’re progressing toward goals in attainment and commissions.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesHard to execute/time-consuming

Our next challenge is one we know well: Overly complex compensation plans that make it hard for leaders to execute well and maintain over time.

When this happens, managing the comp plans becomes a labor-intensive time suck for accounting personnel that can lead to payment processing errors, finger-pointing, and unhappy reps.

To avoid this situation, include no more than three compensation levers per comp plan.

For example, an account executive plan may start at 8% commissions for deals up to 80% of quota. Then, add accelerators from 80 to 100% of attainment and for over 100% of quota.

Find the right balance between offering your reps multiple ways to earn commissions without overdoing it.

Then, when it comes to simplifying the execution and maintenance of your comp plans, automate it with software like QuotaPath. This eliminates the time-consuming manual effort of monthly tracking, scheduling payouts, and making plan adjustments while providing reps easy access to current, past, and future commissions.

Too complicated to understand

While overly complex plans make it difficult for plan administrations to maintain, think about your reps under the plans.

The more complex the plan is, the more likely you are to risk rep understanding. When that happens, you overwhelm and confuse your reps, leaving them uncertain about where to focus their efforts.

The solution is to start by collecting rep feedback to shape plans. This helps you determine the source of rep confusion and address it.

Then, leverage a strong communication plan for introducing a new comp plan, including sufficient opportunities for managers and reps to present their questions. Add more clarity by giving all stakeholders visibility into breakdowns of plans as well as progress toward goals and earnings information with software like QuotaPath.

Calculate OTE:Quota ratios

Use this free calculator to ensure your reps’ on-target earnings and quotas mirror what they’re bringing in for the business.

Try it NowFails to drive customer acquisition cost efficiency

The last challenge our leaders noted is CAC.

Optimizing your plans to drive CAC effectively involves many elements that influence the efficiency of your growth engine, including sales capacity, marketing spend, and management overlay.

To improve CAC, start by assessing your Quota:OTE ratio.

Ideally, this ratio should be 5x for SaaS companies, where sales reps carry quotas that are five times their earnings if they hit 100% of their quotas.

Consider removing or adding a sales rep if your plans fall below this threshold. Remember though, that if your business relies on marketing-driven inbound leads, adding a rep may reduce overall attainment with more reps reliant on the same lead source.

By contrast, removing reps may increase overall attainment since fewer reps use the same lead source. This may result in leaner operations and greater Quota:OTE ratios in your comp plans.

However, it’s essential to consider whether reducing team size would reduce bandwidth such that it hampers your team’s ability to manage effective sales cycles.

Find the right balance, then investigate bottlenecks to determine opportunities for further improvement.

Other ways to optimize CAC include minimizing management overhead and incentivizing short deal cycles.

Solve your top comp plan challenges

Looking for more ways to solve your compensation challenges? Download the full report or chat with our sales team about sales compensation management improvements using QuotaPath.