Hi, I’m Graham Collins, QuotaPath’s Chief of Staff. Since 2019, I’ve conducted more than 350 comp management strategy calls.

These calls have included first-time sales leaders, tenured sales executives, CFOs, CEOs, you name it. Turns out, that no matter how much or how little experience someone has in building a sales compensation plan, people tend to make the same mistakes.

Below, I shared the five biggest takeaways around sales compensation, comp management, and commission structure that I’ve learned from these calls.

1. Don’t go at it alone

So many compensation plan mistakes are made because Sales and RevOps leaders think that they have to build a comp plan by themselves. Maybe they’re hired as a VP of Sales and think their CEO expects them to be a comp plan expert. I’m here to say that’s nonsense!

The best plans that I’ve seen involve collaboration across Finance, RevOps, and Sales. If you don’t have a RevOps function, then Sales and Finance should work together. Two (or three) brains are better than one, especially brains with different specialties.

Additional tips:

- Ask reps for feedback on their existing comp plans. What do they feel is unfair? What’s annoying? What’s been successful?

- Talk about it with your peers. What’s worked well for them? What hasn’t, and why?

What happens when you try to build it yourself:

When I built an SDR compensation plan for my team by myself, it was horrible. It was overly complicated, I didn’t test the data, and I ended up having to redo it after rolling it out to my team. If I had asked for another set of eyes on the plan, most of those issues would have been avoided!

2. Keep it simple

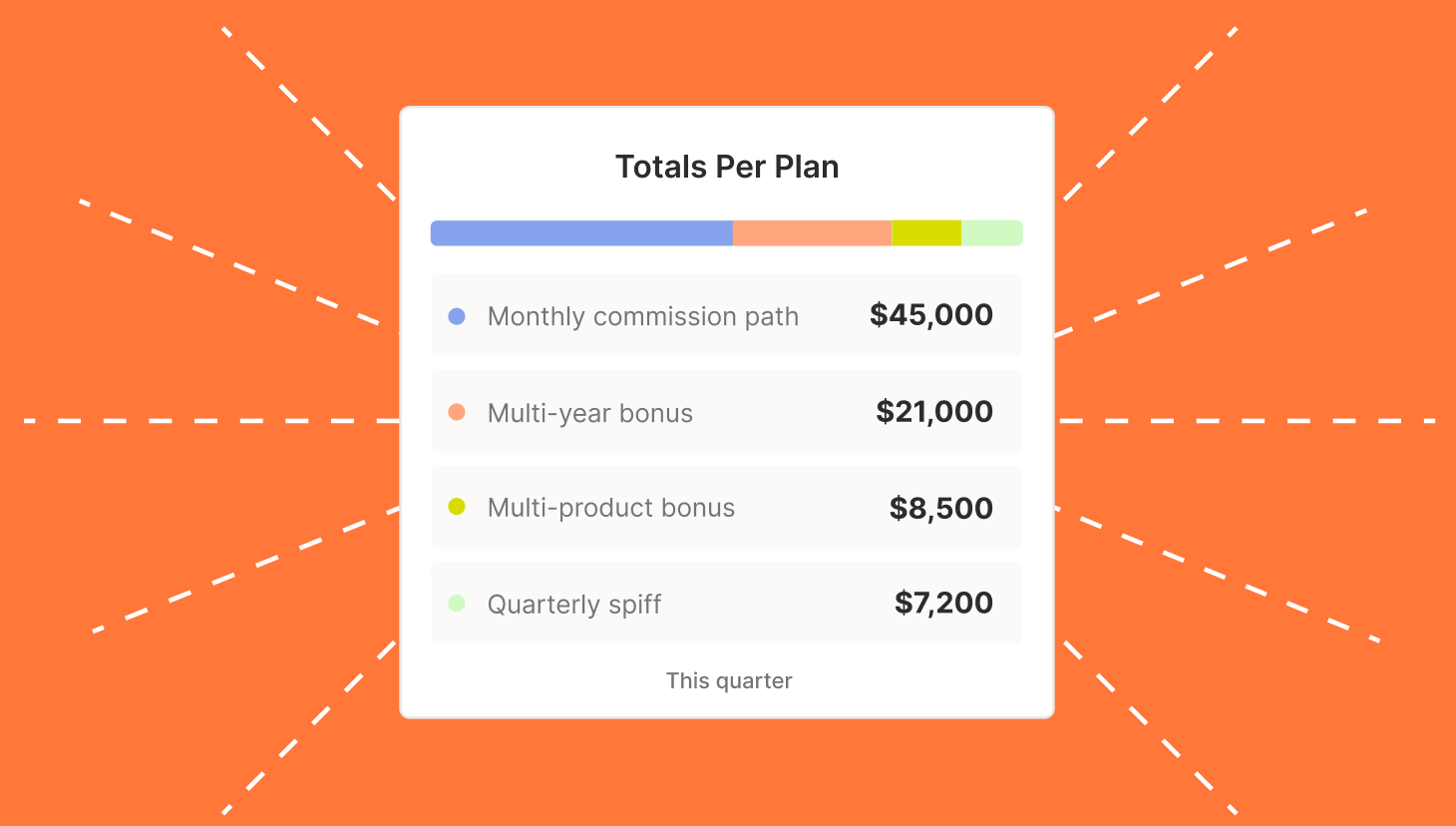

Sales reps, like all people, have a limited amount of brainpower to dedicate to their jobs… which includes trying to understand their sales commission payments. If you force them to use too much time thinking about which types of deals you want them to sell, they’ll simply sell whatever they can. A key to sales compensation strategies is to encourage and discourage certain behaviors. If the plan doesn’t make that abundantly clear, reps will latch on to any deal they can close.

Examples:

- Multiple products: If you pay the same sales commission rates on different products, but only want reps selling the one with the higher profit margins, your reps will continue to sell both because it pays the same.

The fix: Drop the second product’s commission down to discourage reps from selling it.

- Multi-year deals: If you pay 10% on a 1-year deal and 11% on a 2-year deal, you’re not really incentivizing them to sell multi-year deals. An extra 1% commission isn’t paying any more bills.

The fix: However, if you pay 1.75x the commission on a 2-year deal, the rep will absolutely try to lock in the longer contract.

What happens when it’s too complex?

Reps will sell whatever they can and leave it to the “commission gods” to pay them accurately. Keep it simple. Use round numbers if you can (ie: 10% instead of 9.743%). And apply the same commission rate and accelerator tiers across products when not trying to steer reps to sell specific products, of course.

3. Test it (and don’t leave out extreme examples!)

Test your commission pay structure using historical data. If you don’t have any historical data, use random or expected data. Run extremes, like if a rep were to hit 400% quota.

What happens when you don’t test the extremes?

I saw a plan once that included exponential accelerators. Every 10 percent the rep achieved above quota, the commission rate increased by 1.1x. At a certain point (around 350% attainment), they’d have to pay their reps over 100% commission on the annual recurring revenue. They hadn’t tested the plan.

Fortunately for them, none of their reps hit 350% quota. But had they kept the plan into the next year, there were a few reps who would have likely hit those numbers.

4. Align plans to company goals

I’ve seen a lot of plans that can be easily fixed by building them out based on company goals. This is how the calls go:

Caller 1: We can’t sell Product A.

Me: Why can’t you?

Caller 1: Because the comp plan pays a lower rate.

Me: So your reps won’t sell it. Raise the rate and they will.

Caller 2: We’ve had problems selling multi-year contracts.

Me: Do you pay your reps more for doing so?

Caller 2: No.

Me: Oh. Ok.

- The fix: Compensation plans should be the caboose, not the engine. Focus first on what you want the company to accomplish, then collaborate on the plans to model them based on those goals. If a company aims to increase their average contract values, for example, the comp plan should reflect that by rewarding reps for selling larger deals. If you want to sell to ideal customer profilet customers, give an extra bonus for those deals.

5. Variable compensation isn’t everything

People often over-rely on compensation to drive different behaviors. Then they end up violating a bunch of the rules. A good example that I’ve seen in SaaS is having decelerators on discounted deals. I see the logic there: you want to discourage discounts, so you pay a lower commission rate. However, that type of behavior can be changed through coaching and setting up rules around who can discount and how much you can discount. That way you don’t risk further complicating your plans but still get the desired outcome.

Another example I’ve seen is activity bonuses, something like paying $200 every time a rep makes 500 cold calls in a month. Instead of outright compensating them for that, you should take the time to show them how making X cold calls results in Y meetings. (You can use our free Sales Funnel resource to help show this.)Then, based on your historical information, those Y meetings would result in additional revenue. It is a longer discussion, but one that causes them to want to do the behavior for the end goal rather than just to get a bonus.

Compensation shouldn’t be used to replace coaching and support from managers. Instead, variable compensation should be used to reward performance and drive the right selling behaviors based on business goals.

To schedule your own call with me, book time here. To learn why QuotaPath is the only rep-friendly commission tracking and compensation management software available, schedule a call with our team.